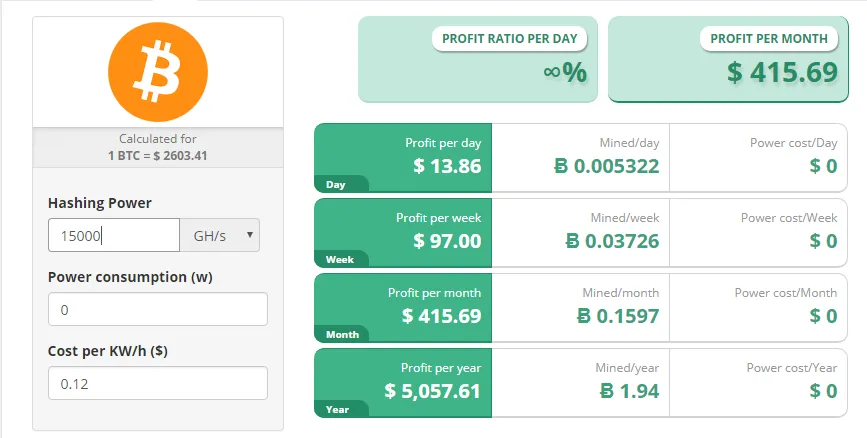

To those of you thinking about purchasing a BTC mining contract... take this into consideration when looking at the calculators

Current maintenance fee: USD 0.00028 per GH/s per day. Say you buy the $1,950 contract for 15,000 GH/s. --> ($0.00028)x(15,000) = $4.20 cents a day.

So make sure to subtract that from the current $13.86 --> $13.86 - $4.20 =$9.66. But that's not the number that concerns me. It's the fact that they take the FIXED FEE of $4.20 in bitcoin. So todays cut would be ($4.20/$2600) = .001615 BTC. So divide that by the total --> .001615/.005322 = 30.35%.

What is IMPORTANT to consider is that if the bitcoin price goes down that will become a LARGER PERCENT. Imagine the bitcoin crashes to $1,700. Now Genesis's cut is -->$4.20/$1700 = .002 --> percentage-wise = .002/.005322 = 47% cut to genesis.

However in all fairness, if the price drop, so will the difficulty, and the equilibrium of payout likely will be almost maintained. Right now ETH is doing a terrible job maintaining that equilibrium. Bitcoin might be more promising but here's where Bitcoin contracts fundamentally differ IMO.

When the coin price goes down on most contracts, so should difficulty, and thus coin payout goes up. With bitcoin when the price goes down the amount of coin payout is less. And ofc bitcoin is "lifetime" there is that.

These genesis mining contracts are like going to an all-you-can-eat restaurant and trying to break the house. Not saying they are bad, I have over $3,000 in genesis but the real question to ask yourself is am I getting more coins at the end than if I were to buy it now with the same cash? That's what you want to beat.

Thanks for reading. Please subscribe :)