Last week the U.S. House passed the “Tax Cuts and Jobs Act,” its first major revision to the U.S. tax code since 1986. What changes are in store and what will they mean to Texas? Will this 440-page bill, when reconciled with its Senate counterpart and passed into law, save the Union from financial doom? Before attempting to answer that question, let’s examine the bill itself.

Tax Reform Bill Overview

On November 16 the U.S. House passed H.R. 1, the “Tax Cuts and Jobs Act,”. a “reconciliation pursuant to title II of the concurrent resolution on the budget for fiscal year 2018.” This resolution serves as a framework for congressional oversight of executive appropriations, while simultaneously defining revenue sources. What are the top features of the bill?

Image courtesy of 401kcalculator.org###

Image courtesy of 401kcalculator.org###

Top Features of the Tax Bill

The bill defines a new top personal income tax rate of 39.6%, with lower brackets of 35%, 25% and 12%, depending upon your annual income. It lowers the corporate tax rate from 35% to 20%. While eliminating the state income and sales tax deductions, it preserves the ability to deduct up to $10,000 of your state and local property tax from your gross income. The bill raises the threshold of the estate tax from $5.6 to $10 million and ultimately repeals the tax in 2023. The home mortgage deduction is capped to loans under $500,000. The standard deduction is increased to $12,000 for individuals and $24,000 for a married couple. Last, but not least, the alternative minimum tax (AMT) is repealed. Now, we ought to look at what is not in the bill.

Missing From the Tax Bill

Notably absent from this “Tax Cuts” act is a repeal of ObamaCare, the biggest tax increase in thirty years. Not even the individual mandate is eliminated! Many taxes were enacted and others increased in the so-called “Patient Protection and Affordable Care Act.” The repeal of the PPACA would restore more financial liberty than all of the provisions of the current bill. Returning to that bill, the 401(k) changes that the House initially proposed are absent in the final bill. Considering both its features and those that are missing, what impact will this bill have on the United States financial position?

By the Numbers

Congress currently spends $500 billion more each year than it takes in. That is a $1,500 deficit per person per year. With a 2017 budget of $4.15 trillion, it collected $3.64 trillion in revenue. The Congressional Budget Office projects our annual deficit will increase $150 billion per year under this bill. With a current U.S. debt of over twenty trillion dollars ($63,000/person) and unfunded liabilities of $135 trillion ($413,000/person), any consideration by Congress and the Senate to increase the revenue-spending gap is sheer insanity! Yet, even this dire situation neglects the elephant in the room.

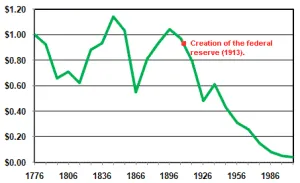

Value of U.S. dollar from 1776 to 2006. By DLuber1.

Value of U.S. dollar from 1776 to 2006. By DLuber1.

Inflating the Elephant

Where do you think Congress borrowed the aforementioned $500 billion this year to make up the difference between their spending and their revenue? From the Federal Reserve Bank? Yes. But, where did the Fed get that money? From you! Let’s look at the process in a nut shell, using one million dollars as an example.

At the behest of Congress, the Treasury Department issues a $1 million security instrument for sale, typically as a bond. That security is usually purchased by the Fed. The Fed credits the Treasury $1 million. The Treasury notifies Congress, who spends the money though executive agencies to buy goods and services, thereby injecting one million dollars into the money supply. Where did the Fed get the million dollars? They created it from nothing! Who is competing for the goods and services purchased by the federal government? You and I. What is the long term effect? Rising prices. Since the government has these newly minted dollars before prices respond, they are able to purchase goods and services at effectively a discount. By the time you and I spend the money we earned (not created), prices have risen in response to increased demand.

In short, monetary inflation, the process I just described, results in long term price inflation. The latter is commonly just referred to as “inflation” by the government and the fake media. Nevertheless, you can now see that monetary inflation is a hidden tax! Knowing that the federal government is spending us into oblivion—look no further than Venezuela for the end game—what choices do we face?

Texit or Sink With It

Congress, at the behest of their special interests, is a spendthrift that has already bankrupted the United States. As Jeff Thomason wrote so well in “Federal Spending/Debt Will Drag Texas Down With D.C.,” as Texans “our ultimate civic responsibility is to ensure the political and economic freedom of our children …” Unless we restore the Republic of Texas, we will be abandoning that responsibility, dooming our young—and yet unborn—Texans to financial indebtedness. Join us in creating a future of financial freedom for our children!