If you have been saving for retirement or wondering how much you should save for retirement, there is a rule that has been pretty much standard. It is called the 4% rule, which basically means that you can take 4% of your retirement savings out and expect it to last the duration of your retirement. While it is a basic rule, everyones needs are different so its important to look at the specifics of why this rule actually works, for how long it will work and how much you actually need to save for this rule to work.

The first thing to take in mind is that this rule is based on what the market has returned on average in the last 30 years. On average if you count reinvestment of dividends, the market has returned around 9%-11% per year, the rule of thumb is roughly your money doubles every 7-8 years over a 30 year period. These returns alone really show the power that having money invested can bring. Even with an event like the 2008 financial crisis, the returns end up still being pretty fantastic.

The 4% rule relies mostly on how long you think you will be retired for and how much supplemental income you have along with the money stored away. If you expect to be retired for 20 years the rule has a 90%+ success rate and about an 80%+ rate if you expect to be retired for 30 years. You would still have money after these times most likely, but the idea is you want to whether the storm if there is an economic event like a bear market cycle. The real problem would be if you wanted to retire in a certain year and it happens to be a bad economic year.

For example if you wanted to retire in 2008, with the value of stocks being so low, many people just decided to work for a few years until they went back up, which they ultimately did. You could also play with the amounts if you wanted to be more conservative, so say for example you wanted to do a 3% rule instead of a 4% rule. Not only would your success rates long term go up, but you would also be able to weather a bad market much easily and not have to worry much. The key always comes down to how much money you actually have invested and how much you can live on.

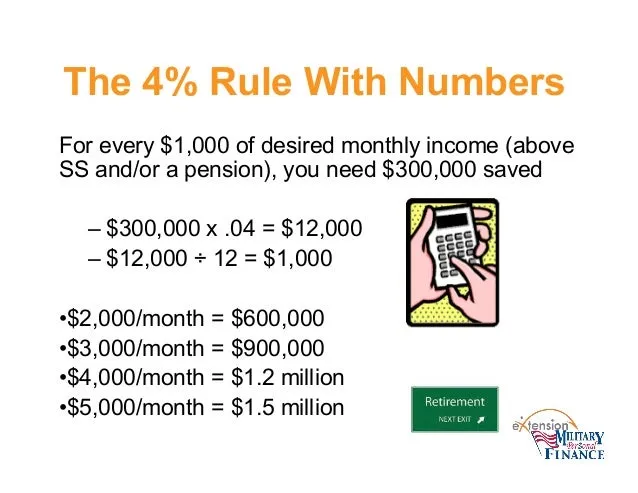

So how much money do you need invested for the 4% rule to work ? Basically the 4% will be added to any sort of other retirement plans you might have through work and social security. So if you plan on getting a decent amount in a pension and social security, you might not need as much money from the 4% rule to survive. It comes down to what your spending habits are. If you need 40,000 usd to live a year and expect to get no social security or any pension, then you would need a million dollars in the market in order to live.

You should also take into account inflation over that long period of time because 40,000 usd might not be that much near the end of your retirement. The key is you want to be able to retire comfortably and now have to worry about finances. The 4% rule is a good basis point for this, but you might want to adjust it a bit for your own preferences and needs. When in doubt talk to a financial professional (who is also a fiduciary) to look at your finances and find what is right for you. Tomorrow ill most likely write an article on how to get a million dollars in the stock market, which isnt as hard as you might think if you start contributing when you are very young.

-Calaber24p