Economies built around using fiat currencies are in melt down around the world. Except the for the U.S. which has seen the reverse with an economic upsurge. The U.S. isn't immune to the popping worldwide debt bubbles. It's to blame.

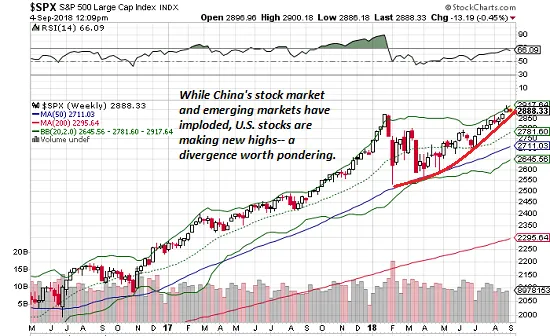

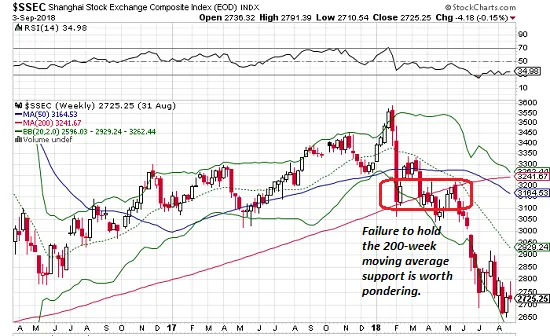

As the U.S. S&P 500 stock market index is soaring high, higher than ever before, the Chinese Shanghai Stock Market is crashing after being unable to hold it's 200-week moving average support.

Source

Source

China is an engine of global growth, while the U.S. is the world's consumer paradise that eat up what China puts out. Since China sells, it should be doing well. But the buying U.S. is instead. What's going on?

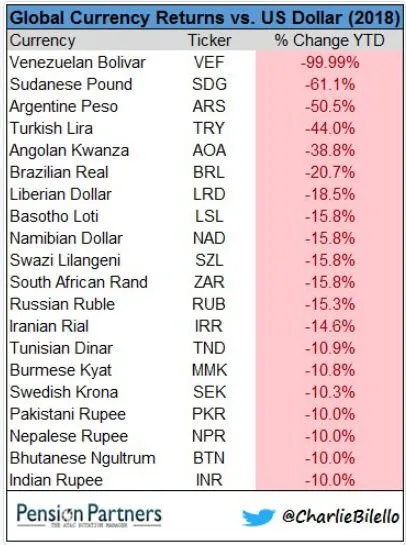

These two top economies of the world have been in a bull run for nearly the past 3 decades, yet now they are diametrically opposed in economic performance. Looking at other world currencies, they are also in a meltdown. This doesn't bode well for the world economy, even if the U.S. appears to be on top and dominating.

Source

Any nation can create an illusion of solvency by over-borrowing, over-spending and over-printing their currency. But eventually this money-magic game implodes as investors and traders lose faith in the currency. All currency value is based on belief, faith, trust and loyalty in it's value. If the game is rigged and manipulated, it's not really worth what people believe it's worth. When people catch on to the deception and the coming devaluation and loss of purchasing power, they bail.

With so many currencies falling apart, it's not a coincidence. They all share a common disease that is causing the outcome. The global debt bubble built up from the past decade after the 2008-2009 economic crisis is popping. The indebted, over-leveraged and mismanaged nations are showing symptoms of the disease first through stock market crashes or currency meltdowns.

When the past economic crisis hit, the bubble never really deflated the whole way. In an effort to prevent a reset back to the grounded reality and live in the real world again, more money-magic manipulation was used to pump things back up into the clouds of fantasy. This was through the expansion of debt and asset valuation.

The global economic system was out of whack back in 2008-2009 with a $500 billion subprime mortgage bubble popping. But the unreal global financial system of $200 trillion was rescued with more financial trickery. The "fix" of creating more debt to inject more money into economies and keep them afloat only made things worse and made the whole system even more vulnerable than it was in 2008. The bubble was just inflated even larger than before. And when it pops, things will be even worse than before.

With so many currencies around the world under pressure and leaking, it's a sign of another coming financial crisis. The current high valuations of assets and currencies will sink to lower levels in order to correct a system that is out of touch with reality, floating in the clouds as inflated bubbles of bullshit.

The U.S. looks great. Many people think there is nothing to worry about if you're in the U.S. market. But the U.S. started the subprime mortgage crisis, then went on with inflating the bubble through more debt and printing of fiat currency. The U.S. market is not immune to what's happening and what's coming. When the asset bubble pops, defaults on financial obligations will pile up, spending will decline, and the economy will crash.

Countries that printed money and went into debt, such as those in emerging market economies, took on loans in U.S. dollars. With currencies falling in value, it will take even more of their local currency to pay back the U.S. currency of debt they owe. Their loans are going to go bad, and the U.S. and EU banks are going to end up with piles of bad loans and bad debt.

Recall in the past crisis that many countries have bailed-out failing institutions that were deemed "too big to fail", as their failure would have sent the economic dominoes falling everywhere. The public had to bail-out companies that failed to be fiscally responsible. We had to pay for their failures. We footed the bill. And we will suffer because of their actions indefinitely it seems.

Governments don't want to let the bubbles pop, and will keep using the public to pay for corrupt industries to survive and keep playing money-magic manipulation games that fail and make everyone suffer. Now many nations have instituted bail-ins, where people who have money in institutions will have to foot the whole bill. Instead of the public at large through taxes paying for failures, it's going to be people with bank accounts and investors.

Prepare to lose most of your money when the banks start failing in the upcoming economic crisis that we are now seeing the start of.

Thank you for your time and attention. Peace.

References:

- The Global Financial System Is Unraveling, And No, the U.S. Is Not immune

- Major Currencies All Over The World Are In "Complete Meltdown" As The $63 Trillion EM Debt Bubble Implodes

If you appreciate and value the content, please consider: Upvoting, Sharing or Reblogging below.

me for more content to come!

me for more content to come!

My goal is to share knowledge, truth and moral understanding in order to help change the world for the better. If you appreciate and value what I do, please consider supporting me as a Steem Witness by voting for me at the bottom of the Witness page.