August 31, 2016

Original Post-August 2016, Updated for Election 2017.

Neo-Liberalism, Billy No Mates? , or, just misunderstood and kind to small children and animals

Discussion with Founder member of The peoples party/Ecology Party and Now The Greens Clive Lord.

In the recent hustings for the Green Party leadership for the Green Party of England and Wales I have had a few interesting dialogues with Clive Lord and sought out some of his writing to see what made and still makes him Tick. I have also had a similar exchange of tweets and comments with Dereck Wall another former speaker candidate for the Green Party of England and wales.

Clives Stich is citizens income or universal basic income. Its mine too so we have a common objective and our reasoning to get to that place one would think would be similar. Well to answer that yes and no. Clive and I agree that exponential growth on a finite planet is impossible and that the strain on the Common resources of the planet is to great and decisions uninformed by externalities are less than sensible. We are in a completely different place on Political Economy though and our understanding of Money and Money creation.

Clive recently Blogged under the title.

SOCIALISTS AND NEOLIBERALS CAN AND MUST BE FRIENDS

28/08/2016 · by Clive Lord

Here is our dialogue so far my last comment awaits moderation. Other folk who read my blog here please read Clives Blog and this post and join the dialogue as I say often there is more than one way to skin the Political Economy cat and the ways of ´´Doing Money´´

4 responses to “Socialists and neoliberals can and must be friends”

rogerglewis 28/08/2016 at 15:15 · · Reply →

Hi Clive,

Neo Liberalism is a pretty broad political philosophy but starts with the notion Look after the Economy and the large economic Players and the rest will look after itself. It is classical Liberalisms very close First Cousin. Neo Conservatism is also its sibling

I was reading some of your published work on these questions last week also and wonder how far you have got in your thinking with Money creation and the question of Interest on money. This is for me the nub of the matter something I have in common with Joseph Prouhdon, explained by Peter Kropotkin in the Encyclopedia Britannica thus.

https://archive.org/stream/PeterKropotkinEntryOnanarchismFromTheEncyclopdiaBritannica/Peter-Kropotkin-Anarchism-Encyclopdia-Britannica-Eleventh-Edition_djvu.txt

”Now Proudhon advocated a society without government, and

used the word Anarchy to describe it. Proudhon repudiated,

as is known, all schemes of Communism, according to which

mankind would be driven into communistic monasteries or

barracks, as also all the schemes of state or state-aided Socialism

which were advocated by Louis Blanc and the Collectivists. When

he proclaimed in his first memoir on property that ” Property

is theft,” he meant only property in its present, Roman-law,

sense of ” right of use and abuse ” ; in property-rights, on the other

hand, understood in the limited sense of possession, he saw the

best protection against the encroachments of the state. At the

same time he did not want violently to dispossess the present

owners of land, dwelling-houses, mines, factories and so on. He

preferred to attain the same end by rendering capital incapable

of earning interest; and this he proposed to obtain by means of

a national bank, based on the mutual confidence of all those who

are engaged in production, who would agree to exchange among

themselves their produces at cost-value, by means of labour

cheques representing the hours of labour required to produce

every given commodity. Under such a system, which Proudhon

described as ” Mutuellisme,” all the exchanges of services would be

strictly equivalent. Besides, such a bank would be enabled to

lend money without interest, levying only something like 1 %,

or even less, for covering the cost of administration. Every one

being thus enabled to borrow the money that would be required

to buy a house, nobody would agree to pay any more a yearly

rent for the use of it. A general ” social liquidation ” would

thus be rendered easy, without violent expropriation. The same

applied to mines, railways, factories and so on. ”

We can learn a lot from the Swiss referendum on Citizens Income as discussed here.

´However, the nearly universal misunderstanding of money is a major obstacle. For too long we’ve allowed a small coterie of bankers and “court economists” to hold the secrets and “tutor” us. So, it’s time for total openness.

First, regarding the claim that the Swiss proposal would’ve been too costly, what’s entirely omitted from the discussion is that the proposal (and similar proposals elsewhere) appear to call for re-distribution of existing money—taking money from certain sectors through taxation and re-allocating it to the people-at-large.

The implication is that the money supply is basically static and that re-distributing limited funds would require tough budget decisions—sparking tax hikes and associated spending increases in several areas; hence the claim “costs too much.”

But a successful basic-income plan can and must be based on the creation of new money, or “distributism,” not on reshuffling existing money, which is “re-distributism.” That’s the “state secret” that no one wants to touch.

The issuance of new money needs to happen to overcome the huge “gap” between today’s paltry purchasing power and the massive mountain of debt and the towering totality of prices on all available goods and services. We have full stores and empty wallets. (Ideally and importantly, governments should reclaim their interest-free money-creation rights and forbid private central banks from creating money any longer).´´

http://leconomistamascherato.blogspot.se/2016/07/basic-income-lets-name-real-problems.html

Banking reform is a tricky business I think Clive and usury is their business and price discovery in the market is their creed. Those of us that understand the finite planet and exponential growth disjoint will I think find it very hard to make the Bankers our friends and Neo-Liberalism being the Political Wing of the Usury industry will not be won over. On this basis I disagree with the direction of the argument in your piece here.

Clive Lord 29/08/2016 at 00:42 · · Reply →

My definition of neoliberalism is based on hearing Monbiot – the 0.1%, (not 1%) who are in complete control of everything to all intents and purposes. But you could accuse me of sloppy writing. What I really mean is that a lot of people who are generally ‘right of centre’ should be seeing the Greens aiming for what they want to see.

I guess you are a’Positive Money’ supporter. I was persuaded otherwise by two formidable brains, Jonathan Dixon who is no longer active in the Green Party, andAlison Marshall, who does blog and correspond.Dixon convinced me that money is neutral. I twill favour faithfully and well whatever ethos is in control. Ergo, if people generally make growthist assumptions and ant to buy caravans and yachts and things, the banks telling them tey aren’t allowed to lend much will only infuriate people against whoever imposed such restrictions. On the other hand, if expectations are low, I claim I always expected interest rates to approach zero, as they have done. that to me supports Dixon’s thesis.

So we have to achieve the culture shift which regards less stuff as the norm, not just a blip.

I envisage the Cits BI as normally being balanced by taxation in some shape or for, not necessarily just on personal incomes. Land Value Tax seems to me an obvious feature. I would, however, see money creation along the lines of ‘Helicopter Money’ whenever economic activity fell below what was ecologically sustainable.

The Swiss result was not widely reported here so far as I am aware, but one comment I did receive from an email group I belong to was that the ‘scare’ of floods of immigrants taking advantage was what made the result so one sided.

rogerglewis 29/08/2016 at 06:28 · ·

Hi Clive,

The standard economics theory and practice is that money is neutral the Treasury growth models and the ones of the big city banks and accountants ignore it completely. This notion is similar to the notion of Climate modelling ignoring the sun it is the standard establishment approach and makes the sums easier but lacks a certain Je ne sais quoi.

on Neo-Liberalism , this is a video interview I did with Roy Madron.

On the monetocracy here is an interview with Roy from the early noughties about his book Gaiain democracies.

I have been corresponding with Roy and reading drafts of his new book on Super Competent democracies.As Roy says, Neo Liberalism is a whole ideology against state provision of anything and inimicable to the interests of society, which it actually claims does not exist. Capitalism Roy says can and does exist and do Fine with high levels of Democracy seeing the social provision as a cost of doing business. Neo Liberalism is not pragmatic at all, it is an elitist and fanantical creed, almost cult likein many ways.

My monetary reform activism Clive is not limited to being a Positive MONEY supporter or indeed a supporter of David Malone for GP leader, or any one organisation, institution or individual, I do not do Tribal. I also undertstand Modern Monetary Theory but disagree with their stance on state sanctioned usury (On Usury I am in a very small minority, This is also true of my Anarchist beliefs ). and support thier efforts but also follow the Social Credit movement in Cananda and have studied Islamic finance thoroughly as well. As I said above my position is squarely with Prouhdon. The Usury is the root of the growth requirement which you and I both share grave concerns about. For the Usury full enchelada Kreutz is the Babby as they say in Bristol.

Kreutz has a book now published in English called the money syndrome

http://www.themoneysyndrome.org/index.php/publisher/

Money is not Neutral for Kreutz and neither is it neutral to Steve Keen and countless and growing numbers of heterodox economists.It was also seen as anything but neutral going back into the mists of time. Peak Ignorance on Money was probably around 2007 in the run-up to the Great Crash happily that is a peak we can be pleased to have reached and passed, whilst some still cling to the cosy notion that Money creation and debt do not matter.

If we had something other than money and something other than the Neo-Liberal ( Classical Liberal ) Notion of the free Market perhaps money could be neutral but when one Knows the process of money creation intimately and has been exposed to some Hyman Minsky one wonders how the notion of moneys´ neutrality could remain in place.

This is Steve Keens introduction lecture entitled The Alternative to Neo Liberalism

If we continue to use money based metrics with usury being the price of money clive we will continue to falsely compare economic and socio economic choices against a flase metric. The Price of Natural electrical energies for instance is judged against notions of Internal rate of returns and Net Present Values which use interest rates as the basis of its discounting future monetary streams into present values.The Interest component for Public housing projects is something like 77%

”The capital share in garbage collection

amounts to 12 % because here the share of capital costs

is relatively low and the share of physical labor is particu-

larly high. This changes in the provision of drinking water,

where capital costs amount to 38 %, and even more so in

social housing, where they add up to 77 %. On an aver-

age we pay about 50% capital costs in the prices of our

goods and services.”

from http://userpage.fu-berlin.de/~roehrigw/kennedy/english/chap1.htm

In this Video Margeret Kennedy and others talk about the influence of Helmuth Kreutz on their own work.

Democracy and devolution of power to communities, complementary currencies promoting localisation as Schumaker famously said Small is Beautiful. It really is the Interest you know Clive, Compound interest and notions of exponential growth have decoupled people from the Balance and synergies of our Natural environment.

Clive Lord 29/08/2016 at 23:41 · ·

I may have to cut along story short. You say you have read some of my posts. 29th May 2016? The neoliberals may be ruthless bastards, but they are unlikely to be stupid. It is in their own interests to evolve a culture like that of the Siane (See my book resume). I envisage something which will closely resemble Feudalism, but unlike under Feudalsim everybody, whatever their start in life, will have opportunities to rise through the ranks. Also no no ewill ber at risk of starving. I am unlikely to get a publisher to do a re-write of my book, but if I do, there will be a chapter in which I explain my conjecture that Feudalism and the Indian Caste system were responses to the ‘Tragedy of the Commons’ where they had more time for manoeuvre than the Easter Islanders had. You can use theide if you quot eme as your source, and give people my blog address.

There is much I could say about money, but I am loth to spend all the time necessary on your copious links. But you have given me a new insight – he potential conflict of interest between store of value and means of exchange.

But there are, or were before we messed them up, ‘primitive’ tribes which either had no money or if the did, could nevertheless use it within a sustainable culture. I still have difficulty in thinking of money as other than neutral per se.

I have never had an answer I could make sense of from monetary reformers to two puzzles 1. Every time bad debt is written off, isn’t that the same as creating ‘debt free money’?

2 Velocity of circulation Faster, where confidence and expectations are rising, is the same as more money created isn’t it? similarly whenever expectations etc dip, the money Sully will contract willy-nilly, and trying to increase it by Helicoptering or whatever is trying to push apiece of string. It will only work if it, or some other factor raises expectations at the same time. Positivists I have tried talking to just say yes, and go on as though velocity remained constant

rogerglewis 30/08/2016 at 14:02 · ·

Your comment is awaiting moderation.

Hi Clive,

This is a long answer because you ask two key questions which deserve a full explanation. I make no apologies for the links and quotes.

The Bernard Lietaer video at 1 hr and 9 minutes repays´ watching.

- You say.

”Feudalism and the Indian Caste system were responses to the ‘Tragedy of the Commons’ where they had more time for manoeuvre than the Easter Islanders had”.

There have been tragedies of mismanaged commons’ but The Tragedy of the commons as a category is too wide in my opinion, it is not inevitable.?

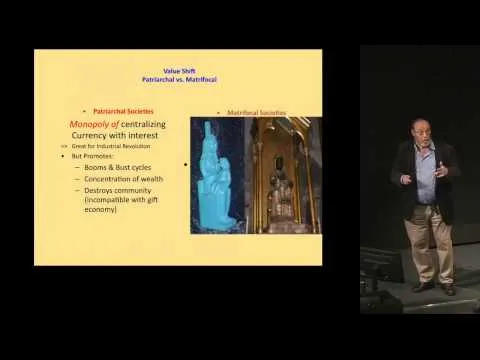

Mono Culture and Diversity Leitear on Matrifocal or Hierarchical Patriarchal structures.

Stresses efficiency breaks easily and is not robust , Diversity and symbiosis is less efficient but more robust we need permaculture and diverse systems and not mono cultures, a very basic ecological tenet which can be applied well to political economy and finance.

2”.Potential conflict of interest between store of value and means of exchange´´.

The conflict is not potential it is very real they are mutually exclusive functions. - Every time a bad debt is written off, isn’t that the same as creating ‘debt free money’?

Repaid or written off debt destroys money as The asset is realised or rather liability is extinguished.Its a basic accounting identity explained by Graeber here.

https://www.theguardian.com/commentisfree/video/2015/oct/28/david-graeber-what-government-doesnt-want-you-to-know-about-debt-video

Money if understood in terms of a flow of credit that is secured by loans thereby creating money gives the best understanding of where the money comes from and how it is extinguished. This partly helps with the second question on the velocity of money which is a very good measure of cash and gets less clearly defined as one starts looking at asset financing and property financing which is, of course, a huge component of the money banks create when one gets into derivatives the wheels really start to come off..

Quiggley again.

Money and Goods Are Different

”Thus, clearly, money and goods are not the same thing but are, on the contrary,

exactly opposite things. Most confusion in economic thinking arises from a failure to

recognise this fact. Goods are wealth which you have, while money is a claim on wealth which you do not have. Thus goods are an asset; money is a debt. If goods are wealth; money is not wealth, or negative wealth, or even anti-wealth. They always behave in opposite ways, just as they usually move in opposite directions. If the value of one goes up, the value of the other goes down, and in the same proportion.”

The Relationship Between Goods and Money Is Clear to Bankers

In the course of time the central fact of the developing economic system, the

relationship between goods and money, became clear, at least to bankers. Thisrelationship, the price system, depended upon five things: the supply and the demand for goods, the supply and the demand for money, and the speed of exchange between money and goods. An increase in three of these (demand for goods, supply of money, speed of circulation) would move the prices of goods up and the value of

money down. This inflation was objectionable to bankers, although desirable to producers and merchants.On the other hand, a decrease in the same three items would be deflationary and would please bankers, worry producers and merchants, and delight consumers (who obtained more goods for less money). The other factors worked in the opposite direction, so that an increase in them (supply of goods, demand for money, and slowness of circulation or exchange) would be deflationary.”

http://letthemconfectsweeterlies.blogspot.se/2016/02/usury-hells-fuel-and-mans-oppressor.html

Relavant parts of Tragedy and hope are all extracted in the notes to my Poem Usury Hells Fuel Mans Oppressor. - Velocity of circulation Faster, where confidence and expectations are rising, is the same as more money created isn’t it? similarly whenever expectations etc dip, the money supply will contract willy nilly, and trying to increase it by Helicoptering or whatever is trying to push apiece of string. It will only work if it, or some other factor raises expectations at the same time. Positivists I have tried talking to just say yes, and go on as though velocity remained constant.

Velocity of Cash

yes, redit creation is driven by banking expectations and borrowers appetites .

Aggregate demand including Socio Economic decisions by community government and national government and then International trade.are key to how much demand can be realised

”The value of goods,

expressed in money, is called “prices,” while the value of money, expressed in goods, is

called “value.” p.49 (Commercial Capitalism) Quiqqley shows how Bankers make the distinction and real power lays in the Value of money and not the prices of goods.

on how debt and credit creation effects aggregate demand is summed up in this argument. In my poem this is the not even wrong part.

”A counterfeit Nobel laureate, theres an irony.

Denies that in money there can be a place that gertrude stein called there, home once but no longer there , there in Oakland. A precursor to some sub prime heritage.

A speaker of truth to power could follow Pauli ´Das ist nicht nur nicht richtig, es is nicht einmal falsh!

”Not even wrong, not even there.

All counterfeit, yet to counterfeit the counterfeit? a crime.

What of the shepherd of this unruly nothing,

where will they pen and fence this pack of wolves.

Will they dress this pack of cards in sheep’s clothing.

Limit the herd a need for Golden standards.

Prudence of sound Money and even sounder usury.

Fix the price and patronise those who will honour the thievery. A mechanism to harmonise silent ballot boxes.

A gentlemen from belgium would complement his single currency. Unruled and unruly sets a course for austerity on a continent many times at war. A fight of 11 rounds.

Spread like a cancer through the development of continents, enabling the killing called wars. That increase the debt and centralise the money power.

Quiggly shewed the tragedy, little hope it seemed,

blind faith in capitalisms harlot. That babylonian whore.

At first a mere money trick for ragged trousered philanthropy. With usury, take away whats not even yet been paid. Ruskin would see wealth as that which is valuable in the hands of the valiant. Real goods sustain and wealth succours. Usurious money is but an unmade claim and worse. No banker has earned that newly minted note that hangs discordant in the air, as apt to rob as to pay.

How obscure this obscurant cult of mammon.

What smoke screened hall of mirrors.

How obese and gluttonous the leviathan of usury.

Austerity for the likes of you and I.

More banqueting and evacuated vomit spews from the sceptred top table. Corrupt in patronage and jealousy of power. Overstuffed with greed and thirsty for more.”

http://www.neweconomics.org/blog/entry/reconciling-krugman-and-keen-using-nefs-model

”We argue that Keen’s definition of Aggregate Demand is more appropriate, especially if the role of credit creation by private banksin shaping macroeconomic dynamics is to be understood.

We show how, in the simplified model we present, no growth can take place without the creation of credit by banks. The net change in the level of debt (what we call ‘Net Credit Creation’ = Credit Creation less Debt Repayment) is the single most important variable affecting the dynamics of the economy.”

Story of the 11th Round.

http://www.lietaer.com/2010/09/the-story-of-the-11th-round/

So how does a loan, whose interest is never created, get repaid? In a static or declining system, it requires someone else’s principal being used. In other words, not creating the money to pay interest is the device used to generate the scarcity necessary for a bank-debt monetary system to function. It forces people to compete with each other for money that was never created, and penalizes them with bankruptcy should they not succeed. When the bank checks creditworthiness, it is really verifying their customers’ ability to compete successfully in the market place– that is to say, to obtain the money that is required to reimburse the principal and interest. Ultimately, someone must always lose.

In the current national currency paradigm, one reason why so much attention is paid to central bank decisions is that increased interest rates necessitate more bankruptcies in the future. The economic pie must grow that much faster just to break even. The monetary system obliges us to incur debt and compete with others in order to perform exchanges and pay the resulting interest to the banks or lenders. No wonder “it is a tough world out there,” and that those who live within a competitive monetary system so readily accept Darwin’s supposed “survival of the fittest.”

Lietaers work on complementary currencies, WIR Bank in Switzerland and other local currency schemes is essential to providing a monetary measure by7 which externalities can be reflected and priced into investment and spending decisions.

http://userpage.fu-berlin.de/~roehrigw/kennedy/english/

Margrit Kennedy: Interest and Inflation Free Money

(Published by Seva International; ISBN 0-9643025-0-0; - Four Basic Misconceptions About Money 15

…First Misconception: There Is Only One Type of Growth 18

…Second Misconception: We Pay Interest Only If We Borrow Money 24

…Third Misconception: In the Present Monetary System

We Are All Equally Affected by Interest 25

…Fourth Misconception: Inflation Is an Integral Part of Free Market Economies 29

Interest on money drives need for expansion.

Reliance on one currency ( the dollar is a defacto gold standard.with no monetisation of an analogue for silver to provide circulation and a multiplier due to velocity.

”Patriarchal Value Coherence

All patriarchal societies in history have had the tendency to impose

a monopoly of asingle currency, hierarchically issued, naturally scarce or artificially kept scarce, and with positive interest rates. This was for instance the case in Sumer and Babylon, in Greeceand Rome, and from the Renaissance onwards in Western societies all the way to today.The form of these currencies has varied widely, ranging from standardized commodities, precious metals, paper or electronic bits. But what they all have in

common is thatgovernments accepted only that specific currency for payment of taxes, that this currencycould be stored and accumulated, and that borrowing such currencies implied payment of interest. They all have in common Yang characteristics as illustrated in Figure 1.”

https://www.scribd.com/doc/34659324/The-Monetary-Blind-Spot-by-Bernard-Lietaer