China has been embattled with aggressive devaluation of the RMB as the economic growth has slowed to the lowest level in over 25 years. Meanwhile, the USD has surged on the back of strong economic growth in the US.

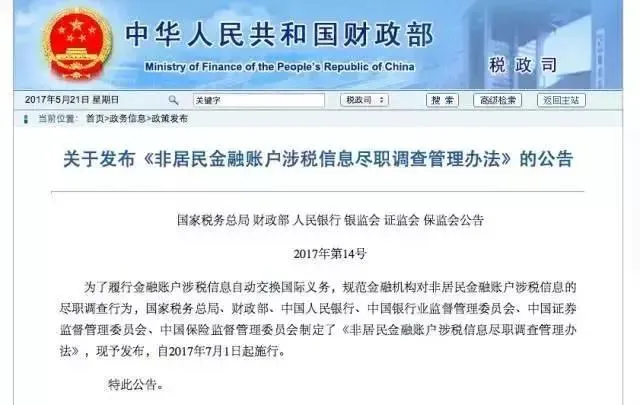

New policy on foreign exchange and cross-border remittance comes into effect July 1st

Source

For those unaware of what the policy entails. These have been in place for a while but not officially enforced as the government has given financial institutions a lead time of several months to implement systems safeguarding their policy.

As of July the 1st, the rules officially go live.

The policy states :

Individuals are limited to exporting $50,000 per year.

Transactions are capped at $10,000 each, and once per day

Individuals must fill out a large transactions report

Individuals are prohibited from export of capital for buying bonds, insurance products and real estate

You may not lend your quota to other people to send money abroad

Individuals will be strictly investigated for money laundering if the rules are broken

What about Bitcoin?

The three largest Bitcoin exchanges in China (Huobi/Okcoin/BTCC) have only recently re-enabled Bitcoin withdrawals after several months of investigation by the PBOC pushed the exchanges to tighten up on Know Your Customer / Anti-Money Laundering policies.

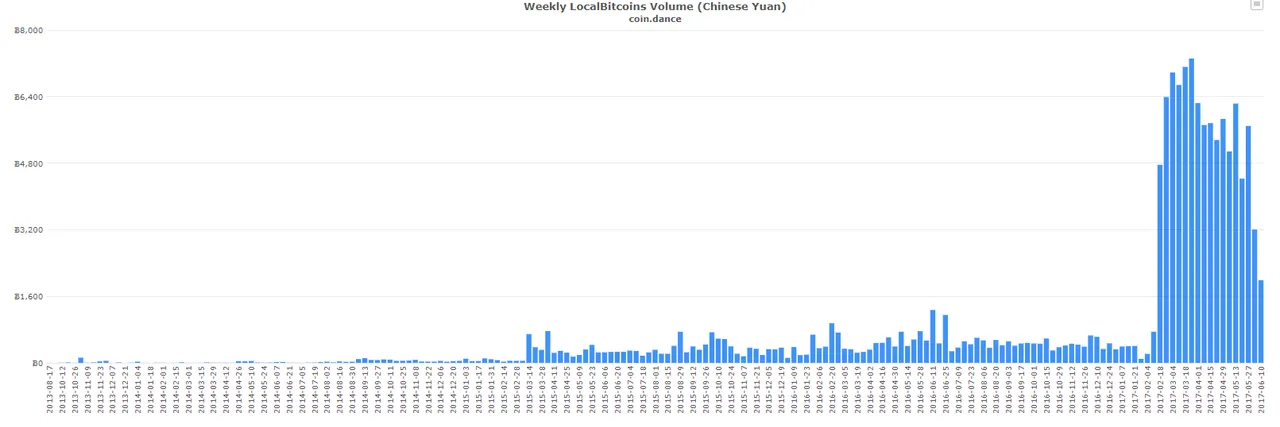

LocalBitcoins Volume in China

With the main exchanges enabling Bitcoin withdrawals, volume on localbitcoins in China has seen a significant drop. But remains above the multi-year average.

Bitcoin prices in China still command a 3% premium over average Bitcoin prices on western exchanges at time of writing.

Impacts on Bitcoin and other industries post July 1st?

Capital controls seem to be working as USD reserves have actually started going up since controls began tightening late 2016.

Now that investing in real estate is prohibited, the global property market will no longer be propped up by the worlds largest buyer of overseas real-estate.

Some reports have suggested capital flight is a large contributor to the Bitcoin bullish market.

With the PBOC closely watching the exchanges, Bitcoin may become less attractive as a method of sending larger amounts of money abroad. This is evidenced by the muted volumes on the top three exchanges.

However, our "favourite" person in Bitcoin - Jihan Wu thinks otherwise :

But I don’t think the Chinese Government will do very aggressive regulation over bitcoin. I just think they want to control the risk for those investors who don’t have enough knowledge about bitcoin.

Is the July 1st going cause some more volatility on the markets?

Most likely.

Whilst most people have been focused on the Bitcoin UASF for August 1st, it is difficult to ignore the potential significance of the Chinese capital outflow measures officially being enforced starting July 1st.

People completely unaware of Bitcoin are now asking me about it, many of them also showing great interest in ETH.

It's been a wonderful opportunity for me to introduce Steemit to them whilst general chatter about crypto is at an all time high.

What I see, is a fine example of human psychology. People see assets like Bitcoin and ETH soaring only to invest for a quick buck. Meanwhile, smart money secures their exit.

Have they not learned from the Shanghai Stock Market? Apparently not.

Set your calendars for July 1st. Something big might happen!

I want to take this opportunity to say a big thank you to Steemit and all my followers and friends who have supported me throughout my journey, giving me the opportunity to be free of the chains from China. It has been truly liberating and for that I extend my gratitude to all of you. Under normal circumstances, avid travellers such as myself would no longer have the means to go freely abroad. Steemit has changed my life forever. Travel with Me and Miss Delicious will live on!

As always, I appreciate your up-vote, follow and comment!