It took me some time to write this post, as I like to reflect on things a little.

But the event CryptoFinance 2017 was just awesome!

Great location, great speeches, great hosts and a great social gathering as well.

If you have time available, I would highly recommend to watch the livestream CryptoFinance2017: Oslo, October 19th (Steemit Livestream).

I do not think I exaggerate if I said that every speech were fantastic: They were all pretty short, and straight to the point, just as I like it.

So, I just wanted to comment on a some of the speeches (mostly Steemians) and some of my epiphanies during the event.

Ivan Liljeqvist @ivanli had an amazing speech, which included how blockchain technology can help citizen that live in corrupt regimes and which suffer from hyperinflation (rubles). His speech is posted @ivanli.

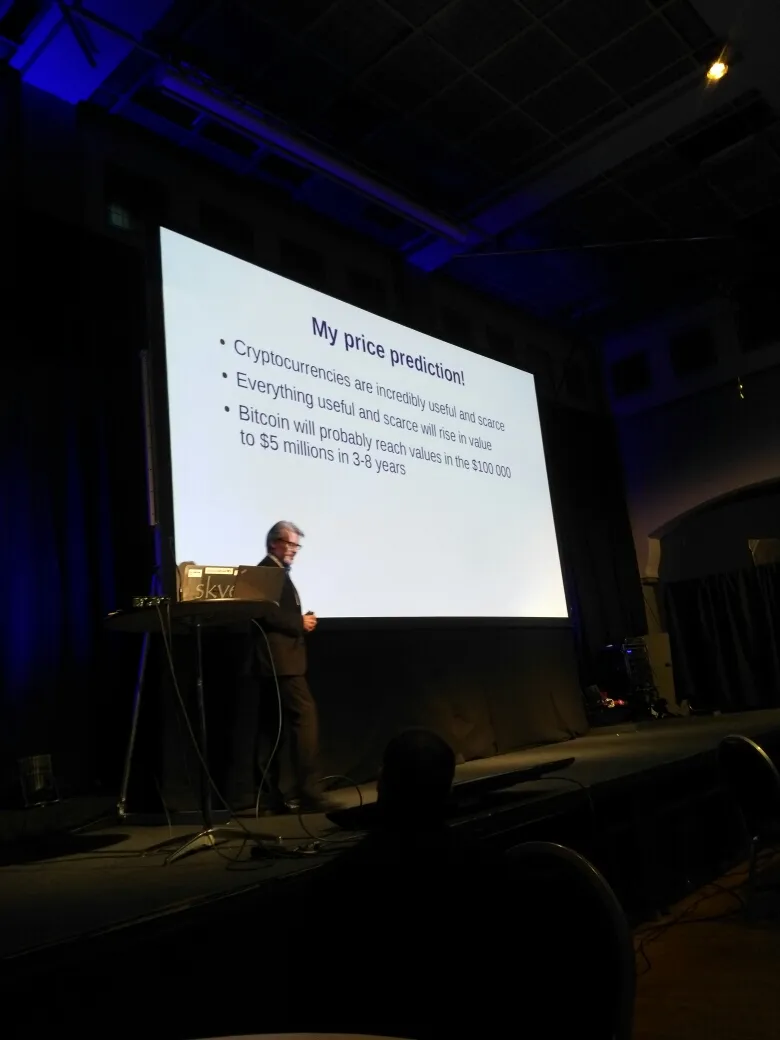

Stephan Nilsson, the founder and chairman of the Norwegian Bitcoin and Blockchain Association, is pretty bullish!

Christian Lains @clains had an amazing speech about Bitgate, the internet of value and the need to integrate old finance with cryptofinance.

Chris Coney @marketingmonk had a very interesting talk about decentralised exchanges.

My personal thinkering is that we should also try to make exchanges based on cryptocurrencies where you can also trade stocks (as UIA) and have chat rooms, and that investors can post stock analyses etc that can get upvoted (similar to Steemit). This will definitely help bridge that gap between cryptofinance and traditional finance.

Cédric Cobban @cob had a very passionate speech about Muse,

which is aiming at being owned and controlled by musicians.

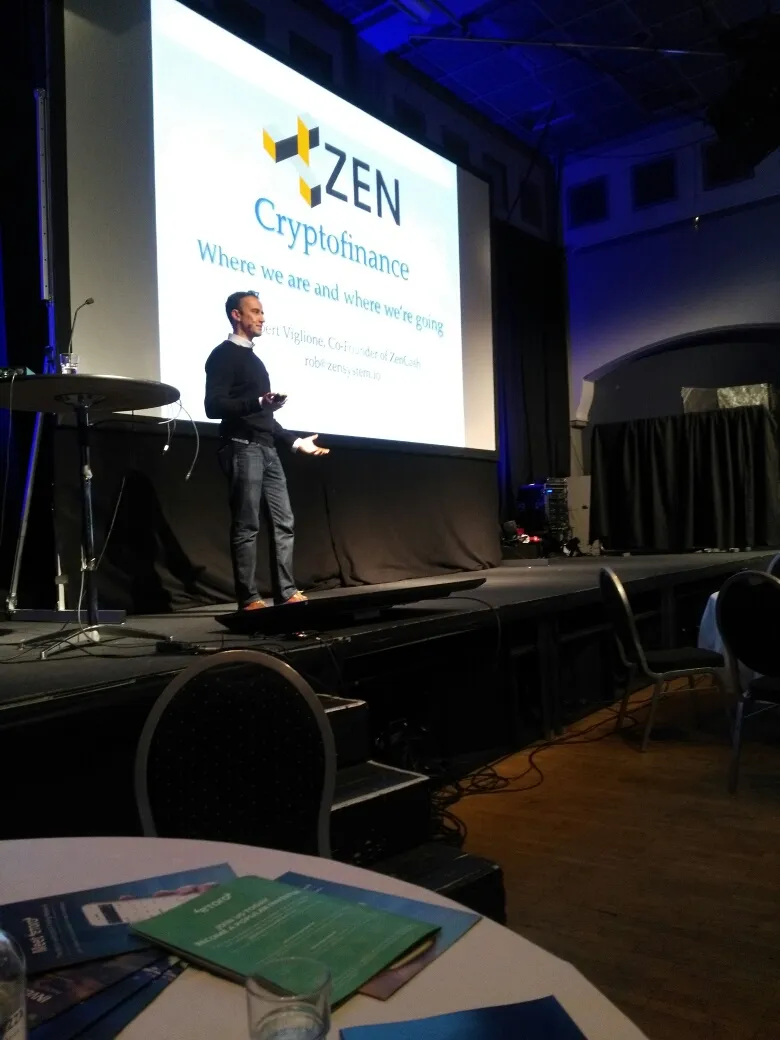

Robert Viglione @finpunk

He is the co-founder of ZenCash and is currently doing a PhD in finance too.

He had an amazing speech about finance and ZenCash.

He talked about that finance is being disrupted and the ‘uberization’ of finance.

That Bitcoin is not correlated to other asset class, and even though pretty volatile itself, could decrease the overall portifolio variance. My investment hypothesis is that the very rich are going to go hard into digital assets, once they understand or are told this.

He talked about the lack of price models for digital assets.

However, we do not have price models for gold either, we have just agreed to give it value.

He also talked about tapping into the Holy Grail: making money and change the world.

He also talked a little about ZenCash:

ZenCash is a privacy coin, which I personally believe has some very interesting technological aspects concerning privacy, reward system, and how the nodes are distributed.

Very shortly, I have bought some ZenCash and planning to buy more.

Disclaimer: This is not meant as trading advice. Do your own research and due diligence. Cryptocurrencies are high risk investments.

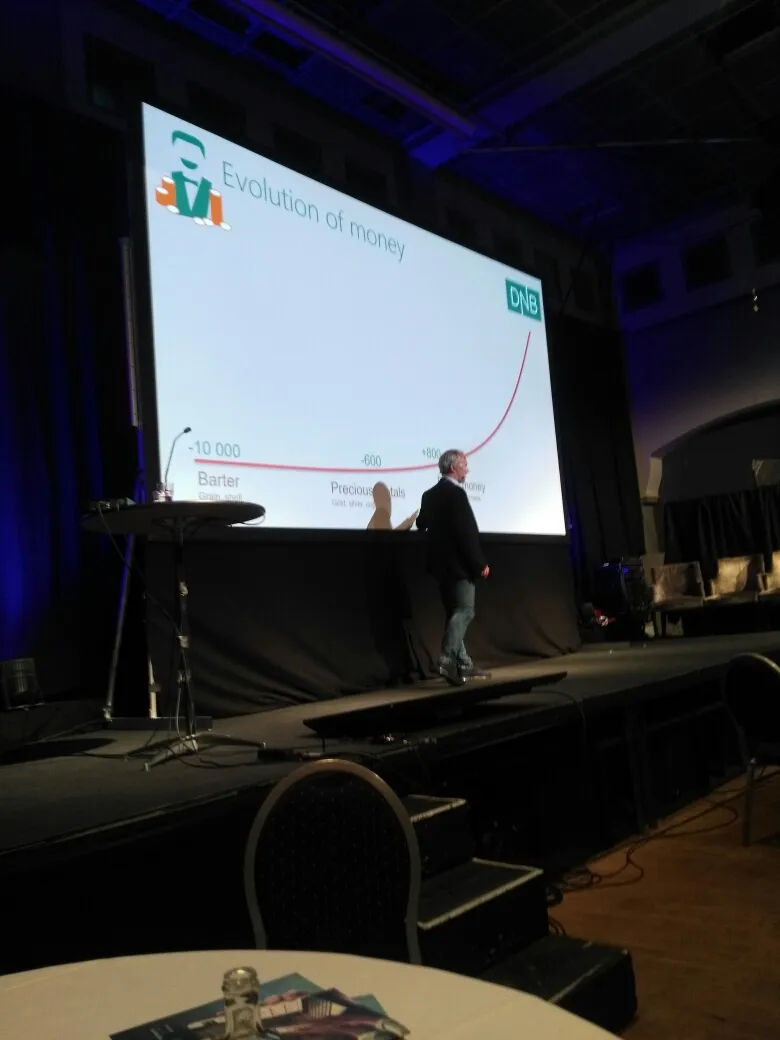

Lasse Meholm works in DNB with fintech and blockchain development. He had a very interesting speech about the evolution of money.

We later ate dinner at the same table and it was cool to be able to discuss money in such a philosophical manner with a bankier.

He argued that Bitcoin could never be used as 'money' as the volatility is too high, and that we need to have cryptocurrencies with lower volatility. I did not tell him, but there is actually a cryptocurrency that is specifically aimed at lowering the volatility, and it is called MinexCoin and is going to be listed at exchanges very soon.

I do not know if his argument is relevant though. On the contrary, most thing that turned out to be used as money started as commodities, and then become money.

As you know, commodities (e.g. silver) are pretty volatile too. Bitcoin’s volatility is going to decrease over time as the ‘true’ value is reached. Until then, expect booms and bust cycles.

I also think that one reasons why the banks are reluctant to include cryptocurrencies is that you cannot print them. Actually, in fractional reserve banking only 6% of the money is from the central bank, and the rest is printed in the other banks (such as DNB). Very scammish business model!

I also discussed my concern about the ethics of using such a large amount of energy to mine BTC, given the much more efficient alternatives. A miner on my table said he got all this heating from his mining rig.

I suppose my problem is solved then. We could just create rigs that are both effective at mining and creating heat, and we get the BitOven that creates money, and you get heating indoors too!

The food was fantastic (no photos) with a mixture of steak and also a lot of fish (sashimi) and seafood (crabs, shrimps and mussels). The beer was free (I drank 5):)!

So, I wish to thank the people at BitSpace and all the speakers for an amazing event.