VISA or Amex transactions may look instant when you are using their outdated services. But actually that's not true. https://www.monetha.io/ Which was one of the most sucessful ICOs ever tried to adress the issue of high fees and multi-week settlement time for these merchant payments. (Yes, I used to think Bitcoin sucked.) When I first saw their ICO I was thinking who the hell would invest in this. Their fees were extortionist and transaction time too high compared to using Dash, NEM, PIVX, Bitshares, Verge etc.

Traditional payment gateways take up to 15 different type of fees. With a transaction fee ranging from 2% to 6%. By using the Ethereum blockchain, Monetha will have a single step and one fee only: a transaction fee of 1.5%.

But later I figured out how terrible VISA, Amex, MasterCard bunch were. And because of that, Monetha ICO was incredibly successful raising 95 000 ETH in 18 minutes! (but now it's gone down a quite a lot from that former glory)

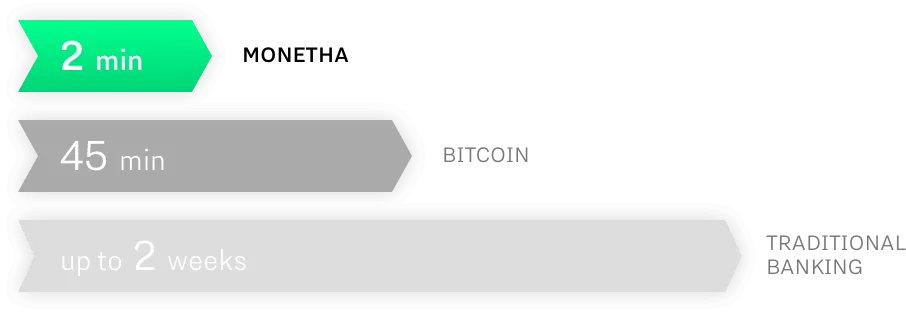

Most people are unaware of just how many stages there are in a single VISA or Mastercard transaction. An accepted transaction is only the beginning of a long sequence of intermediary transfers before it lands in the merchant's bank account days or weeks later. Time is money, which is why Monetha transacts in a matter of seconds. No intermediaries. Just you and the customer.

Now Amex is trying Ripple for near-immediate transfer of funds. What kind of funds and with whom? Let's hear some quotes.

"It’s only a matter of time before central banks adopt blockchain to settle high-value, interbank fund transfers,"

OoooKaaayyy

Basically Amex is so fed up with middlemen, they want to use Ripple(XRP) to pay other banks. Great. Here is a revolutionary idea. What about letting ripple do all transactions. VISA ended up making their own blockchain-based business-to-business payments service. Again, not for the common people. Just cronies cutting out middlemen between them. Visa's global head of solutions says: "This week's announcement is just the first step as we work towards a commercial launch of Visa B2B Connect. We are beginning to process bank-to-bank test transactions with select clients. Additional banks, including corporates, will follow soon."

This is our competition people. Witness them. These jackasses think highly of themselves for doing near immediate fund transfer with another bank while I can send 10 million dollars (If I had that much) to a person in Zimbabwe under 2 seconds using Dash, PIVX or Bitshares. Not 2 weeks. 2 seconds.

All I have to say is: "Know thy Enemy".

With a mobile wallet at your hand you are already faster and cheaper than the bank. With their current developments they'd be able to have easy cross-border payments by facilitating direct payments between institutions. That's it. When you are your own bank, VISA or Amex wouldn't have much of a place left for them. They can't be cheaper and as they are middlemen, they will be always slower no matter how many of their own middlemen were cut off.

Promote public blockchain and let these middlemen know that they are a liability to human progress no matter how much they try to ride the blockchain and optimize their age old processes.