Hello Steemians.

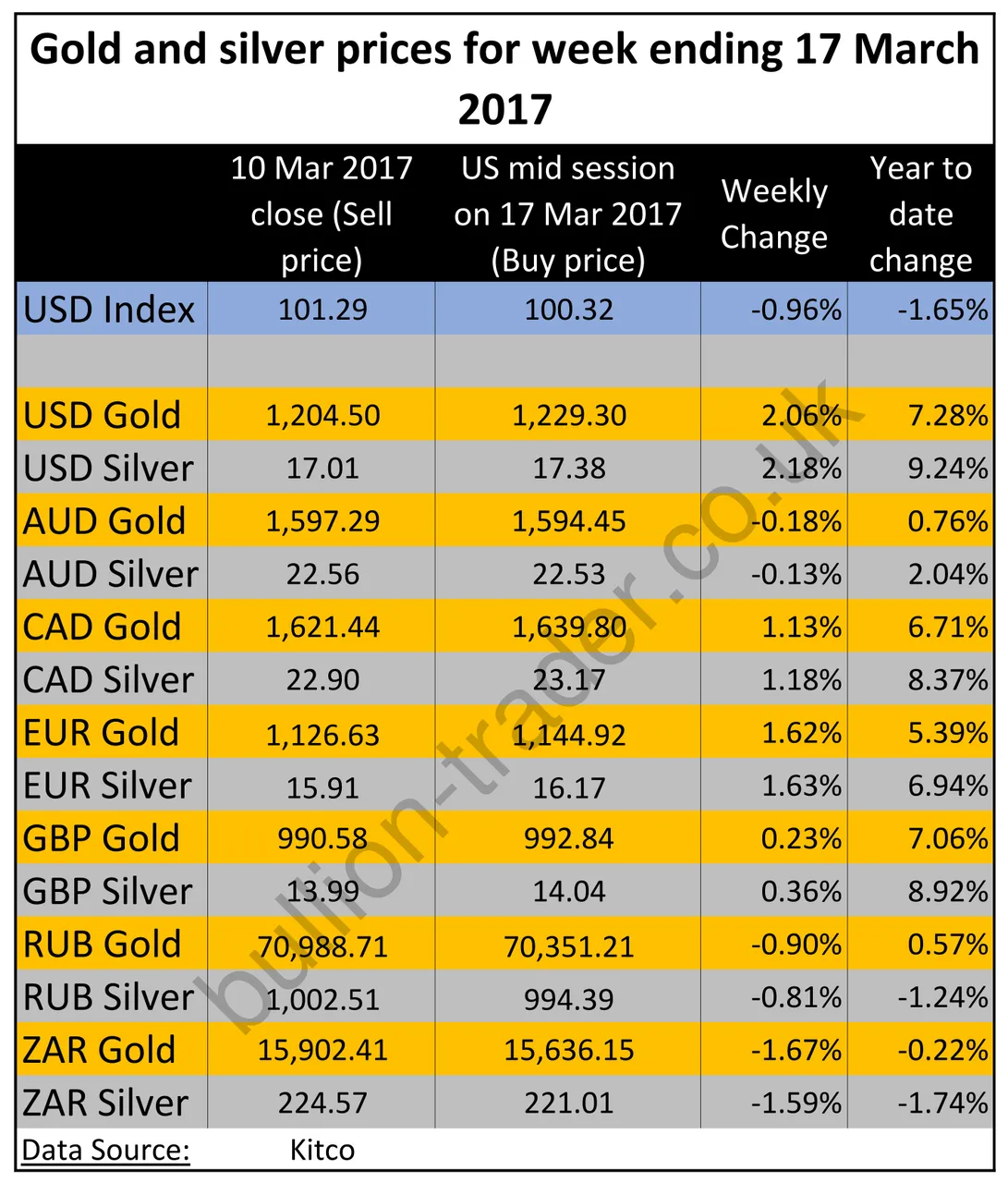

The USD index is down for the week so gold and silver prices would be up in USD terms.

Fed raises rates as anticipated.

On Wednesday 15 March 2017 the US Federal reserve raised the fed funds rate by 25 basis points, which is 0.25% in yours and my language, and indicated more rate rises were on the cards this year. The immediate effect on you and I is that our housing loan payments and possibly any other debt repayments will increase. Sadly, we suspect, the same can't be said about any interest paid to us from our savings account.

Gold and silver prices reacted favourably, with gold climbing vertically to settle above $ 1,220 for the day. Silver did the same, since gold and silver always track each other. If gold goes up, silver will go up. Likewise, if gold goes down, silver will go down.

Gold and silver is the only money not controlled by any one government. They are also outside the banking system so when there is a financial crisis, gold and silver stand separated and do what they do best – protect wealth.

The Federal Reserves' justification is carefully crafted so not really worth paying much attention to. Safe to say they will never reveal the real reason for their actions and anyone that put some thought into the current economic climate will realise that all central banks have their backs against a wall.

In 2008 the central banks all started reducing their interest rates in conjunction with various QE (money printing in everyday language) programmes to stave off a meltdown of the global financial system, caused by the banks that were effectively bailed out by the reduced interest rates and QE money.

With their interest rates now close to zero, should a financial crisis arise – which seems very likely, they cannot reduce these interest rates further to kick start an economy or help the banks out again. Essentially they are out of bullets.

The likelihood of interest rates returning to previous levels of between 4% – 6% is very slim. If they raised them by 0.25% four times in 2017, they would only manage to raise them by 2% this year. That could potentially be destructive in itself for the following reason.

Since global debt (government, corporate and personal) has increased exponentially a 2% interest rate rise in one year would cause so many defaults that banks wouldn’t survive. It would be 2008 all over again, except a lot worse, since there is now much more debt than in 2008.

What happens in the global financial system in future is anyone’s guess, but a few things are certain.

- Inflation will rear it’s ugly head, since this is the only way, apart from an outright default, that all governments can pay off todays' debts in the future. This future could be 50 years or more so it’s a long time-frame. During that time, inflation will ravage the money in your pockets and bank accounts so that in 50 years time, todays' money will be worth almost nothing.

- Government spending very seldom decreases and since governments only get their revenue from taxes, taxes will be increasing to pay for the increasing spending.

Protect yourself and your families wealth, no matter how small, by investing in physical gold and silver.

Getting started with investing in physical gold and silver is much easier than many think. Visit the bullion-trader education centre to see how easy it is and where to get started.

Access our educational videos where we also cover many other aspects of gold and silver investing.

Take control of your future. It’s never too late to start and you’ll never regret it.

Have a good weekend.