SUMMARY

Note: For anyone who missed the BitcoinLive Information Webinar, here is the replay link:

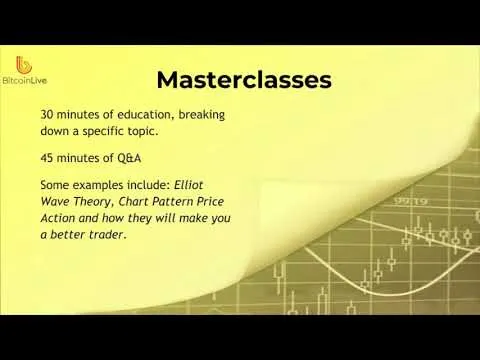

As of June 4, ALL Crypto Analysis will be posted on the BitcoinLive channel and Steemit will be dedicated for Equity, Commodity and Options Analysis. To Signup for the BitcoinLive limited Founding Membership slots, use this link: https://get.bitcoin.live/haejin/

__

The below chart of Taiwan Semiconductor Manufacturing (TSM) has pretty much completed its five wave run up as shown in the below weekly chart. I believe an economic downturn could be approaching. The first to feel the early effects of a recession are usually the financials and the technology companies. An event or some news are approaching to justify the forecast.

IF this wave count is correct, then the correction has likely already started as shown below. The red ABC sequence could already have completed the wave A and since the MACD is a bit on the oversold stage, a red B wave bounce is likely.

On a larger degree of trend, the blue impulse were subwaves to a primary cycle wave 1 (purple). Wave 2 completed and so has wave 3. The current correction is likely to be wave 4. Note that the price target for wave 4 does NOT overlap with wave 1; hence, adhereing to the EW rules. Purple wave 5 sould deliver all time new highs.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--