Wealth comes from making smart decisions. If you started to invest in cryptocurrencies at the beginning of 2017, you would be getting unparalleled returns right now. The market is continuing to move at an extremely fast pace.

At its peak, it reached a market cap of just over $117 billion in June, up from $18 billion at the beginning of the year. For the first half of 2017, the top three cryptocurrencies—Bitcoin, Ethereum, and Ripple—had returns of 165%, 3,500%, and 3,329%, respectively.

As a result of high growth, the market is prone to extreme volatility that can leave new cryptocurrency investors anxious to cash out early. During steep market corrections, panic selling starts and pessimism grows in the media.

While it is tempting to quit—out of fear of losing money in a volatile market or to use the returns on that new car you want—the right move is to stay committed and HODL (Hold on for Dear Life). As can be seen from the history of dot-com stocks, those who cash out early will later regret it as blockchain technology becomes widely adopted.

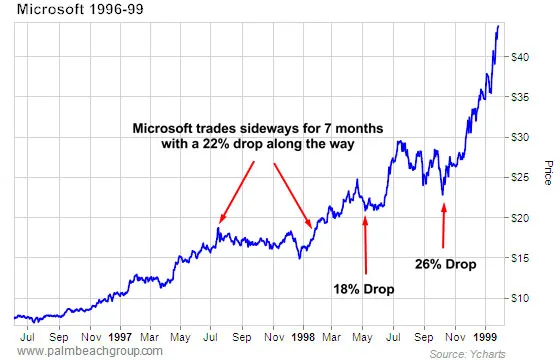

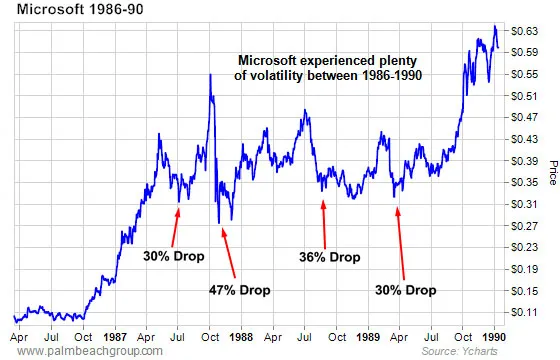

In terms of high returns and volatility, cryptocurrencies are so far following the same path as dot-com stocks during the 1990s. From 1986-2000, Microsoft went from just 10 cents a share to over $50. As the charts below show, the company’s stock also experienced a great deal of volatility during this high-growth stage, just as cryptocurrencies do today.

Eventually, assets can become way overpriced as more and more people get involved and the market reaches maturity. And, that is when it is time to get out. Whether the cryptocurrency market will also become a bubble is not something we will know for many years. Blockchain technology is in its infancy. It is just beginning to get attention from the general public, companies, and governments. According to a World Economic Forum Survey, most experts believe that it will not become mainstream until 2025.

A lot could happen in the next few years. Many experts believe that the greatest amount of growth has yet to be seen. It is predicted that the market cap for all cryptocurrencies, currently at $85 billion, could reach $1 trillion, perhaps much more.

Investment legend Michael Novogratz believes they will be worth around $5 trillion by 2022. Saxo Bank analyst Kay Van Petersen believes that the market cap for Bitcoin alone could be worth $1.75 trillion in ten years, which would put each Bitcoin, currently worth $2,300, at a price of $100,000.

A long-term investment in cryptocurrencies shows keen insight about the potential of blockchain technology to leave its mark on the future. The blockchain enables industries to increase the speed of transactions, reduce costs, eliminate intermediaries, improve security, digitize assets, and implement better bookkeeping. Just as the Nasdaq has a variety of stocks from different companies, the cryptocurrency market has hundreds of digital currencies representing various applications of the blockchain.

If you have not invested in cryptocurrencies yet, it is not too late; in fact, it is still just the beginning. Understanding the underlying blockchain technology and the history of dot-com stocks will help you survive the volatility roller coaster and reap great wealth.