The Perfect Combination

“She never cared about money or business at all.” - WB

“...He would go around saying: “I’m going to be the richest man in the world!” Then when somebody comes inside and play music, I’d be more excited. I don’t know. How does anyone know?” - SB

“It did make a difference what we’re going to do with the money after we’ve made it. I thought I would pile it over the years but then she would unpile it in terms of running a very large foundation... I was pretty good at compounding money and therefore society would benefit by waiting.” - WB

“I was genetically blessed with the certain wiring that’s very useful in a highly-developed market system where there are lots of chips on the table and I have to be good at that game.” - WB

Circle of competence

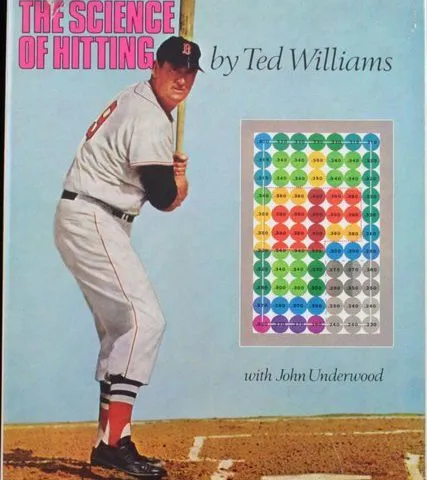

Warren read a book where there’s a picture of a baseball batter and the strike zone is broken into multiple squares. The batter would essentially aim at a particular region depending on how the ball was pitched. While this technique is good for baseball, Warren says that in investing, he’s in a no-called-strike business which is the best business one can be in.

He can look at a thousand different companies and he doesn’t have to be right on every one of them or even fifty of them. So, he can pick the ball he wants and hit. -And his trick in investing is just to sit there and watch ‘pitch’ after ‘pitch’ go by. And then, wait for the one right in your sweet spot. When people are yelling “Swing you bum!” - Ignore them. There’s a temptation for people to act far too frequently in stocks simply because they’re so liquid.

Over the years, he did a lot of filters. He knows what he calls his “circle of competence” so he stays within that circle and never worries about things outside that circle.

“Defining what your game is, where you’re going to have an edge, is enormously important.” - WB

Learning From the Past

One of the reasons Warren is successful is he is brutal on appraising his own past. He wants to Identify them as thinkings and avoid them in the future.

He says If you’re emotional about investments, you’re not going to do well. You may have a certain feeling about some stocks but stocks don’t have feelings about you.

Warren is probably one of the most rational persons one would ever meet and Charlie Munger would be a close rival. Charlie became a man that Warren depended on. His first experiences in the ‘discarded cigar butt era’ probably convinced him that it was not exactly where he wanted to be. He made so much money for so long, doing what he had been taught by Ben Graham which was to buy very cheap stocks. It it was cheap enough, he didn’t care if it was a lousy company with a lousy management team. He’s buying them anyway just because they’re the cheapest.

Image Source

Charlie Munger must have had a big impact on him and moved him toward looking for wonderful companies at fair prices rather than fair companies at wonderful prices.

-It was enormously important because Berkshire scaled up in a way that would have been impossible to do otherwise.

The Key Indicator

What are the indicators he looks for within companies before making an investment? -The key there is the response they make when making a deal. Price, to a degree is immaterial. You’re not just buying an asset but rather a brand name, a real franchise and Charlie was very much responsible for that. Warren and Charlie became partners from the moment they met, sharing their expertise and the lessons they had learned before they met.

Building a Business and a Work Environment that Fits You

“I have constructed a business that fits me. It’s kind of crazy to spend your life painting if you’re painting a subject you don't want to look at. I’ve got to paint my own painting in business on an unlimited canvas in a way. ...It's a different sort of place (my office). I work with a great group of people who would make my life very easy and take good care of me. We have 25 people in the office and if you go back, it’s the exact same 25. - The exact same ones. We don’t have any committees at Berkshire. We don’t have a public relations department or Investor Relations. We don’t have a general counsel nor we have a Human Relations Department. We just don’t go for anything that people do in just a matter of form. It’s exactly the life I like and it’s not work. It’s just a form of play basically.” - WB

He likes his office quiet. He shuts the door since he doesn’t want to hear people talking outside and it has always been 5-6 hours a day reading. What’s remarkable is how much he remembers. Some of his friends say that he’s like a little computer which hard drive seems to have an unlimited space.

Warren is indeed talented and he coupled it with hard work and he seems to have partnered with the right people at the right time in his life. The good thing is he has shared these lessons and so much more. It’s up to us how we would take them.

Part 1 - Becoming Warren Buffett

Part 2 - Becoming Warren Buffett

Part 4 - Becoming Warren Buffett

Please upvote, resteem and follow me, thank you.