Money is everywhere. Some love it, some hate it, but none can deny the important role it is playing in our everyday lives. In this post, we will see the main functions and properties of modern money what it is used for and what do we get from using it.

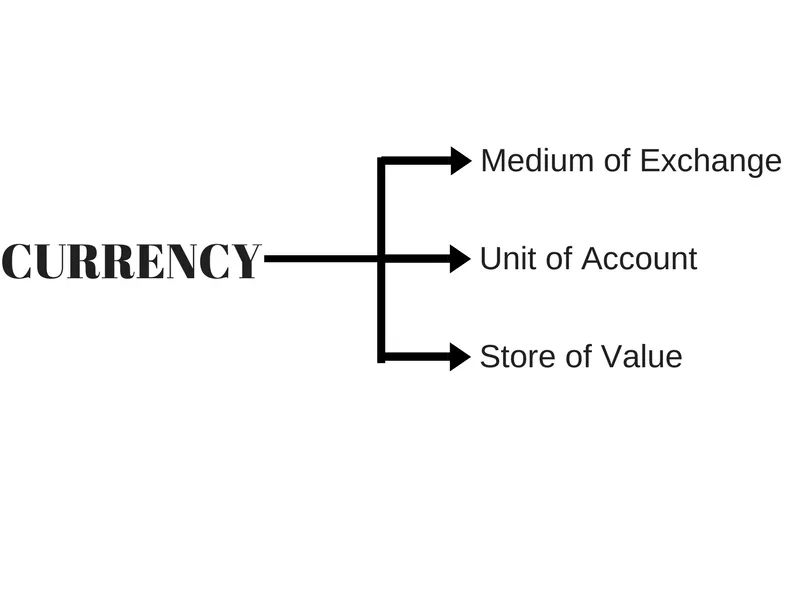

Money has three main functions : means of exchange, unit of account and store of value. No currency is perfect on all these roles. There are compromises in some areas and money is evolving along with our society, so a currency that now is considered useful and valuable in the future might be obsolete.

Now let's explore these three main functions

Medium of exchange.

Money today is a type of IOU ( I Owe You ), but one that is special because everyone in the economy trusts that it will be accepted by other people as a medium of exchange to facilitate transactions for goods and services.

Without money, all transactions would have to be conducted by barter, which means direct exchange of one good or service for another. The difficulty with this system is that in order to have a particular good or service from a supplier, one has to possess a good or service of equal value, which the supplier also desires and this is called double coincidence of wants. In reality such coincidence is not very possible to happen. Money effectively eliminates the double coincidence of wants problem by serving as a medium of exchange that is accepted and trusted in all transactions, by all parties. Because everyone trusts in money, they are happy to accept it in exchange for goods and services and has become universally acceptable as the medium of exchange

There are five properties that make a system a good medium of exchange. These are durability, that means money can be passed around without the danger of wear and damage, transportability, it's whether money can be easily put in my pocket and transferred anywhere.

Next is divisibility, if they can be divided into smaller "pieces", fungibility or interchangeablity with goods , services or other currencies and last non-counterfeitability,. It has to be extremely difficult if not impossible to make fake money .

The modern money that we use are durable and divisable. They are transportable, even though in some cases there are serious limitations. My country, Greece still has capital controls so it not easy to export large amounts of money. They are fungible, that means you can exchange euros for both dollars and books. And maybe the biggest problem of money is counterfeit notes, which no one really knows how many are in circulation.

Store of Value

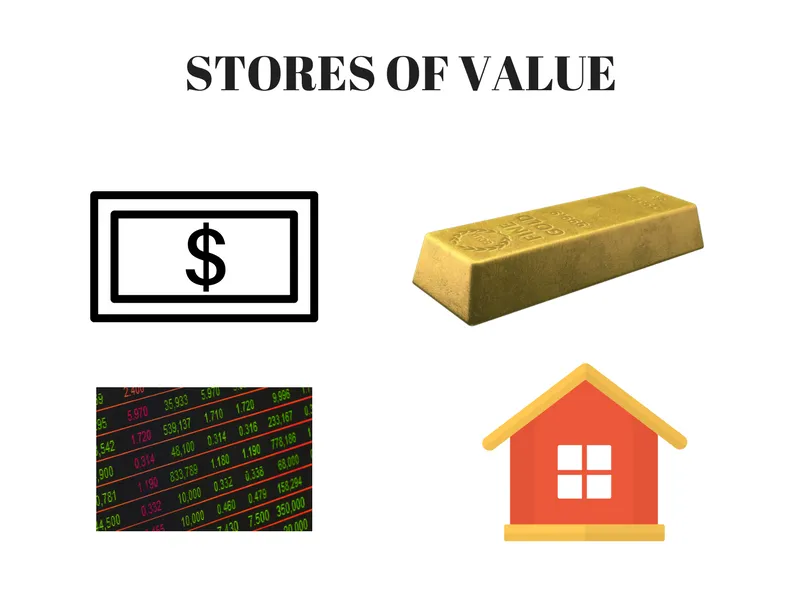

A store of value is a mechanism by which wealth can be saved and retrieved in the future with some predictability about its future value. In order to be a medium of exchange, money must hold its value over time. If money could not be stored for some period of time and still remain valuable in exchange, it would not solve the double coincidence of wants problem and therefore would not be adopted as a medium of exchange.

Money is not the only a store of value that we have. There are many other stores of value or assets as we call them like precious metals, jewelry, bonds, stocks, land, works of art, and even baseball cards and stamps. As all asset prices have greater or lesser degrees of unpredictability and volatility there is no perfect store of value.

One could say that also money is not a great store of value, since it depreciates with inflation. However, money is more liquid than most other stores of value because as a medium of exchange, it is readily accepted everywhere. Furthermore, money is an easily transported store of value that is available in a number of convenient denominations.

Unit of Account

The last main function of money is unit of account, a standard measurement of the value of goods, services, economic activities, assets and liabilities. It's the thing that everything is priced after, so it provides a common measure of the value of what is being exchanged. When you have a common unit of account you can compare a pizza to a mobile phone or a piece of land. When you know the value or price of a good, in terms of money, you can decide about how much of the good to supply and how much of the good to purchase.

Stability of the value of the unit of account makes it more useful as a unit of account. In inflationary currencies, for example, over long periods of time, results are not comparable, leading to the need to use nominal (actual) vs. real (inflation-adjusted) values in order to make measurements comparable again. Here we have to note that the unit of account doesn't have to be the same as the medium of exchange, but usually it is because it is a lot easier for the users. Imagine prices were shown in Euros (unit of account), but only dollars were accepted (means of exchange). We would have to use calculators all the time. There exceptions , though , in currencies with high inflation where merchants have been known to post prices in dollars or other stable currencies (units of account) but to settle in local currency at the current exchange rate (medium of exchange).

These three functions are all closely linked to each other and yet there is not one form of currency or asset that is perfect for all these three roles. For example, a medium of exchange needs to be a good store of value, there are many good stores of value that are not good means of exchange. Houses, for example, tend to remain valuable over quite long periods of time, but cannot be easily passed around as payment.

There are cases that an asset is less useful as the medium of exchange, if it will not be worth as much tomorrow or in other words if it is not a good store of value. In some countries where the traditional currency has become a poor store of value due to very high rates of price inflation, or hyperinflation, foreign currencies have come to be used as an alternative medium of exchange or even store of value.

And here it ends this article. More articles will follow about the history of money. We will see the origins of money, it's evolution and will take a look at the future of money, so stay tuned.

And until we have all the money we want,

Be healthy, Smile and Steem.

References and Additional Material

[1] Introduction to Digital Currencies MOOC 9 from University of Nicosia.

[2] https://poseidon01.ssrn.com/delivery.php?ID=602105112074019109098093072067082100009027025060007078094069113010096011074019099022118037004106027044014126064099095076069020038018032065037098084111086028087091064042045082105023067093077091023080064075098066090111089065009026123011006070015121082&EXT=pdf

[3] https://www.cliffsnotes.com/study-guides/economics/money-and-banking/functions-of-money

[4] https://www.tutor2u.net/economics/reference/characteristics-and-functions-of-money

[5] https://staffwww.fullcoll.edu/fchan/macro/4functions_of_money.htm

[6] https://www.youtube.com/playlist?list=PL68lGg7SjGZDxL4vZmFrlb8T_Iz79HXeL

Images were made with free elements at canva.com