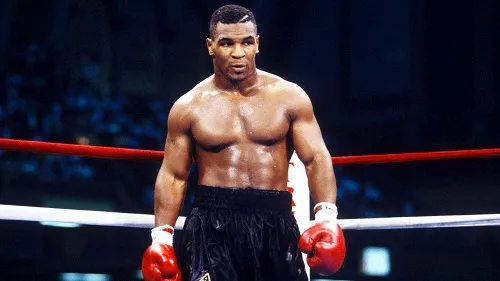

As the famous Mike Tyson quote goes:

"Everyone has a plan until they get punched in the mouth".

While that quote can be seen as simple boxing reference, for me it is a microcosm of life in general, especially when it comes to investing. You can read as much as you want about investing, investment strategies and practice with demo trading accounts but without experience 'in' the market these things can only take you so far. Research and practice may help you gain a basic understanding of investing but until you have your own money invested in the market facing the real-life consequences of your money being at the behest of a market you have zero control over you haven't learned anything. You will often find that the athletes we consider to be legends in their sports are those that have faced and overcome adversity. The reason for this is that they had to experience something that put them out of their comfort zone and required them to overcome a challenge they couldn’t possibly have accounted for.

In every single asset class I have invested in, be it; Stocks, Property or Cryptocurrency I have always felt that I have been well-educated and have a good understanding how the market works. Until of course each of those said markets have punched me in the mouth. Most of the time this has resulted in me losing money (on paper), feeling different emotions and learning valuable lessons. While there are some negative short-term effects, ultimately the experiences have resulted in a better understanding of investment and a better ability to manage my emotions. When you are playing a long-term game, a short-term loss can be an extremely valuable lesson. Due to all my experiences in losses, I am a much better investor.

In the context of the cryptocurrency market, we have been going through a bear market on the back of an astronomical bull market. Of course, most of us have lost a lot of money during this time and while some can choose to be negative about their losses, I would encourage people to look at the experience they have gained. For a lot of investors, cryptocurrency has been their first investment and as a result the concept of ‘bull and bear markets’ are foreign to them. However, after experiencing both the high and lows associated with the ups and downs of the cryptocurrency market they will be better able to recognise what is happening in the market in the future, and as a consequence be better positioned to take advantage of the market.

Experience isn’t only limited to investing but life in general. In this current political climate, you see commentary from a lot of ‘woke’ college students that have yet to even enter the workforce or leave home. It is easy to judge people and come to conclusions when you haven’t had to face any real adversity for yourself. While you are relying on your parents and playing a game that doesn’t translate to real life (College) everything seems straight forward but once those safety measures are removed you are exposed to the real world.

I am not advocating for anyone to jump straight into investing or into any aspect of life, however without acquiring actual experience you really cannot fathom the true reality of any pursuit whether that be investing or life. With regards to investing, experience in markets I believe to be a multiplier in the learning process. While you can learn on the ‘sidelines’ so to speak, you aren’t learning about yourself as you don’t have to deal with the subsequent emotions and decisions you make as a result of market forces. Vulnerability is where we shine best, if everything was easy life would be boring.

Image source: MMA Uno