It's been four years since I first started out on my mission to retire early, back in 2014, at the tender age of 40. Thanks to a combination of frugal living and hard-saving, I'm on target to retire from full-time work this July (yes, after just 4 years of saving!), and, with luck, I should be able to fully retire before I reach 50.

Initially I tracked my expenditure and savings obsessively through 2015, however, I've gone a little bit off-track with some wayward expenditure recently, and so I'm is simply an update on my progress in January 2018 in order to both get me back on track and to motivate others to join in on the 'early retirement extreme mission'.

It's standard practice among those aiming for early retirement to post their expenditure and savings stats.... the publication of which is something I've been trying to refine for a while. Here's my latest efforts broken down into the following:

- Income in different categories

- Expenditure in different categories

- The holy grail: the expenditure to savings ratio

- Total Net Wealth

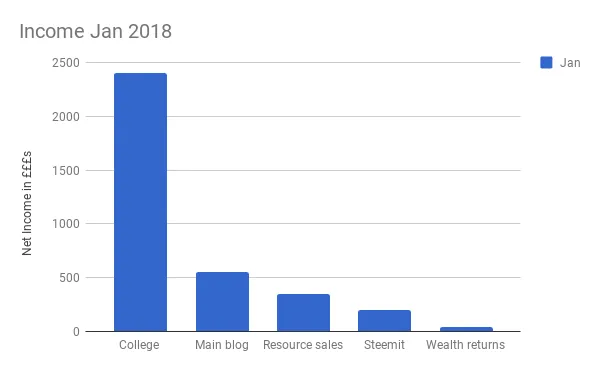

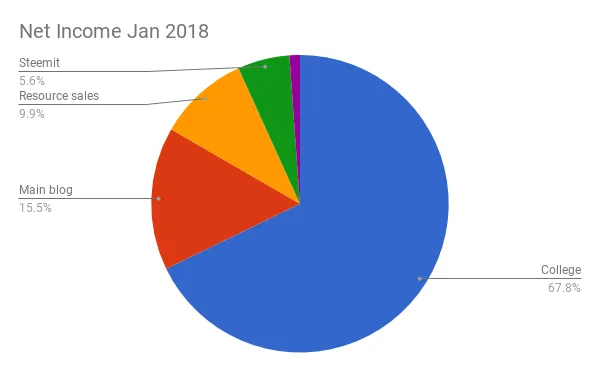

Income in January 2018

** Total Income = £3540** (*approximate figures)

Until half way through 2017 my main job was my main source of income, however, other income sources have gradually become more significant, which is partly why I've got a bit slack with recording my ERE progress.

I'm now pretty much in a position where I can drop my main job and survive off my 'second income sources', which is precisely what I'm doing this August!

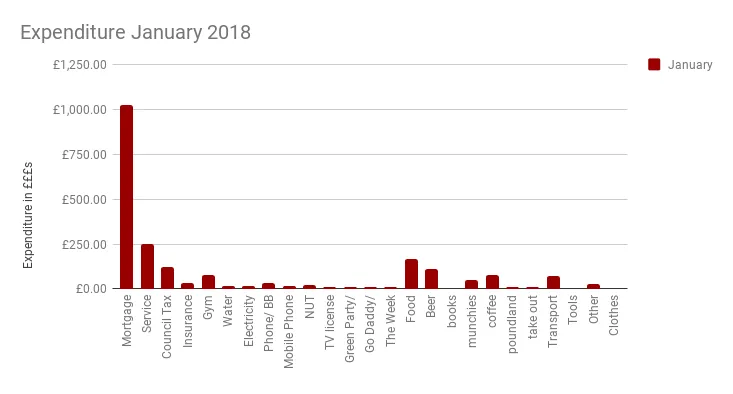

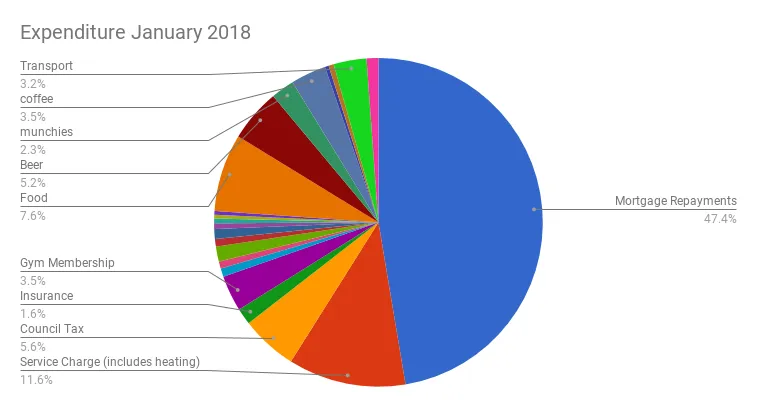

Expenditure January 2018

Total expenditure = £2160, broken down into the categories below:

It's worth noting that by far and away the single largest area of expenditure was on my mortgage (deliberately overpaid to bring down the lifetime cost of interest payments; service charge is next, which is similarly property related.

Savings ratio

- not including mortgage I saved 39% of my income

- if I include my mortgage as 'savings', I saved 69% of my income.

_the savings ratio is the 'holy grail' of ERE - if you can learn to live off 50% of your income, and save 50%, then you can effectively cut your years of doing paid work in half (on a conservative estimate, it should actually more because of the wonders of compound interest)

I include my mortgage payments as part of my savings as I won't need to pay this when I'm retired (by which time the mortgage will be paid off), and so as far as I'm concerned, I can effectively live off about £1K/ month or £12K a year.

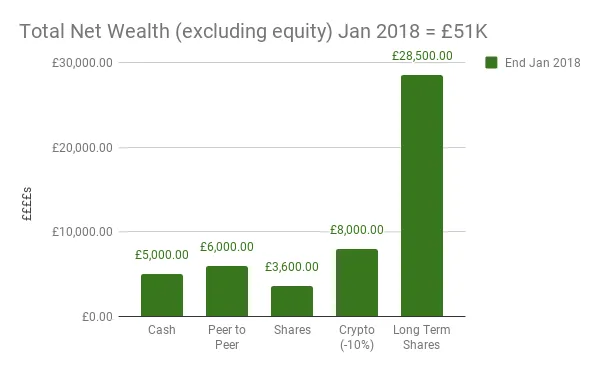

Total Net Wealth

I don't include my equity in this, as I need somewhere to live. On the whole, quite a balanced portfolio I think, if a little less healthy since the recent crypto crash...

Conclusion: how long until I can fully retire from paid work?

I'm in something of a beneficial position compared to most ERE peops: I've got a nice little teacher's pension waiting for my from 60, which will see me through just about until state retirement age at 67, possibly 68 by the time it gets there!.

Once I've paid my mortgage off and worked some Permaculture magic on my house to reduce outgoings, I'll need about £8k a year in my early retirement, which means I could retire at age 54 on what I've got.... so I've got about 9 years to go until I'm financially independent. IF I can maintain my current savings levels, and combined with the increase in wealth gains which will accelerate, my rough calculations are that I should be able to fully retire by 2022.

Although all of this might be moot because I'm quitting my full time job this coming August, and given that I'm quite happy earning money just blogging, I'm not too fussed about bringing this age forwards ATM... but I'm sure that'll happen.

Anyway, very self-indulgent post, cheers for reading.