Useful article about Fraud Detection Machine Learning System

What is a financial fraud?

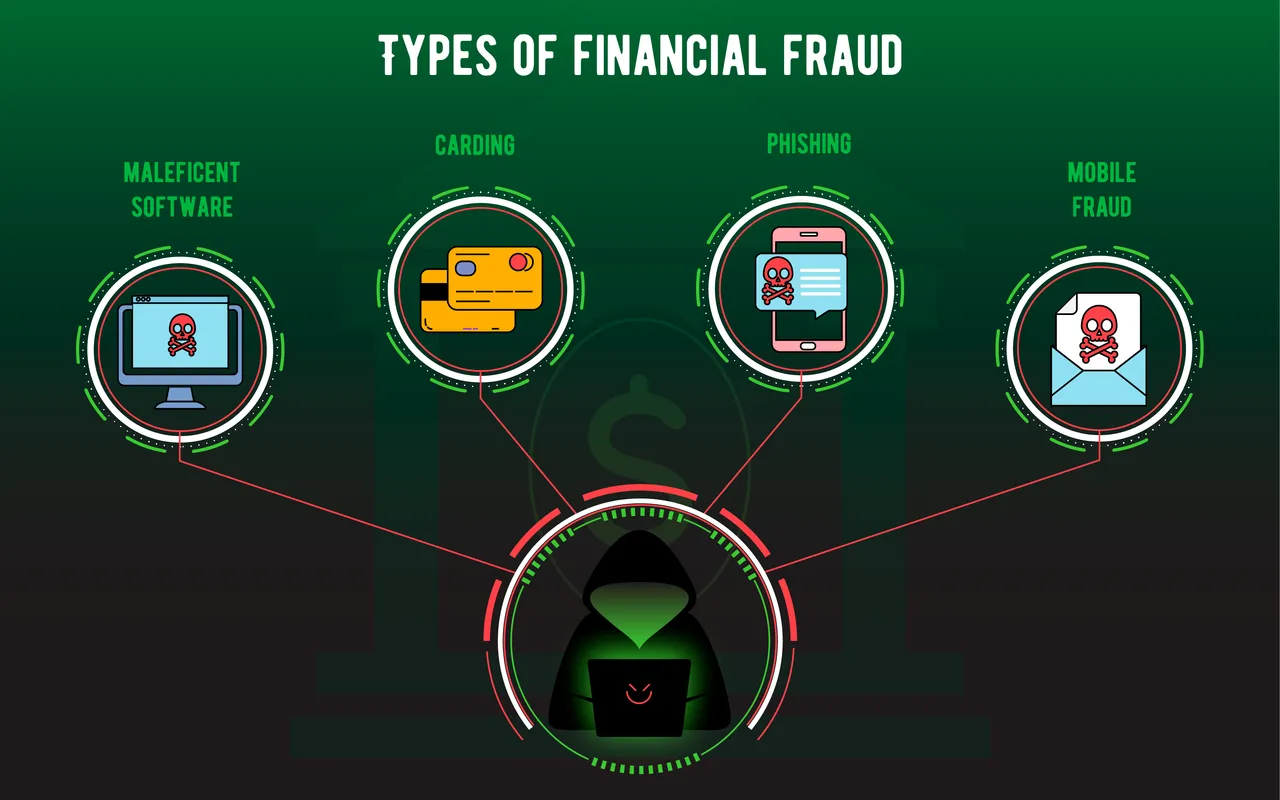

Fraud particularity lies in cheating people. There are many different ways to do it. But if we speak about the financial field, there are a few widespread manipulations like:

Carding

Counterfeit banking card skimming. Hackers are installing special devices on ATMs that read card data;

Maleficent software

Viruses are not sleeping. Hackers create viruses that can simplify the process of stealing money. But in most cases an antivirus can detect such software;

Phishing

A type of Internet fraud that allows criminals to steal the confidential data of users. Sometimes it can be a fake copy of your website, for example, where you input all your personal data but then falls into bad hands;

Mobile fraud

A maleficient virus can read all information you input in your mobile app and steal important financial data.

Generally, all types of a financial fraud can be divided into 4 main groups:

- falsification of financial accounting;

- misuse/appropriation of company property;

- abuse of an official position;

- fraud in e-systems.

In some cases, if it is about abuse of power or something like this, the administrative measure can be applied. However, when business processes that are in the fraud risk group are processed in informational systems, administrative measures can be useless. That is where anti-fraud systems come in.

Anti-fraud system and how it works

Such systems represent specialized fraud prevention software or software and hardware systems that monitor, detect and manage fraud levels. Primarily, systems are developed for banks, telecommunication service providers, payment systems and so on.

Cyber attacks of today are focused more on online banking services, maleficent software for mobile devices and special-purpose fraud in automated payment systems known as internal and insider fraud.

So, to fight all mentioned threats to information security, software called financial fraud detection system or anti-fraud system is applied. By the way, our developers already have experience with the development of fraud detection systems.

Principle of functioning

Now then, let's look at these systems and explore how they function and how efficient they are at fraud detection.

Basics

Various developers create algorithms that may vary from similar ones in other software since they can be implemented in a different way. But the basic principles anti-fraud systems are working on remain permanent. First of all, it is a search of abnormalities like atypical actions in procedures with large data arrays that often recur.

The majority of developed systems have a basic range of actions that should be adapted to each specific case. So it may be better to create your own system from scratch.

Thus, the main signal of fraud lies in atypical actions and it helps understand how to control frauds.

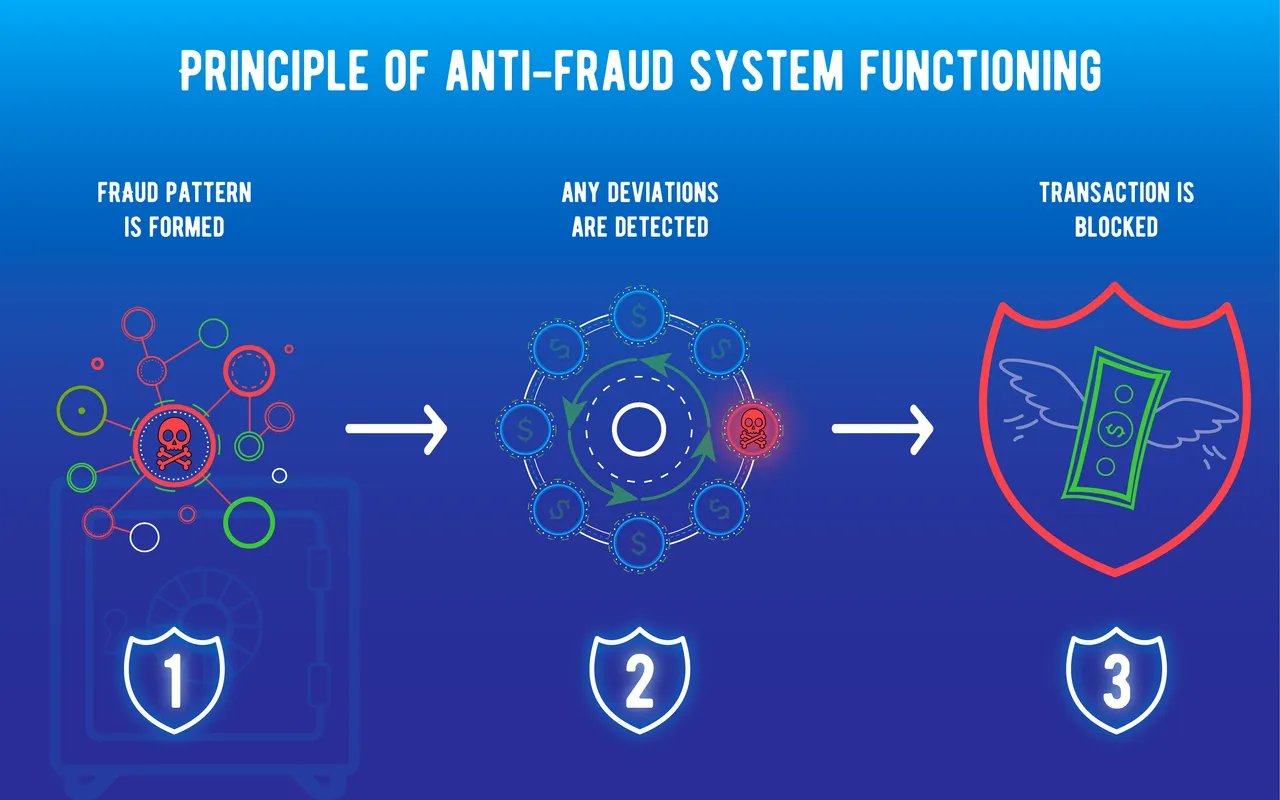

It is necessary to arrange a working procedure with the fraud-detection system:

- You need to form ordinary and habitual actions users perform;

- You should adjust automatic notifications;

- If there are any deviations from the habitual working process, notifications will be activated.

But depending on your scope of activity, the formation of algorithm patterns for fraud detection may vary, so keep that in mind.

Analyzing the data

In each specific case, the array of analyzed data will be different as well. So an anti-fraud system should analyze data collected from financial systems like automated banking systems, transaction databases for payment systems in your software and so on. Machine learning in banking industry, as well as any other industry, can become really necessary.

Criteria for selection should be fixed individually by you in your software or we can do it upon the completion of development process according to your requirements.