If you’re in one of these nations, you need to be aware of economic collapse coming within the next several years and perhaps as soon as next year. This will be much more catastrophic than the economic crisis in 2008/9 caused by the real estate bubble in the U.S.A..

In danger are countries with the lethal combination of high external debt (as sorted by debt-to-GDP ratio) and negative trade balances.

Short-dollar Vortex

This is because external debt is vulnerable to rising interest rates combined with cratering foreign exchange rates for the domestic currency relative to the U.S. dollar which I explain is a coming “short-dollar vortex” in my previous blog: Global Crisis […] Coming. The reason for the coming spiraling rise of the U.S. dollar is because so many nations are vulnerable to rising interest rates (c.f. also) and their need to pay back dollar-denominated loans/bonds, so this will drive a contagion and crisis in confidence which will cause international capital to stampede out of these vulnerable countries and into the U.S. dollar and dollar investments for a safe haven. IOW, capital follows the herd as capital moves then more capital follows it. This is what exacerbated the Asian Crisis just before the turn of the 21st century.

This short-dollar vortex will cause a spiraling debt crisis in the vulnerable nations, as is already underway in Argentina:

Vulnerable Countries

S&P Global recently published a list of 5 such vulnerable countries: Argentina, Colombia, Egypt, Pakistan, and Turkey. Note Egypt, Pakistan, and Turkey are fragile, but not because of external debt.

For example although Colombia rebounded slightly since 2016 with the dead-cat bounce up in the oil price (and receiving $5 billion in remittances from their nationals abroad presumably primarily from the USA and Europe which will decline precipitously as the those economies collapse into their economic abyss), they have worsening regional export and migration contagion along with significant deficits (trade and government budget) — with massive ongoing infrastructure investment needed to satiate the revolutionaries — on $39 billion in exports (45+% of which is oil) even with the $60 oil price which will decline again to find the final bottom lower than the $27 low in 2015 due to increased competition in the production of oil and the contagion of a global recession in 2020:

And Colombia has only 5 years of oil reserves remaining with no investment in exploration at these low prices! Fattened party-focused, non-capitalistic Colombians have no inkling of the decade(s) long crisis that is coming.

Some other countries (other than most of the African and Middle Eastern countries) that meet the two criteria I stipulated: Armenia, Australia, Bahamas, Belarus, Canada, Cyprus, Finland, France, Georgia, Greece, Jamaica, Laos, Macedonia, Moldova, Nicaragua, Serbia, Ukraine, and United Kingdom.

However, each country has to be analyzed for mitigating factors. The trade account deficit may indicate a less productive, consumption focused society that has structural problems with business investment. Or it might indicate massive capex imports for a developing nation or excess, conspicuous consumption that can be dialed down in a crisis by the relatively affluent citizens. Also real estate bubbles such as in Vancouver and Australia exacerbate their plight. And all of the socialist countries have an exacerbated issue which is the coming pension crisis (c.f. also this, this, this, this, this, this, and this and exacerbated by the low interest rates since 2009), which is a problem Asia and the developing nations don’t have. Australia is especially REKTED.

For example, are a few articles about Argentina:

Argentina pushes interest rates to 40% to defend the peso

Phase 3 of the global rising interest rates cycle

Why Argentina’s economy is in trouble again

https://thewire.in/external-affairs/argentina-mauricio-macri-debt

Why Argentina struggles to become a normal country

Argentina is getting impatient with Macri’s painful economic reforms

Taming twin headaches of Argentina’s economy

Note that although China and Japan have very high debt-to-GDP ratios, their debt is all internally financed with their domestic currency, so they are more insulated against a rising U.S. dollar even when they experience their coming debt reset. Other than Japan, Asia (including China) has the lowest tax rates, very limited social welfare programs and thus not the for example $123 trillion of unfunded entitlement liabilities that will drag the USA into the economic abyss. Asia’s economic downturn and realignment away from dependence on exports to the West will bottom 2020 – 2022 and start growing again as the West dive bombs into the abyss over this coming decade.

Hong Kong is threatened with deflation collapse because of the peg of the HKD to the USD:

Hong Kong’s intervened to support the Hong Kong dollar for the first time since August 2018 after the exchange rate fell to the lower end of its trading band against the greenback. The Hong Kong Monetary Authority bought HK$1.507 billion ($192 million) of their own currency during London and New York trading hours on Saturday.

The Hong Kong dollar peg to the US dollar has come under a lot of pressure. The problem they face is simply that such a peg also imports the inflation or deflation of the currency to which a peg is created. As the Greenback rises in the political-economic sea of international finance, it will become impossible to hold the peg.

The problem Hong Kong will face is as the financial crisis in Europe erupts, this will push the Greenback higher. If Hong Kong keeps desperately trying to hold the peg, they will import

DEFLATIONand turn their economy down very hard all because of international events. The models we showed at the Singapore Conference targeted 2019 for an important turning point.

The reason is because if the HK authorities maintain the value of the HKD higher than its free market value by defending the peg, this will cause relatively increased hoarding of the appreciating asset (i.e. hoarding the HK$) and thus reducing spending and business development investment in all other things in their economy. The deflation spiral is a self-reinforcing feedback loop that eviscerates public confidence in the economy, because less spending and business development investment depresses spending and discourages business development investment.

Socialism End Game

China has not been Communist since at least the 1960s. And Asia supports instant death for drug pushers.

Doug Casey: "We Are On The Cusp Of A Civil War"

Jonathan Roth - Civil War Coming to America?

The Illinois Pension Crisis – Giving The Pensioners All State Assets

The Public Pension Crisis is Our Undoing

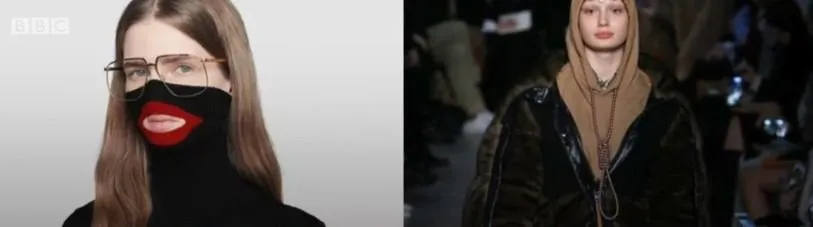

The Decline in Quality is Part of the Cycle

Identity politics is destroying the West:

Fashions Turning to Civil Unrest for Inspiration

Cohen & His Allegations Against Trump

https://www.armstrongeconomics.com/world-news/pension-crisis/forecasting-political-correctness/

The great public pension fraud here in Ontario, Canada allowed the public service unions to endorse Liberal candidates who would give them their 3% raises every contract. This gave them an 18% head start (the number of public sector employees) to win an election that only required 34% to gain power. The percentage of Liberal voters rises since children of public employees are likely to vote the same as their parents.

Even when Conservative’s hit the campaign trail, they too promised better civil pay because they knew 1/5th the voters worked for the government. Corrupt as hell!

Your comment on government pensions hits the mark. Ontario is the largest by population of 14 million. The number of public service employees is nuts, 18.6% (1.3 million) of the total employed. The pension burden is enormous. As private wages have stagnated for 2 decades now, pension and benefit costs came out of the employee’s wages, but our civil servants got the raises and the benefits.

The US began to mint two types of silver dollars. The “Trade Dollar” was used to make payments to China for their standard was different from the West. The idea was promoted by the silver miners because the price of silver began to decline due to increased mining efforts in the western United States.

The silver miners effectively donated huge money to the Democrats to support the price of silver, which ended up nearly bankrupting the United States by 1896 and gave the Democrats the name “Silver Democrats.” […] The Democrats stood against gold and sought to overvalue silver to satisfy the silver miners who were funding the Democrats back then.

https://www.armstrongeconomics.com/international-news/britain/medical-professions-view-of-brexit/

The USA has the biggest economy, which is created by having a lower-taxed consumer base. That is why everyone from China to Germany stands in line to try to sell to American consumers. China realizes this is a no-win situation and they have turned-inward by trying to develop its own consumer-based economy with less reliance on selling to Americans.

A majority of Europeans (58%) would prefer to work as an employee rather than risk starting their own business. The promises of pensions and the social state have created a vast economic different picture between Europe and America and in Asia, we see a trend that is beginning to surpass the United States. This contrasts starkly with attitudes in the United States, where a majority (51%) say they would prefer to strike out alone. The United States allowed the property to be owned whereas in Europe the title to the property remains fixed in most of London and is leased out for 100 years where people pay the value as if they had purchased the property, to begin with. Property in London that was “freehold” was rather rare. Many fled to America which was the land of opportunity to actually own property, build wealth, and leave it to your family.

Then rushes in the Marxists. They hate people inheriting wealth and call it unfair. Every generation should start at zero in their mind. Then we have the economists who argue that it is the disparity in income that suppresses the economy in Europe. So what is their solution? Regulate everything excessively and take the wealth away from those who have it and pretend you are handing it to the people if anything is left once they government gets its hands on it for their own lavish pension schemes.

The United States is the venture-capital capital of the world. That will soon be displaced by China. Nevertheless, how to actually measure entrepreneurship is a very distorted view of the economy. One popular approach among economists which overlooks the depth of a nation’s economy is to count how many new businesses with paid employees start up each year, then divide them by the number of companies that are already up and running. The Organization for Economic Cooperation and Development (OECD), calls this percentage the “employer enterprise birth rate.” Others just call it the “start-up rate”.

From this distorted perspective, the United States scores fairly low on that definition coming in second to last when looking at the years 2007 through 2009 during the crash. The glaring flaw in this view is the fact that in the economies which are least developed come out on top, which was Slovakia and Mexico. The United States was predominantly small business also before the Industrial Revolution. Creating criteria of this nature are extremely misleading. Also, the period in question saw many young individuals start out on their own unable to find jobs with their costly degrees. They entered the self-employment segment but were not hiring people. They were breaking out and doing work in various services.

The greatest economic growth follows the LOWEST taxes, developed economies, and lower regulation. When the government attacks all three areas, our computer simply shows that economic growth declines.

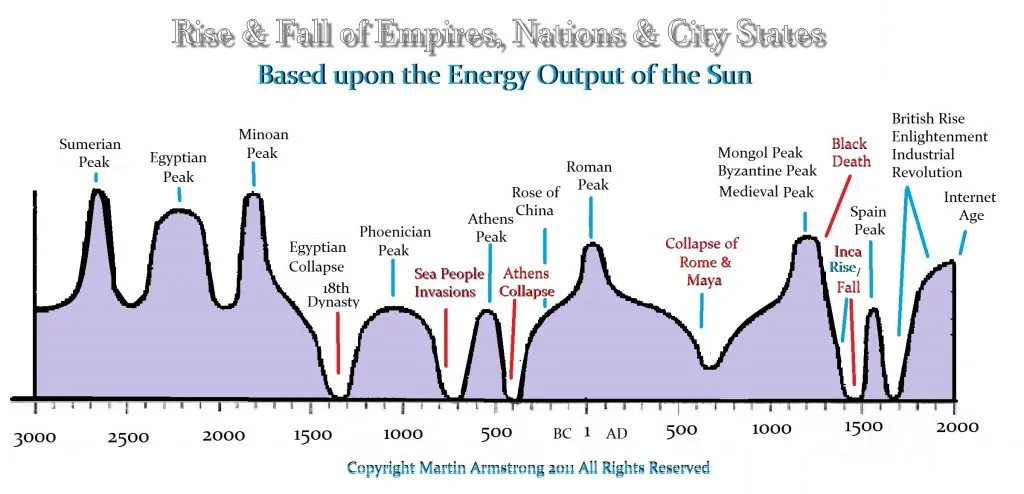

Mini-Ice Age

NASA has confirmed that the past 2 years have been the most dramatic cooling event of the last century.

The Maunder Minimum already underway is causing the economically devastating drought in Argentina and South Africa, crazy hurricanes that devastated the Caribbean, the very unusual raining/cold summer in the Philippines this year (normally no rain and very hot during April and May), California’s schizophrenic devastating alternating drought/fires with torrential rains mudslides, and numerous other extreme climatic and tectonic effects. Westerners especially seem to have forgotten that man is not more powerful than nature.

THIS IS NOT BEING CAUSED BY GLOBAL WARMING OR HUMAN INDUCED CLIMATE CHANGE. WE’RE BEING LIED TO.

World Economy to Decline Until 2036

Armstrong wrote:

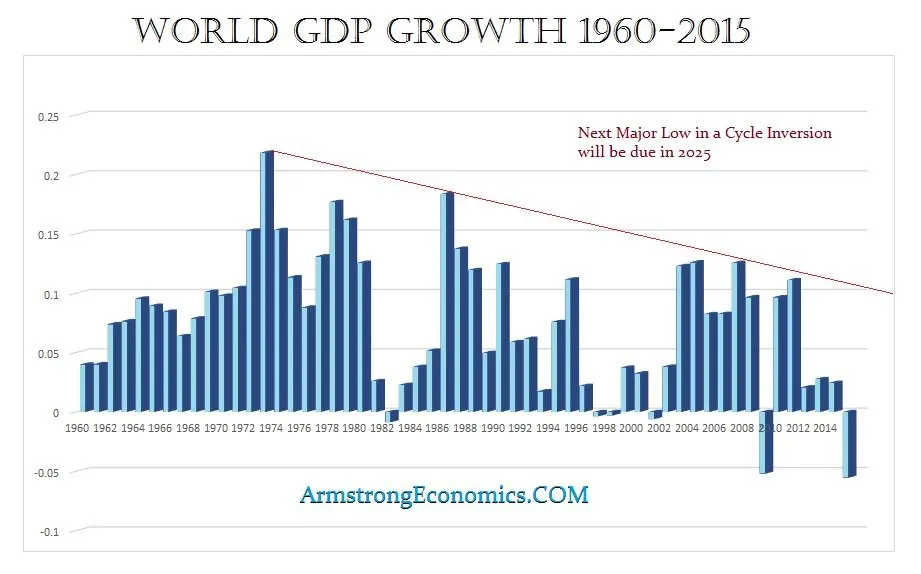

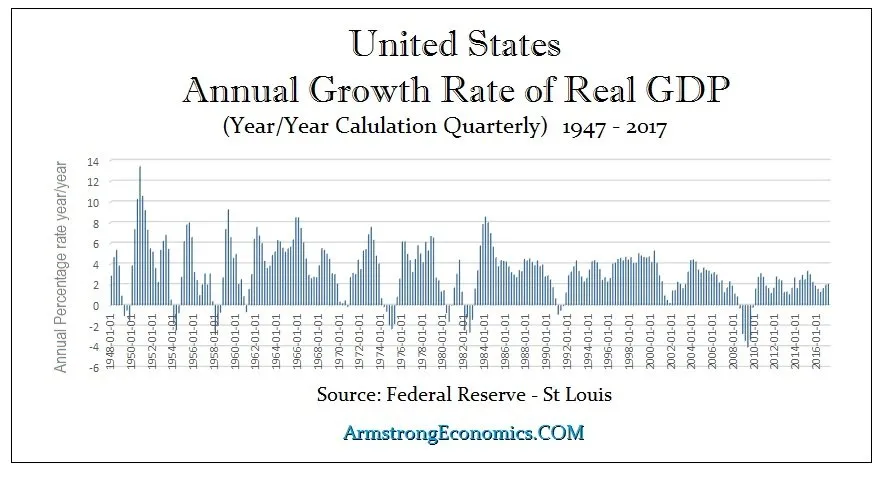

World Economy Declines into 2035.8

The world economy has been in a prolonged economic decline as taxes have risen and regulation has expanded. As government hunts money everywhere, they are bringing the world economy into a major decline since the 1970s. The bottom in nominal terms appears to be 2025. However, in REAL TERMS, we are looking for a decline into 2035.8.

Another projection from Armstrong:

Will Russia’s economy eventually exceed that of Germany? The answer is yes, just as China will surpass the United States. The West is collapsing. World GDP has been in a bear market since the late 1970s. The economy is moving into a recession as we spiral toward 2020. We will then enter STAGFLATION — rising prices with declining economic growth — between 2020 into 2024 with another hard decline thereafter into 2028.

It does appear that the economic decline will be much more severe with respect to Germany than Russia. Therefore, part of the gains in Russia will be not so much from growth as it will be from Germany declining more significantly because of its export economic model.

Those who doubt the predictive power of Armstrong’s cyclical models and historical data modeling, may want to read this.

The reason for the coming stagflation is because the 4 decades sovereign (e.g. US Treasuries) bond bubble is coming to an abrupt end.

When the next recession comes there is going to be a lot of turmoil

Jeffrey Gundlach on the market, millennials, cannabis, taxes, and the 2020 election

As interest rates rise back to normalized levels of 7% (from the current 2% after a slight pause into 2020), not only will fewer people be able to afford to buy a home (and thus real estate and housing prices will crash again), also the servicing of the global (and especially Western) debt is going to consume an ever greater portion of incomes (including tax income for governments):

And because governments will raise taxes. Bill Gates explained, the fact the ultra rich couldn’t possibly be made pay for it (because they can always side-step predatory taxes or as Amazon.com’s recent bailing out of NY plans, they can just leave and take their business elsewhere), so the taxes are going to be raised on the middle class (and also the stagflation will be an indirect tax on the poor). The abnormally low interest rates irreparably bankrupted the pension plans in the West and the general decline coming will cause a massive rise in demand for welfare, both of which the government will be tasked with paying for. So net incomes collapse while taxes and thus costs of everything will rise. Also the malinvestment caused by the debt bubble combined with the increased regulation and costs of complying with socialism, will also force the costs of everything higher as it has destroyed supply. There’s an imminent conflagration (and probably contagion) of effects from the borrowed-time and idiotic moral hazards of socialism and leftist ideology that have pervaded Western civilization.

Additionally Armstrong writes about the corporate bond debt crisis coming in 2021:

We have a very interesting crisis building in addition to the political chaos we see coming in 2020. By the time we reach 2021, we will have over $2 trillion in investment grade corporate debt maturing. This is going to present some very interesting problems. Up to now, we have advised our corporate clients to borrow at these rates and lock it in for 30 to 100 years. The bulk of corporations, who we do not advise, funded themselves short-term. With about $2 trillion maturing by 2021, they will end up pushing interest rates higher from there onward.

So in short, the West is shooting itself in the feet as the Titanic is on flames and sinking. This Western process of self-immolation (aka “societalcide”) will accelerate over this coming decade as Western socialism is destroyed by destroying itself and its society.

But this is creative destruction because it ushers in the vital decentralization technologies which will reshape the global economy and provide massive employment by unlocking the value of maximum division-of-labor and disintermediating behemoths. Conceptualize it simply— if we all tied our shoelaces together, we’d be much less valuable while in that tied up state.

Bond guru Jeffrey Gundlach’s video linked above says 7 times more federal government spending goes to old people than to the youth in the USA. Armstrong wrote:

At the current federal minimum wage of $7.25 per hour, working 40 hours per week, 52 weeks per year, yields an annual income of only $15,080. This is below the annual poverty line. It also reflects something that most people are unaware of —

in Illinois, there are more than 19,000 retired teachers who get OVER $100,000 per year in their pension. According to the latest data, nearly 1.5 in ten federal employees are eligible to retire RIGHT NOW, andin five years the number will hit […] 30%.

Gov. Christie rebukes a teacher at Kenilworth Town Hall

The farce of a false dichotomy of Blue vs. Red irks me. Clinton is the President who signed the repeal of Glass-Steagall, which allowed the commercial banks to go into investment banking enabling the malfeasance that fostered the 2008 subprime mess. And signed the law to make student loans nondischargeable in bankruptcy. The student loan debacle is going to destroy our youth and collapse our real estate market (in addition to the loss of demand as interest rates rise)! The government’s involvement in healthcare and education is corrupt and will always be (because wolves in sheepskin are naturally attracted to hen houses)!

The government is for sale to the highest bidder by both parties.

We the people have to stop bickering, getting riled up by diversionary identity politics, and thus being fooled by the uber wealthy. “Tax the wealthy” slogan is another way we are fooled, because the wealthy never pay taxes. They can leave. They have jurisdictional arbitrage options. This is how the politicians fool us into socialism and raising our own taxes until we are so deep in stagflation that we’re desperate and double-down on leftist radicalism leading to Wiemar Republic leading to the rise of Hitler. And we will do it again eventually. The nature and cycle of collective human action. The wealthy play this like a fiddle, dividing-and-conquering us by getting us to go collectively insane.

I wish I could see some collective sanity amongst my fellow Americans and Westerners.

I am trying to do something to help the youth while also helping myself to be productive. Decentralization is my plan.

I wrote on Quora:

EDIT: note Armstrong has written about being invited to the Chinese Central Bank and being surprised that they knew all about his work. You refer to the USA puppets S. Korea and Japan which are (at least demographically) peaking and declining respectively. Both S. Korea and Japan are opening their economies to Asean workers and they knew they have to become more integrated with Asean as China rises to displace the USA.

Japan has also increased military spending because they can see the writing on the wall. The USA better not fight in the South China Sea, as we will lose our aircraft carriers there if we do. And this grows ever more the case every year. The USA’s sphere of influence is waning.

The antidote to the USA’s decadence would only be to stop misallocating resources. Stop subsidizing the idiotic masses which for example funds the drug consumption which destabilizes Central America. A wall will do nothing to stop the drug trade which comes in via trucking through ports-of-entry. The solution to the drug and migration problem is stop subsidizing the globally noncompetitive flesh.

But the USA can’t accomplish this politically. Democracy does not work efficiently. In fact democracy is the alternative to civil war. And now we’ve reached the point where democracy is not the viable alternative.

Trump highlights the dysfunction of the West:

Trump nails the corruption of the wars in the Middle East:

Trump mentioned the Fed’s desire to raise interest rates as being the Achilles heel of his robust economy. But the Fed has to back off raising interest rates until after the 2020 Presidential election because of the non-domestic, global recession imminent in late 2019 into 2020 (which will be a boon to the USA because of the influx of international capital in the short-dollar vortex).

So barring the attempted abrogation of the Electoral College by desperate Democrats (which otherwise might lead to a Constitutional crisis with a Supreme Court ruling ordering each State’s electorate be honored?), Trump will win reelection in 2020 because never (or at least not in the past 100+ years) has a Republican has lost except in a domestic recession. However, what can happen in 2020 or 2024 is an Electoral College tie, in which case the House of Representatives would decide but with only 1 vote per State delegation, the Republicans would likely win the tie breaker. This would possibly cause a Constitutional crisis with Democrat extremists resorting to terrorism.

The Democrats are in a weak, desperate position due to the Electoral College advantages (e.g. Democrats concentrated in California), Trump’s brinkmanship on census gerrymandering, “new green deal” (no more airplanes) extremism of Democrats scaring the fuck out of centrists, and with the strong domestic economy (driven by the short-dollar vortex influx of international capital to dollar denominated investments). By 2024, the global recession and rising interest rates will have put the USA economy in stagflation. So then the Marxism will become more popular in the USA, especially with the boomers dying off and the disenfranchised Millennials (aka “Justice Democrats”) becoming a more significant (and vehemently energized, extremist) portion of the electorate. Trump will of course be blamed for everything including the rich getting richer via the booming stock market due to the prior short-dollar vortex. The disenfranchised will assert their political will fiercely circa ~2024 and beyond.