Welcome to another installment of the crypto week in review. Each day I'm selecting an article that I consider relevant for the crypto world and, at the end of the week, I collate all those articles in a single one. Not all the articles presented here are actually mentioned in my feed during the week, as sometimes I feel I would clog the view with too much info. But looking back at what happened, in a condensed form, may help us crystalize a better picture about the whole industry.

Monday - After Goldman Easing their Stance On Crypto, Black Rock Is Following Suit

According to a story published on Financial News, ETF giant Black Rock announced the formation of a new division that will asses the potential of crypto trading. This news comes amidst similar position taken, for instance, by Goldman Sachs, who announced a couple of months ago a similar division forming.

Black Rock manages assets up to 6.3 trillion dollars. At the moment of writing, the entire crypto market cap was just a little over a quarter of a trillion, namely $258 billions.

Tuesday - Coinbase Approved To Trade Tokens Deemed As Securities

The US-based platform Coinbase, which has been very active during the last 6 months, announced it received a green light from regulators to introduce in its listings tokens deemed as securities. This would be possible through a series of acquisitions of a few securities trading companies, three of them, to be more precise: Keystone Capital Corp., Venovate Marketplace Inc. and Digital Wealth LLC.

Wednesday - Coinbase Not Really Approved To Trade Tokens Deemed As Securities

In a public message posted by Bloomberg, Coinbase retracted on its previous announcement that they have been received SEC approval for trading tokens deemed as securities.

According to the same source:

“It is not correct to say that the SEC and FINRA approved Coinbase’s purchase of Keystone because SEC was not involved in the approval process,” Coinbase spokeswoman Rachael Horwitz declared.

Thursday - Institutional Investors Provide 56% of Capital Inflow - Crypto Investment Report

A first-ever crypto investment report released by digital asset management fund Grayscale Investments reveals that the majority of capital inflow this year is coming from institutional investors. According to this week’s report, institutional capital accounted for 56 percent of all new investments into Grayscale products during the first half of 2018.

Despite the undeniably bearish picture for crypto markets during this time, Grayscale remarks that “counterintuitively,” the pace of investment has “accelerated to a level that we have not seen before.”

Friday - CoinmarketCap To Clean Up Their Stats

In a blog post published on Friday, CoinmarketCap, the leading crypto price feed aggregator, announced a number of improvements to their data acquisition and display methods. They removed the minimum volume requirement for an exchange to be listed and added a few extra filters, in an effort to bring more transparency into how they gather and present data.

These measures come after many complaints about inaccurate data - peaking with the exclusion of some South Korean exchanges during the last bull run. It still remains to be seen if these measures will actually lead to more accurate data.

If you enjoyed this Crypto Week In Review, feel free to share it in your feed.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

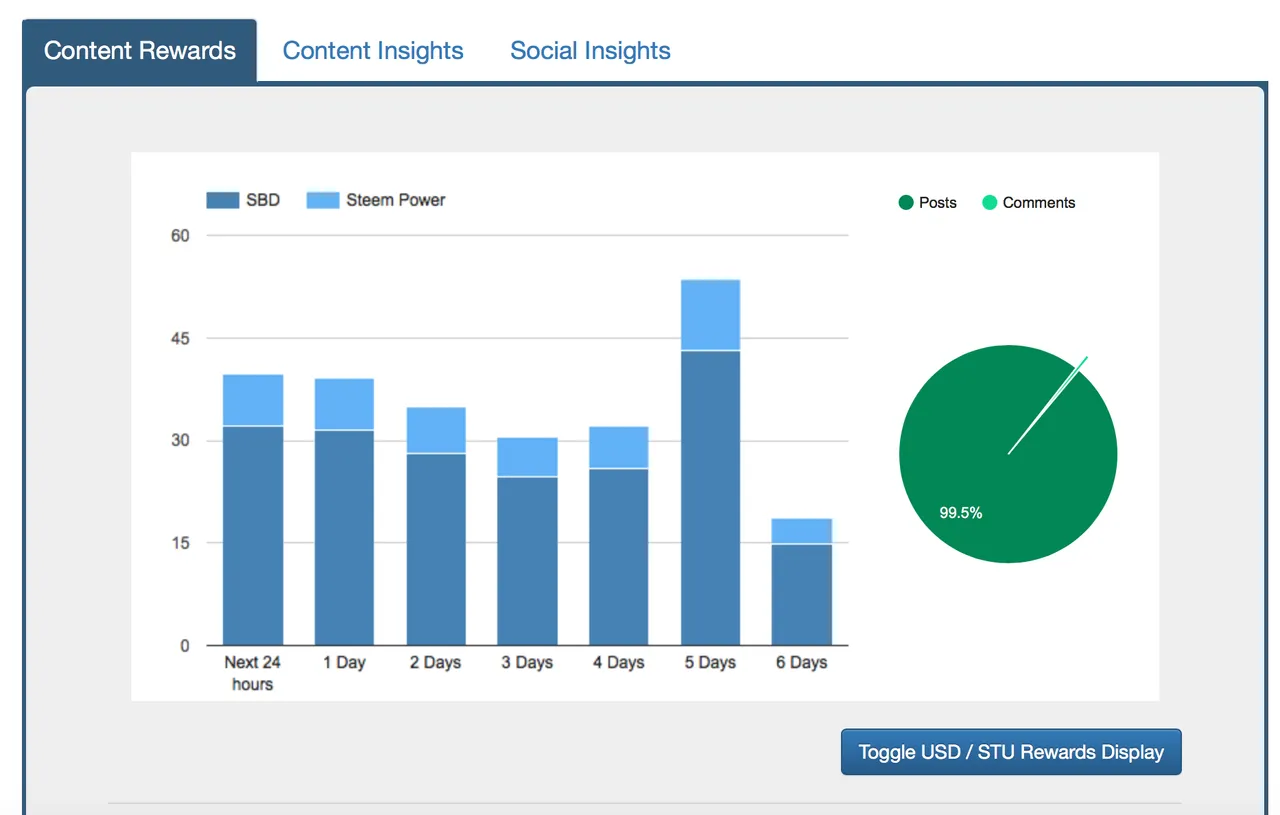

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |