History:

The project was founded in 2016 by Ned Scott and Dan Larimer, creator of BitShares.[3][4] The two are founders of the Steemit Inc. company which runs the Steemit website and funds ongoing development of the platform. On March 15, 2017 Dan Larimer announced his resignation from the company.

Concept :

The idea was described in a whitepaper released in March 2016.

The general concept is similar to other blogging websites or social news websites like Reddit, but the text content is saved in a blockchain. Using a blockchain enables rewarding comments and posts with secure tokens of value. Images can be uploaded and hosted on Steemit. Other multimedia content must be embedded from other web hosts. For formatting, there is a WYSIWYG editor. Users can also opt to use Markdown formatting with HTML elements.

User accounts can upvote posts and comments, and the authors who get upvoted can receive a monetary reward in a cryptocurrency token named STEEM and US dollar-pegged tokens called Steem Dollars. People are also rewarded for curating popular content. Curating involves voting comments and post submissions. Vote strength and curation rewards are influenced by the amount of STEEM Power held by the voter.

Steemit has a reputation system, where new accounts start with a reputation of 25. An account's received votes can influence its reputation up and down, incentivizing online etiquette.

Steem blockchain:

Steemit runs on top of a decentralized network named Steem. Like Bitcoin, Steem is a blockchain with transferable tokens. In addition to moving tokens from one place to another, Steem is also a text content and metadata database that applications or websites can connect to. Through these apps, Steem accounts can transact and interact with the Steem database. Instead of using cryptographic hashes as addresses like many blockchains do, user-chosen alphanumeric account names are used. With human readable account names, transactions can be made directly from an identity to an identity, making them easier to understand than hashes.

Steem also reaches decentralized consensus differently than Bitcoin. It uses a method called delegated proof of stake where block-creating accounts, called witnesses, are elected by Steem stakeholders. Instead of relying on proof of work to find blocks, the Steem network actively schedules these accounts to improve the time between blocks to 3 seconds. Block producers are given a small part of the rewards created in each block; the rest is paid to authors and curators.

Steem has no transaction fees for rate limiting or to pay its block producers. Instead, accounts use bandwidth, which replenishes fast enough that a typical user is not affected or limited.

While steemit.com is the first and reference front-end website interface for the blockchain content of Steem, the network's open and permissionless nature allows third-party websites and apps to connect and interact with the Steem database. Several have been created by third parties. These offer alternative interface designs or features such as Instagram-style image posting. Busy.org is a Steem-interacting website with an alternative user interface. eSteem is a Steem-interacting Android and iOS app. A forum-style application called chainBB is also available.

Non-Steemit apps and websites use the same Steem user credentials as used on Steemit. This is possible because the user account and password are part of the network database, using public-key cryptography. Only the user who owns an account can authenticate actions such as commenting, voting, or transferring with their password or appropriate key. Each account has a set of private keys with different access privileges. The lowest security level key allows posting, commenting and voting, but not transfers of currency. Therefore with a hierarchy of keys, it is possible to use other Steem-connected apps without risking a loss of funds or account control.

Monetary system:

The Steem blockchain has two tokens: STEEM and Steem Dollars.

Steem began with a highly inflationary supply model, doubling roughly every year.[4] However due to community demand, on December 6th, 2016 the inflation rate of Steem was changed to 9.5% per year, reducing by 0.5% per year. [7]

STEEM[edit]

The STEEM token is the network's base token. It is traded on multiple cryptocurrency exchanges and markets. Its market value determines the value of the pool of rewards paid by Steem. Its value also backs the value of Steem Dollars.

STEEM Power:

STEEM Power (commonly abbreviated SP) is STEEM that has been entered into a smart contract and represents the amount of influence an account has compared to the rest of the network. The more STEEM Power an account has, the higher influence its vote has on posts or comments. STEEM Power also determines an account's weight for witness approval voting.

Accounts are created with a small amount of deposited STEEM in the form of STEEM Power. Content creators have the option to choose post rewards of 100% STEEM Power instead of the default 50% liquid currency (a combination of STEEM and Steem Dollars) and 50% STEEM Power. Users and investors also have the option of converting liquid STEEM into STEEM Power, called powering up.

STEEM Power cannot be transferred or traded directly, but the account owner can choose to withdraw liquid STEEM in weekly payments at a rate of up to 1/13th of the account's total STEEM Power. This is called powering down. The account will lose its voting influence in proportion to the STEEM withdrawn.

Steem Dollars[edit]

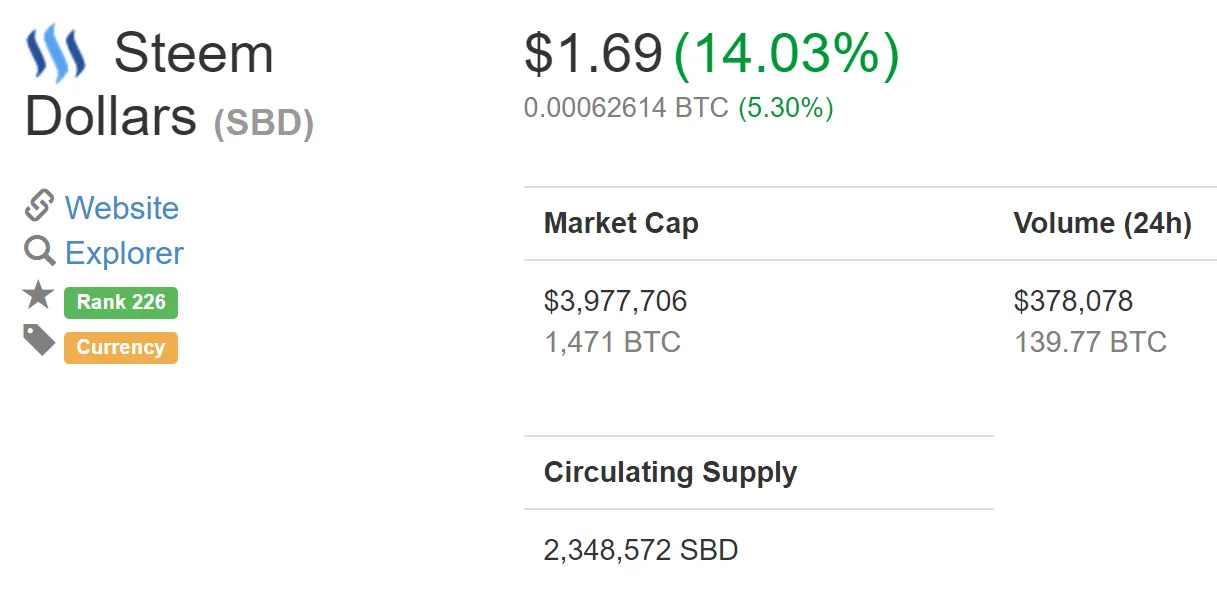

The Steem Dollar (commonly abbreviated SBD) is an asset intended to be pegged to the United States dollar. Steem Dollars can be traded at cryptocurrency exchanges, and used for payments for goods and services.

There is an internal market on the Steem blockchain and integrated in the Steemit website where STEEM can be traded with Steem Dollars and vice-versa. Steem Dollars can be converted into an equivalent-value amount of STEEM in a process that takes 3.5 days.

Steem Dollars which are held receive an interest rate. This rate is set as a variable collectively by Steem witnesses. As of March 2017 this rate is 2% annually. If Steem Dollars are being traded below parity with the US dollar and the supply of Steem Dollars is not too high relative to the liquid STEEM supply, the interest rate may rise.

Wallet[edit]

The Wallet page on Steemit shows the tokens belonging to an account. The web-based wallet allows network transfers of Steem Dollars and STEEM. Additionally it has controls for powering up or down, transferring liquid tokens to and from savings balances, and conversion of Steem Dollars to STEEM. Savings balances are provided as a security measure and take 3 days for a withdraw.

Rewards:

Post and comment rewards are split 75% to the author and 25% to the curators. A 50/50 split of STEEM Power and liquid tokens are awarded to authors and commenters 7 days after a post or comment is made. 100% STEEM Power rewards are optional for posts. Post authors can also choose to decline payouts.

Usage and media coverage:

As of May 2017, there are more than 170,000 Steem accounts. After an initial public beta for which no payments were made, the hard fork on July 4th, 2016 saw $1,300,000 of STEEM and Steem Dollars paid out to Steemit users.

The exchange rate of STEEM compared to Bitcoin rose continuously during July 2016, peaking at a price of over 4 US dollars.[4] In most of July 2016, Steem had the third largest market capitalization of all cryptocurrencies monitored by the website Coinmarketcap.com, reaching a first notable peak at July 20th, with about 405 million US dollars.[9] As of May 25th, 2016 its market cap is 258 million United States dollars.

Steemit has been described as a novel and "disruptive blockchain-based media community" by Adam Hayes (Investopedia) in July 2016. It got media coverage in cryptocurrency- and business-related media.] Author Neil Strauss, a Steemit member, wrote an article for Rolling Stone calling its reward distribution "particularly clever" and echoing the sentiment of its disruptive potential.

Criticism[edit]

Some industry experts question the need for a unique token specific to steem when bitcoin or ether could be used.[13] Others point out that "steem might be a Ponzi scheme.