With many now predicting the mother of all crashes there is several more warnings that are coming to light. Here I report some of the newer warning signs as well as some of the more established warning signs. It appears there some worrying times ahead..

Alan Greenspan's expression says it all:

The Bond Bubble:

Alan Greenspan, former Fed Chief, has warned bond prices are in a bubble. And when it pops it will be bad for everyone. Greenspan says “The real problem is that when the bond-market bubble collapses, long-term interest rates will rise. We are moving into a different phase of the economy—to a stagflation not seen since the 1970s. That is not good for asset prices.”

Michael Pento

Michael Pento from Pento Portfolio strategies speaking with Greg Hunter says:

There is a record bubble in bonds: “Where’s the 10-year Treasury right now? It was 1.3%, and now it’s around 2.6%. We’re going to 4% on the 10-year Treasury. That, by definition, is an absolute bursting of the bond bubble. The problem is this: All assets are priced off of the ‘risk free’ rate of return, ‘risk free’ rate of return on sovereign debt. All asset prices were priced off 1.3% of the 10-year Treasury, or a negative 40 basis points on the Japanese 10-year, or negative yielding German bunds, all assets, and yes that includes real estate and stocks. So, the bond bubble is epic. It is that big in proportion, and it is now bursting.”

The Debt Bubble:

Provident Financial based In the UK who specialize in lending to people in financial difficulties lost 2 thirds of its stock market value on Tuesday 22/08/2017. The biggest fall in any FTSE100 company ever in one day.Portia Patel an analyst at Liberium predicts an approximate shortfall of funding of £73,000,000 by the end of June 2018.

With US debt currently sitting close to $20 Trillion this is yet more indicators there is trouble ahead and then consider Global debt is around 300% of GDP.

Housing Market bubble:

And with Median house prices in the US Year-on-Year rising for 64 consecutive Months and is now above the levels seen in 2006 just prior the housing market crisis.

Stock market bubble:

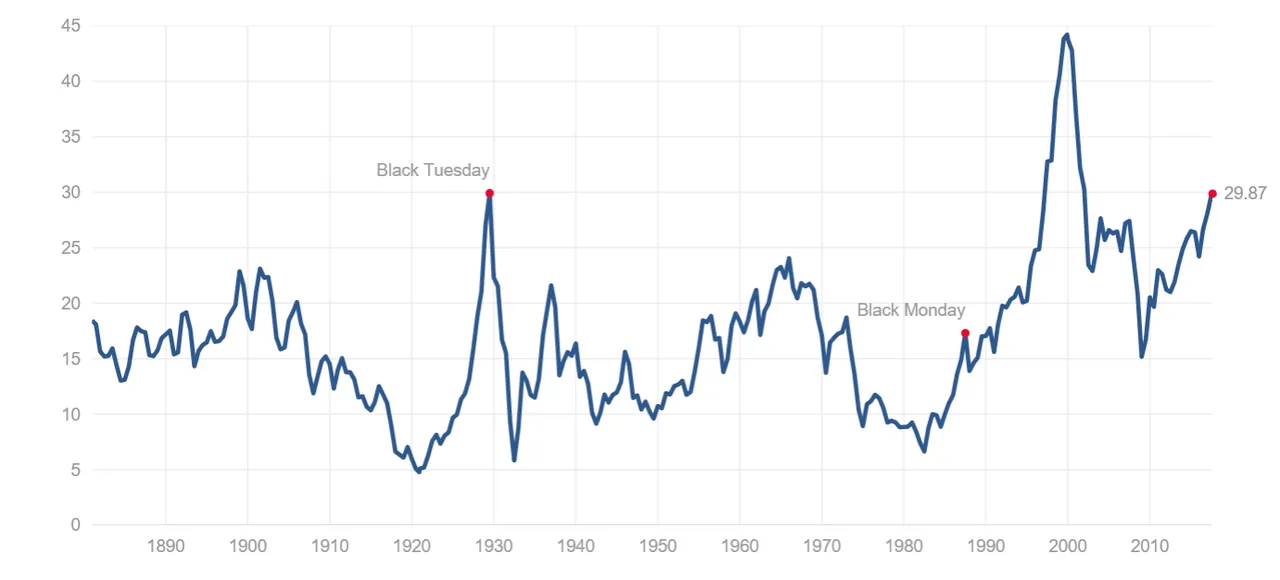

The Shiller CAPE a measure of whether stocks are over or under valued or Cyclically adjusted price to earnings ratio now at 29.43 and considering the normal range to be 12 -18, once again, this shows that there are bubbles everywhere at the moment:

Nobody knows when this collapse will happen or what form it will take only that is likely to be painful for many.