- Can Exchange Markets keep your Bitcoin Cash?

- UNICEF testing ETH Smart Contracts!

- Japan largest Bitcoin trading volume!

- Medici Ventures recorded loss of $ 3.3 million!

At the beginning of August Bitcoin had to accept the first "hard fork", who holds his bitcoins in his own wallet now has the same number of "Bitcoin Cash". But what if the bitcoins are on an online exchange? Do they have to give you the new crypto coins?

Like most crypto currencies, Bitcoin is based on a block-wagered public transaction register, the blockchain. New blocks are continuously produced by so-called miners in a computer-intensive process (the electricity consumption already exceeds that of Croatia!). If the new, "mined" blocks correspond to the rules stored in the Bitcoin software, they are accepted by the nodes of the network and appended to the blockchain. The transactions recorded therein are thus confirmed.

However, the Bitcoin concept has to be adapted to the technical development and the enormous growth of the network. This may require changes to the rules in Bitcoin software. Because of the decentralized organization of the Bitcoin community, the agreement on such rule changes is a big challenge. In the most unfavorable case, a part of the community follows its own concept and accepts a split from the original Bitcoin currency.

This happened on August 1, 2017. Part of the community has since pursued its own blockchain, which on the one hand allows considerably larger blocks, on the other hand rejects a new function called SegWit, on which the majority had agreed. As a result of the splitting of the blockchain, the new, independent Bitcoin Cash crypto currency has been created parallel to Bitcoin.

Bitcoins are distributed to Bitcoin addresses, which can be imagined as a Swiss number account. The distribution of the bitcoins to the addresses can be fully understood at any time using the transaction history recorded in the blockchain. Bitcoin Cash has taken over this transaction history until the time of the fork. The initial distribution of the currency units of Bitcoin Cash therefore corresponds precisely to the distribution of Bitcoins on 1 August.

Technically, this means that with the new blockchain, an identical bitcoin cash address has been created for each Bitcoin address, which contains the same number of (bitcoin cash) currency units. The result is similar to a stock split: 10 Bitcoin will be 10 Bitcoin + 10 Bitcoin Cash. If you use your own Wallet and have control over your Bitcoin address (s), you can trade both currencies independently from the Hard Fork.

Many users do not keep their Bitcoin by themselves, but run depots at a Bitcoin exchange. This takes care of the technical handling of the account management. The stock exchange therefore controls the Bitcoin addresses and thus the handling of the new Bitcoin Cash. Many stock exchanges have announced to allow their users access to Bitcoin Cash, which is due to their Bitcoin holdings, and some have already implemented it. The most prominent exception is Coinbase, which has e-mailed to its users to boycott the new currency and not to pay the bitcoin cash amounts. After a massive protest and a wave of emigration, Coinbase has meanwhile steered in and wants to support Bitcoin Cash now.

With Bitcoin Cash, a considerable economic value has arisen. Meanwhile, the new units were estimated to be 1/4 of the bitcoin value. At the time of this article, they are 8% of the bitcoin. This corresponds to a market capitalization of more than three billion dollars. The question is therefore: Who owns Bitcoin Cash - the Bitcoin investor or its exchange market?

Can the question be clarified at all or can crypto currencies float in a right-free space? It is true that the existing laws are not made for crypto currencies. How bitcoins can be taken under the existing legal concepts is therefore partly controversial. This situation, however, is nothing new for the law. Lawyers apply rules on matters of daily occurrence which have not been taken into account when the regulations are enacted. Legal tools for such cases are in particular

- The widening interpretation of existing rules "sense and purpose",

- the filling of regulatory gaps by appropriate application of rules which are not 100% relevant, but are valid ("analogous application"), or

- the "supplementary interpretation of the contract", which means the filling of gaps in contracts in good faith.

Bitcoins therefore has no fear of a right-free space. That the right can provide answers has, e.g. The European Court of Justice. It decided in 2015 that bitcoins - although not a legal payment - are subject to a certain exception in the law and are therefore not subject to VAT.

Due to the initial refusal, Coinbase users have already announced lawsuits against the exchange market. According to the terms and conditions of Coinbase, the use ratio is subject to English law. This belongs to the legal system of the Common Law. US lawyers argue in favor of users that according to the Common Law

- the owner of a cow belongs also their calf (Prof. Tim Wu),

- a exchange market which retains Bitcoin Cash may be used for negligent harm, a breach of a trustee's duty or unjust enrichment (Lawyer Priyanka Ghosh-Murthy).

In my opinion, the obligation to issue Bitcoin Cash can not be excluded in the contract of use. Such exclusion would be contrary to the terms of the GTC law.

The United Nations Children's Fund (UNICEF) examines how digitalization can help in collecting successful and efficient aid money.

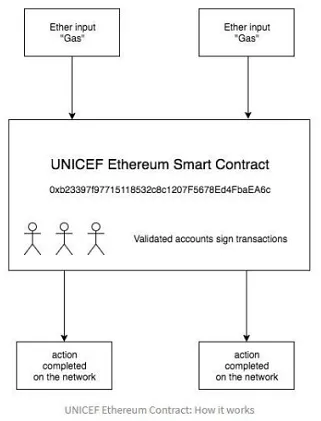

In this context, UNICEF has encountered Ethereum, or more precisely the Smart Contracts of the Ethereum, to expand public confidence. Correspondingly, the Smart Contracts are intended to increase transparency and consequently reduce corruption and mismanagement.

Specifically, international transactions should be better tracked in order to determine what the relief funds were used for. As a result of the Smart Contracts, the cooperating companies or partner organizations would receive ether tokens by digitally signing their receipt.

Other United Nations agencies are already successfully using the Ethereum blockchain in practice. For example, the World Food Program uses the Ethereum-based Smart Contracts to provide Crypto food stamps to refugees in Jordan. In this way, it can be ensured that the funds are emitted only for the intended auxiliary services.

Click on the link below to see UNICEF Ventures Exploring Smart Contracts:

http://unicefstories.org/2017/08/04/unicef-ventures-exploring-smart-contracts/

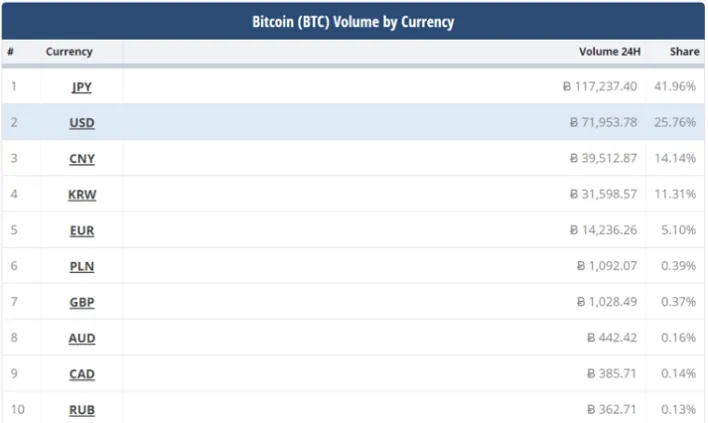

According to data from the CryptoCompare portal, the Japanese yen currently accounts for 42 percent of Fiat's trading volume in the last 24 hours. Japan is characterized by low fees and could thus be ranked first.

With a trading volume of more than 116,000 Bitcoin over the last 24 hours, Japan is the second-place US dollar and even third place in China. This is the first time since February this year that the Chinese Renminbi does not occupy one of the top two places. In February, the disbursements on Chinese exchanges were frozen, leading to trade losses.

Since the restructuring of the markets, China has no longer allowed trading without fees during the payout in February.

In Japan, however, Bitcoin continues to receive further support: recently, the fashion chain "Marui" accepted the digital currency into one of its branches. After a successful test phase, one would expand to the remaining stores in Japan, so the chain.

The rising Bitcoin course also creates a growing popularity. Also in the mainstream media is always reported again by Bitcoins new all-time high. At the time of writing, Bitcoin is $ 3,420.

Besides Poland, Poland also surprised us. The Euro finishes fifth behind the Korean Won, but the Polish Zloty is in sixth place ahead of the British pound. It is possible that the bitcoin adaptation will increase there faster since there is a well-known fast-food supply chain “Pyszne.pl” that Bitcoin accepts.

The overstock subsidiary Medici Ventures focused on blockchain solutions reported a loss of 3.3 million US dollars for the second quarter of 2017. In a report to the US Securities and Exchange Commission (SEC), the company justified the loss with a massive expansion of its own dedicated securities market T Zero.

Click the link below to see the report:

https://www.sec.gov/Archives/edgar/data/1130713/000113071317000039/ex991q217pressrelease.htm

Overstock CEO, visionary and blockchain evangelist since the first hour, Patrick Byrne, continued to feel positive despite the loss. According to Byrne, one must look at Medici in the long run:

Overstock reported a loss of $ 8 million in the first quarter of 2017. The loss is due among other things to a 4.5 million US dollar investment in the Blockchain Startup PeerNova.

Medici Ventures continues to pursue a strict investment strategy. The company has already invested in various start-ups such as PeerNova, Bitt, SettleMint, IdentityMind and Factom. Only in April 2017, Medici has invested another 428.00 USD in an A-financing round in the startup Ripio, formerly Bitpagos. Medici Ventures According to President Jonathan Johnson, the latest investment shows the strong desire to enter into promising transfer business.

Lovely regards

@danyelk

👉

👉