Lookit all that OIL in texas!

It is going from bad to worse for oil bulls (such as Pierre Andurand), who after giving up hopes to see the first rebound in oil prices in 7 days, are now watching oil tumble to the lowest price since the Vienna oil meeting, down to $47.28.

The main catalyst, as discussed earlier, was Saudi Arabia's surprising admission that it had boosted oil production by 263kbpd to over 10 million just one month into the Oil production cut...

... while Kuwait warned that crude can drop to $45/barrel as a result of rising shale production.

Well, if that is the case, then $45 crude is guaranteed, because according to the latest monthly EIA productivity report, US shale is set to expand production by a whopping 109k barrels from March to April, rising from 4.853mmbpd to 4.962mmbpd, and offsetting OPEC's entire February production cut.

Some more details from the EIA:

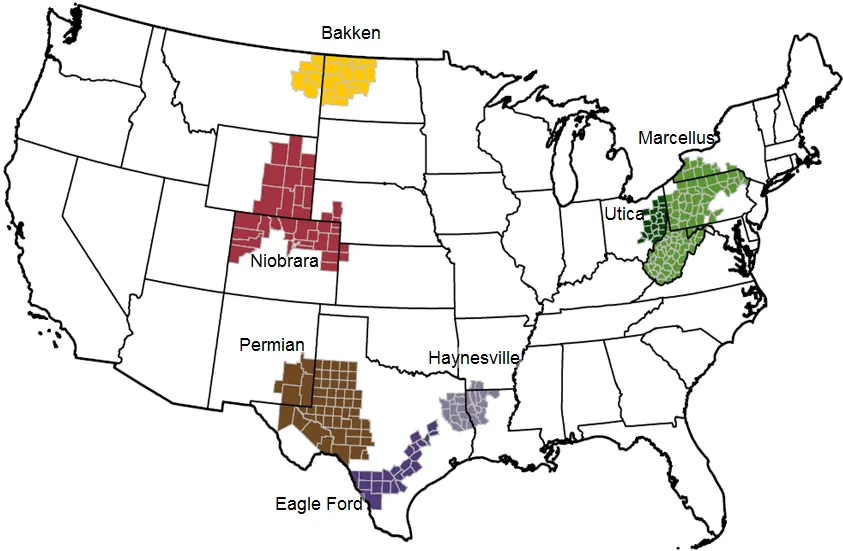

The Drilling Productivity Report uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil and natural gas wells to provide estimated changes in oil and natural gas production for seven key regions. EIA's approach does not distinguish between oil-directed rigs and gas-directed rigs because once a well is completed it may produce both oil and gas; more than half of the wells produce both.

While shale resources and production are found in many U.S. regions, at this time EIA is focusing on the seven most prolific areas, which are located in the Lower 48 states. These seven regions accounted for 92% of domestic oil production growth and all domestic natural gas production growth during 2011-14.

Read More