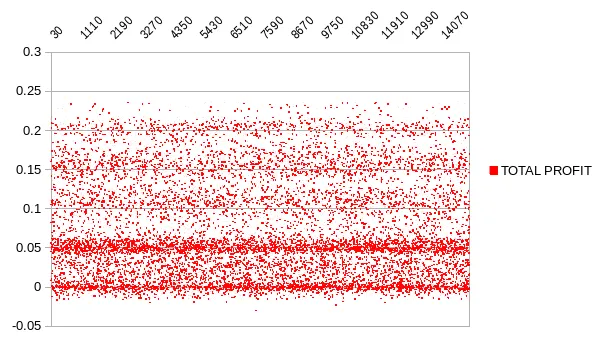

My research is now near it’s end, and I made good progress, the current strategy on the sample data gives a 23% Profit and it’s very robust given that I have ran many Monte Carlo simulations, this time with 15000 elements, and it is now conclusive that the profit is converging toward the 23%, and it’s barely below zero.

In fact the probability, that on a random sample (of the same market, I’m using ETH/BTC), that the strategy will yield a loss is only 12.69770%. Whereas previously it was 12.25064% , 12.91035% , 13.00443%, not much progress on that end, but the profit has considerably grown:

https://steemit.com/money/@profitgenerator/true-profitable-cryptocurrency-trading-research-pt-4

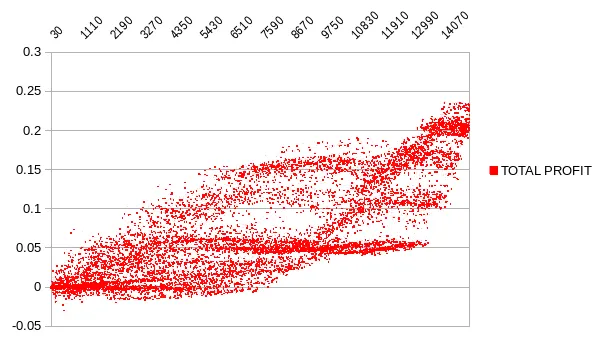

Also the profits are directly correlated with the number of trades and the size of the data:

In this the sample size and respectively the number of trades is sorted ascendingly, so the profit grows as the room for the trades grows, in a kind of spiraling way, but nontheless and uptrend.

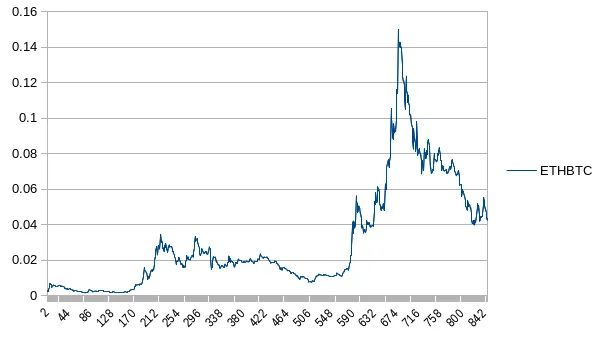

- In case you think this is biased, I mean how hard is it to make profit in ETH/BTC when it’s a bullish overpumped market?

Well that is why this total profit also includes short trades, despite I am not going to short and most people will probably won’t either, it’s still good to quantify both sides of the fence, to give us a balanced view of the profit distribution.

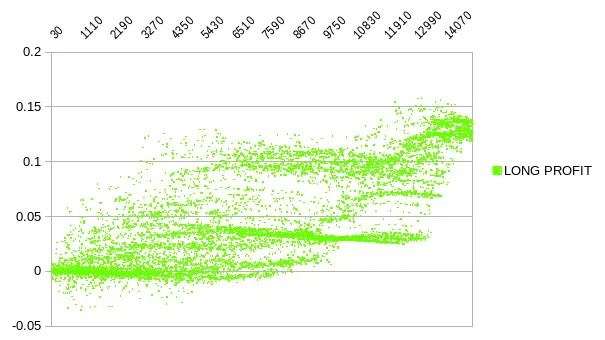

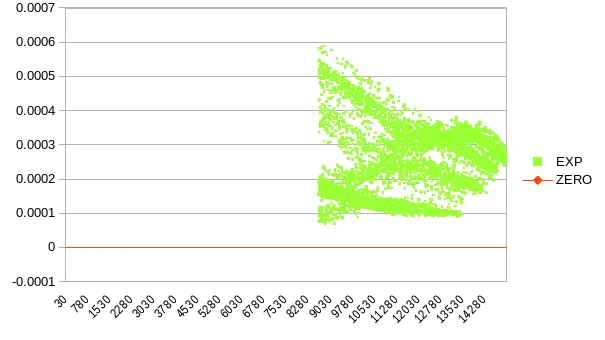

So here are only the LONG trades for ETH/BTC:

The largest LONG profit respective to the best result is roughly 13% and it has 13.78488% probability of losing (if it were stand-alone, which I will expect my strategy to be, without SHORTs).

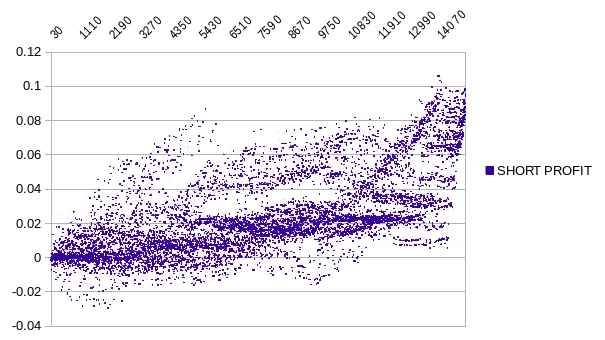

And here are the SHORT trades for ETH/BTC:

The largest SHORT profit respective to the best result is roughly 10% and it has 15.95321% probability of losing.

So it’s almost like a 50-50%, the optimization technique gives us a balanced output, while I could optimize it for the long trades only, I think it’s better if we leave it like this, otherwise the strategy will just tell use to buy always, given how the ETH market was bullish, and we know that a bullish trend won’t last forever, so it’s much better if we don’t take that intuition.

Besides that is not even true, this is my sample ETH/BTC data (older data), and as you can see there are plenty of shorting opportunities here already:

But either way I think a balanced optimization is much better, and then we basically just make sure that the long trades are profitable too, so the optimal profit share would be 50% from long and 50% from short trades, and that is roughly what we get here.

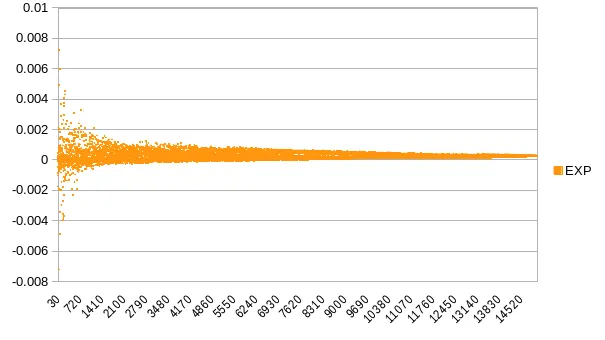

- But the profit is not the only important factor, the expectancy can be argued to be more important

The expectancy is the profit divided by the number of trades, and it can be argued that with a small sample size this will be biased (as you can see the initial dispersion), but later it’s obvious that the expectancy converges above zero, so it’s profitable.

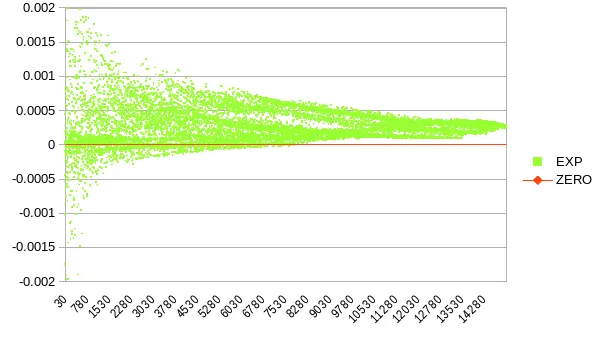

If we zoom in we can see a clearer picture:

And if we ignore the outputs that have less than 300 trades (obviously we would want to take more trades than that in our trading career), then it’s obvious where the money are heading:

Literally not a single losing outcome after 300 trades, but of course only a minority of outcomes have more than 300 trades as this is only the tip of the graph. Nontheless we have a 87.3023% probability for a profitable outcome.

This is important because we can only optimize for the Nth element, so we use the Nth element’s optimization for the N+1 element and so on.

If the N+1 element is so diverging from the traits of the previous elements that it would totally break the system if we were to forecast just 1 element into the future, then obviously if we randomly crawl in our already known data as if we would not know it, it should also break. This is the purpose of this simulation.

But on the contrary this proves us that the N+1 element has only a 12.69770% probability of being divergent from our optimized strategy, and eventually still make profit to offset the diverging elements.

Now of course we could also analyze the probability distribution of the parameters of the strategy, but I am not going to reveal that, all I say is that it’s very similarly converging like this, so my strategy is pretty adaptive.

Now I still don’t know how frequently should the parameters be recalculated, probably at every forecast, just to be safe, so I still have to research that.

Conclusion

So my research is pretty much at it’s end, and once I am finished I will start predicting the markets and post my predictions here. It should be profitable given this research, so it will be exciting. Stay tuned for more!