Why I'm In On The HydroMiner ICO | 60% Current ROI | Crypto Dividends

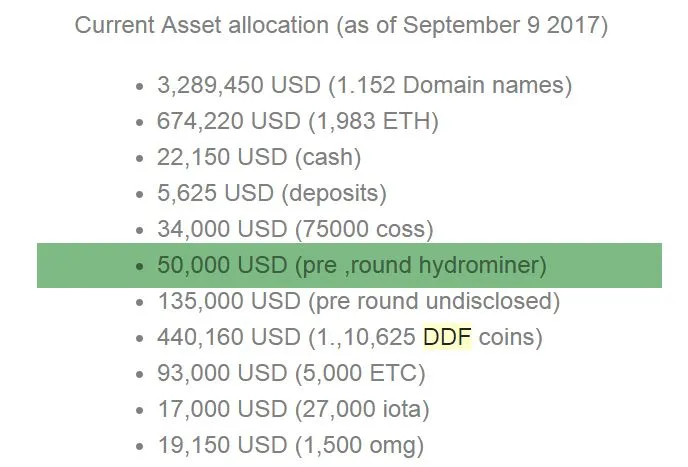

I was first alerted to HydroMiner through the September Monthly Report by Digital Developers Fund who released details of a $50,000 USD Pre-Round Investment.

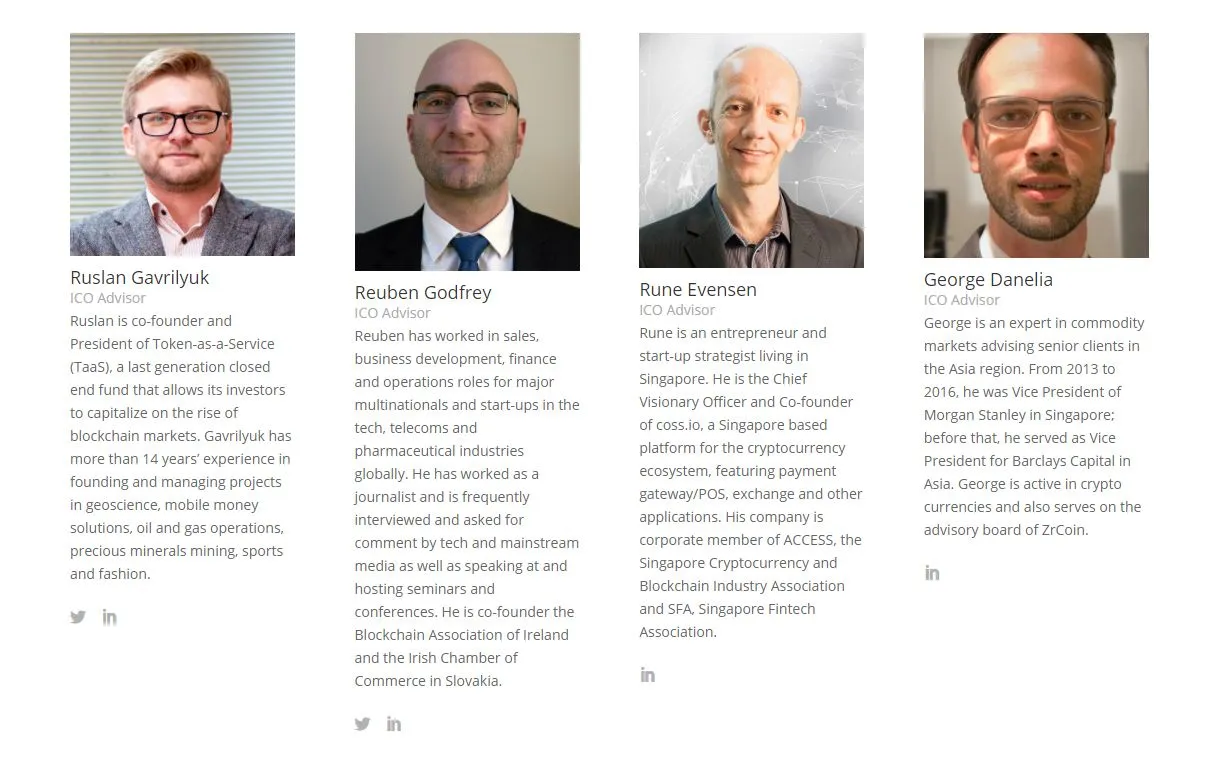

The investment decisions made by DDF are usually very solid, as they have a team of ICO experts who advise the DDF team on the best decision making practices for the benefit of all invested. In a noteworthy addition, the advisory team comprise of some of my favourite member in the blockchain space, include the visionary of COSS, Rune and Ruslan from TAAS, who has done an exception job with the fund ROI.

Following up on the HydroMiner lead from DDF I found a very promising dividend based investment that has potential to bring a solid ROI, below I delve into the details on why im in on the HydroMiner offering.

What Is HydroMiner?

HydroMiner is a already established eco-friendly crypto mining farm who have the unique positioning of accessing hydro power stations in the Austrian Alps. The team already have a profitable running business model and are running a ICO on the 3rd of October to fund the upscale of their operations.

Crypto Mining Profitability

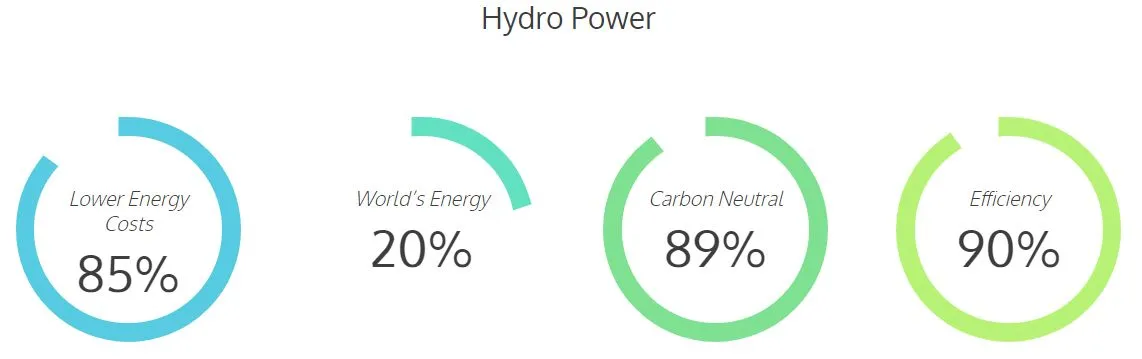

There is a lot of debate in the crypto sphere as to the profitably of mining coins with the ever increasing difficulty. HydroMiner challenges these algorithmic adjustments through means of access to the lowest energy costs in Europe, with a 85% reduced power expenditure when compared to the European average. The team is also diligent in the continual optimisation of mining equipment and mining strategy (see Mining Strategy below). HydroMiner is currently averaging a 60% (PA) ROI on current operations.

Mining Strategy

The team at HydroMiner are very savvy in their coin mining strategy, they are always optimising their decisions based on software algorithms and indicators given by whattomine.com. HydroMiner also prioritises its mining pool operations, based on payouts, stability and liquidity. The Lead Tech (CTO) Christian is constantly monitoring equipment performance (GPU / PSU / Clock-Rate / Temperature) and adjusting configurations for optimal performance.

Hydro Power / Eco-Friendly Operations

The energy output to secure the BTC blockchain draws enough electricity to run a small country, this is a scary fact and is environmentally unsustainable. HydroMiner is leading the charge for more economically efficient and environmentally friendly practices by utilising renewable, carbon-neutral energy, created by hydro power stations. A very interesting feature of the project is the team's adaption to surroundings by using water cooling technology to further reduce costs.

Sea Freight Containers

In the majority of cases HydroMiner has and will build out its mines inside sea freight shipping containers. This is a very innovative strategy, allowing the team to get as close to the power source as possible, while also being very cost effective. A additional point of consideration is the movability of the containers should water levels become problematic, or should the hydro power plant be susceptible to maintenance outages.

HydroMiner Token (H20)

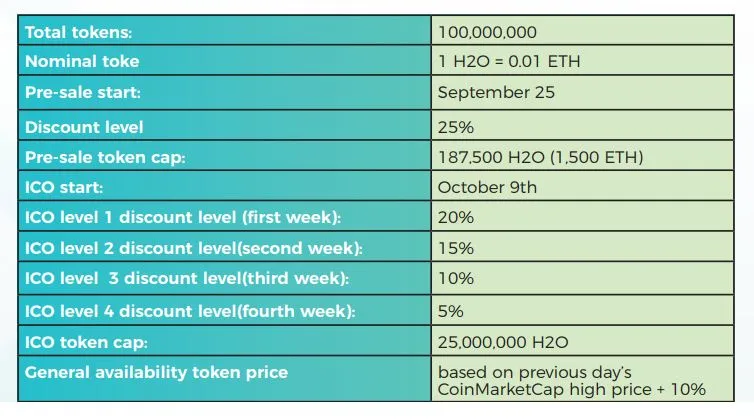

HydroMiner will release a ERC20 compliant token with the tik (H20). The token is representative of 1 watt of mining power and grants the holder the rights to the net proceeds of one watt of mining revenue. The ICO will offer up a total of 100,000,000 tokens with the nominal hydro toke :) being 1 H2O = 0.01 ETH. Pre-sale will kick off on September 25, 2017 and ICO on October 3rd 2017. Post ICO, Hydrominer will link-up with Bancor and use 1% of the funds raised to buy into BNT for the purpose of the “token changer” liquidity between (BNT) and (H20).

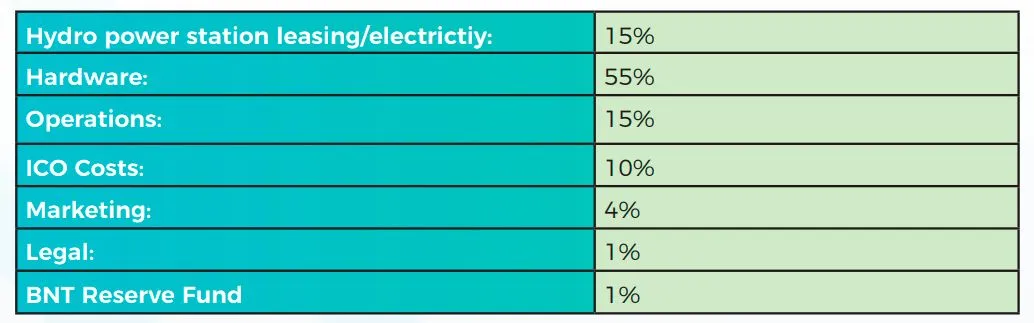

lCO Expenditure

The main funding allocations post ICO will be used for hardware, location (leasing/power) and operations.

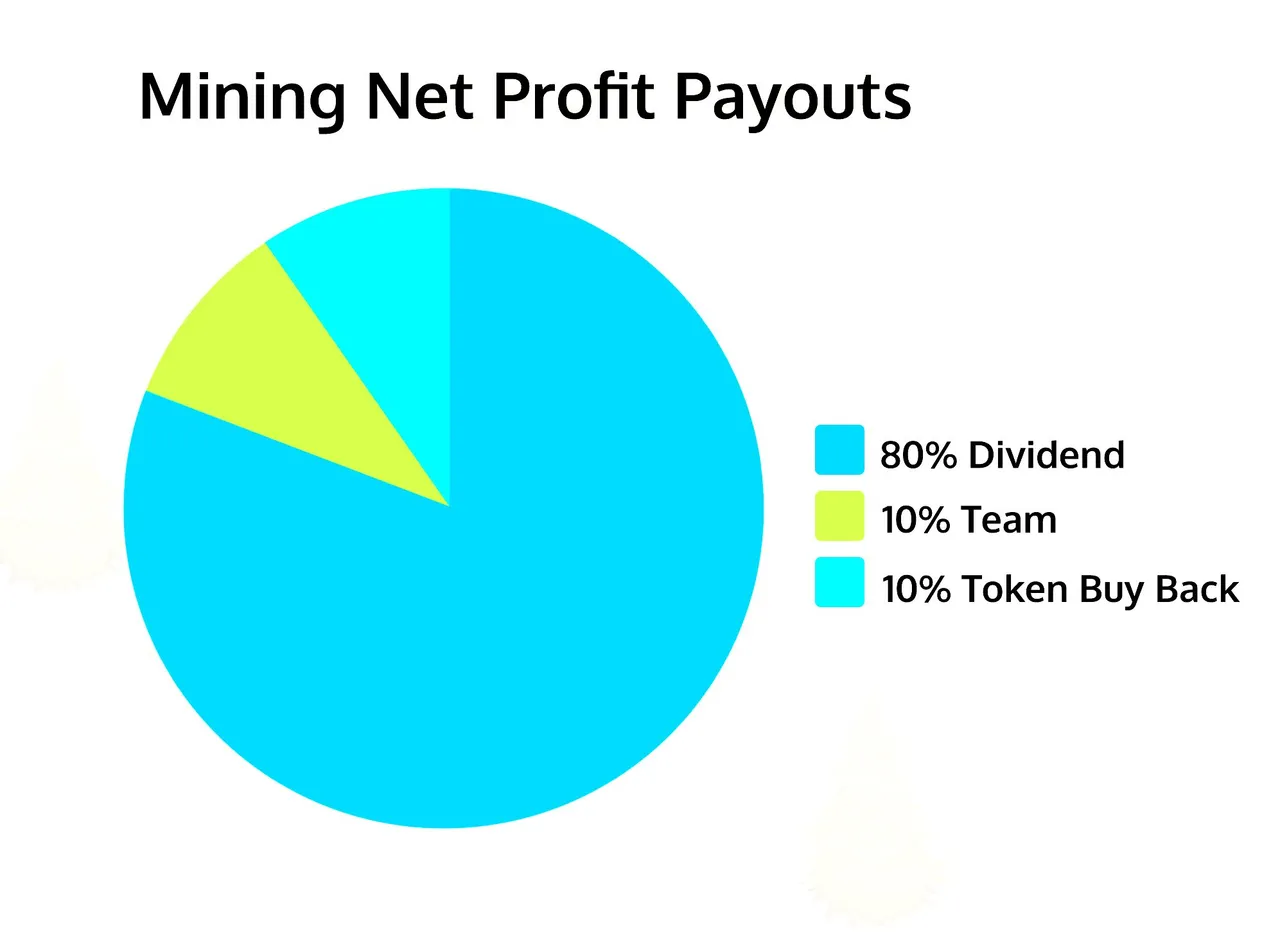

(H20) Dividend Model

The (H20) dividend model is very fair IMO and was essentially the conversion point from me watching to investing: HydroMiner will allocated 60% – 80% of proceed to operational expenses and expansion of operations (hardware maintenance / upgrades). The remaining 20% - 40% will be divided as follows: Dividend: 80% / Token Buy Back: 10% / Team 10%

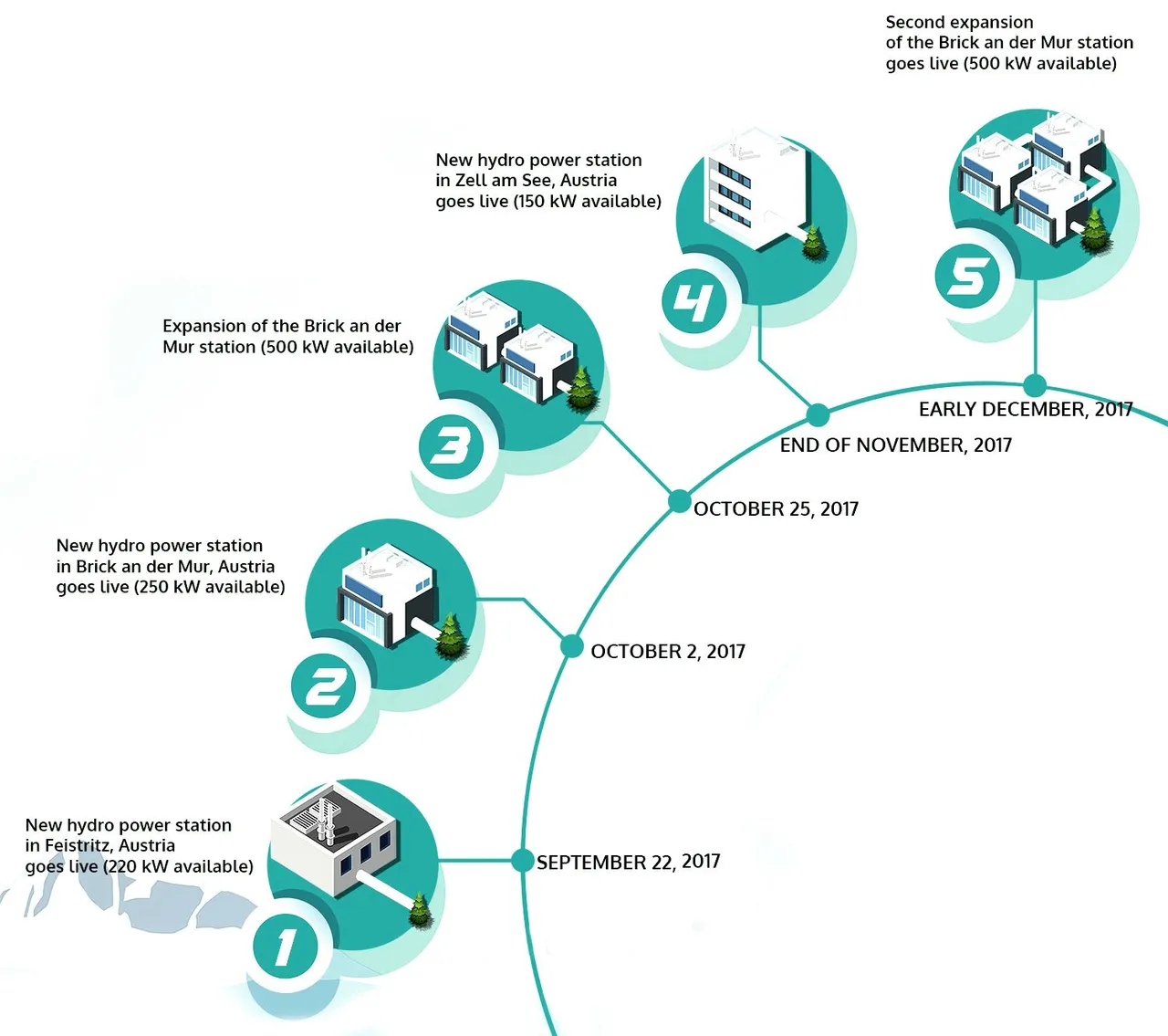

Roadmap

Because the team is already experienced in mining operations, the roadmap doesn't extend in the great abyss of next the decade. The timeline is actually very short and concise with a multiple set of power stations (depending on funding) up and running by late December 2017.

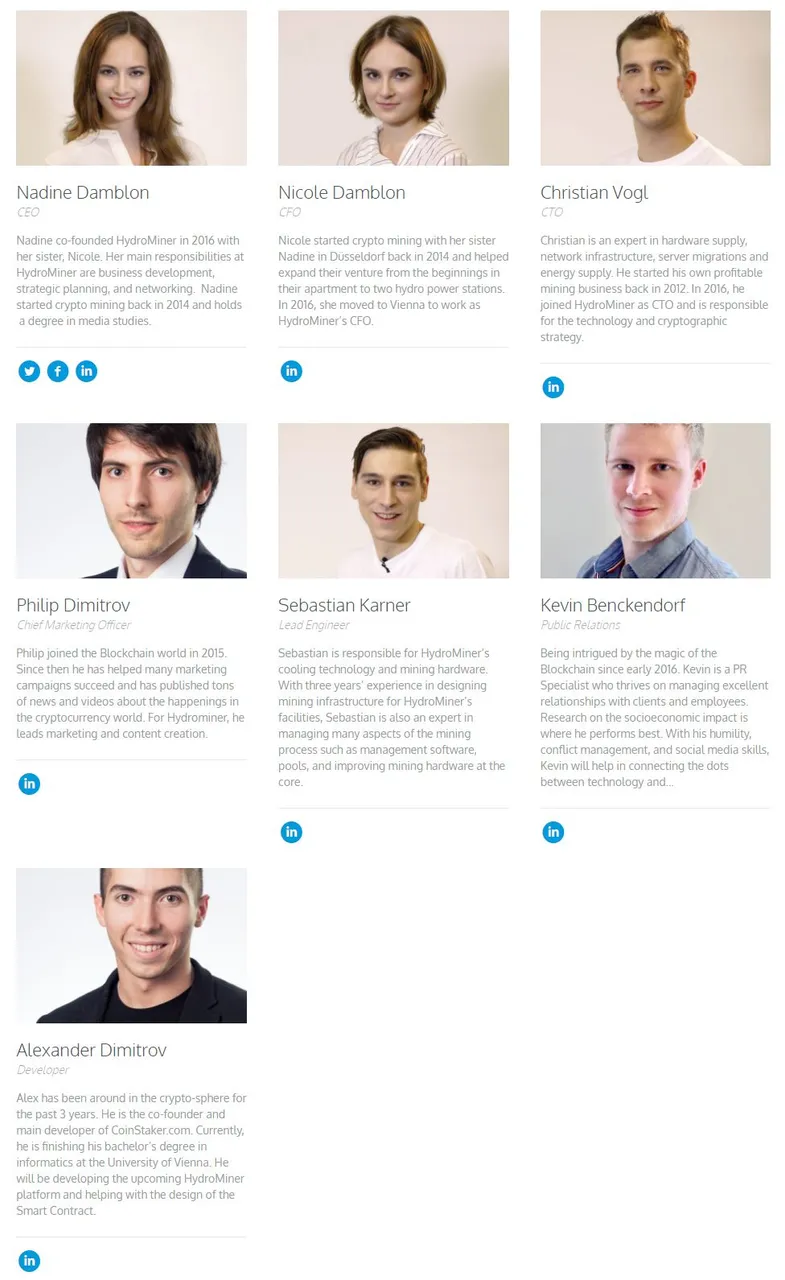

(H20) Team

The HydroMining Top Brass are anything but your stereotypical Bitcoin miners. The team are lead by two lovely Austrian sisters who have been mining since 2014. Nardine (CEO) has a degree in Media Studies and Nicole (CFO) holds a Bachelor of Arts. The Tech-Meister of the operations is Christian (CTO) who is an expert in hardware, network infrastructure, server migrations and energy supply. The (H20) team is also graced by a Lead Engineer; Sebastian, who is the brains behind HydroMiner’s cooling technology.

Conclusions

I was taken aback by the amount of meticulous detail and effort the HydroMiner team have put into the Whitepaper, graphics and marketing of this ICO. With Michael (DDF) on the HydroMiner advisory board and a current annual ROI of ~60%, I feel this is a solid investment. The thing I love most about the project is the dividend model, the team have even gone as far as to create a ROI calculator on the website based on the amount invested in ETH. Check it out HERE. Come Sep 25 I will have my ETH wallet locked and loaded :)

Thanks for reading awesome peoples!

[Disclaimer: please do you own due diligence when investing and don’t solely take my point of view as the only angle. I highly recommend everybody dig through the projects bitcointalk, reddit and team linkedin profiles to help formulate your own opinion – I thank you so much for reading and wish you successful dividend returns]

Ryan Jorgensen | Stock Photographer | Blockchain Nerd

Twitter: @CryptoDividends

Website: http://jorgo.photography/

Crypto Dividends focuses on the niche blockchain business models that generate passive income without the need to sell or speculate. We seek to discover and promote the best dividend yielding cryptos.