Week 40 - Investment Moves

- Current US market condition @ 10:58 am (EST)

- Week 40 passive dividend

- Oct 1 Options Trades

- Sept returns - up; more to come?

- US PORT Strike (can we learn from the UAW 2023 strike)

Current US market condition @ 10:58 am (EST)

The markets are opening Q4 with a RED day. Q3 was a good quarter for the stock market and normally Q4 will be also GREEN.

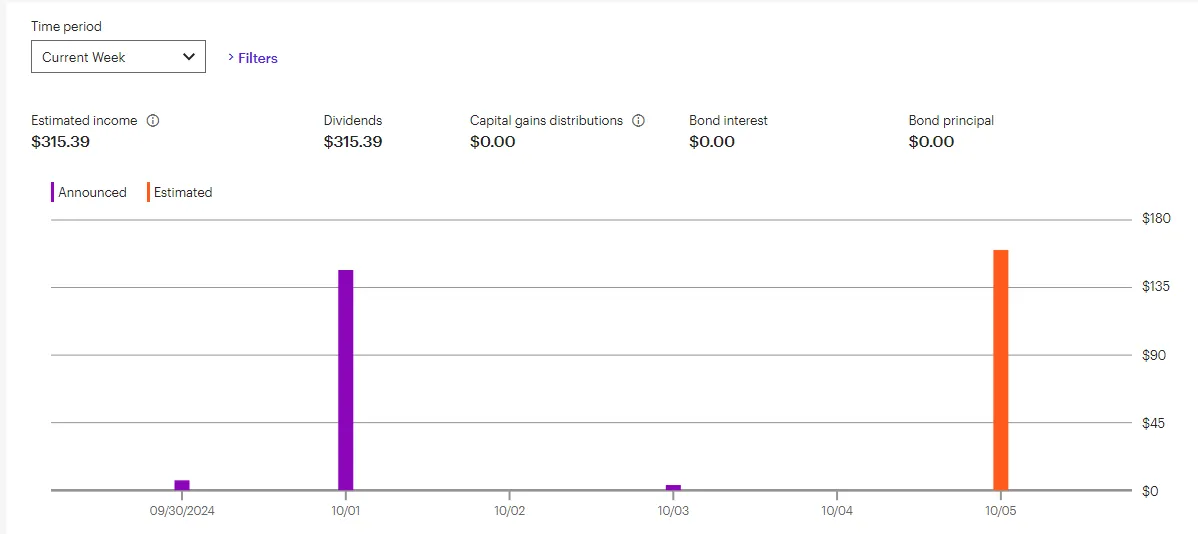

Week 40 passive dividend

Here are the expected dividends for this week:

Oct 1 Options Trades

Here are today's (Oct 1) investment moves. I also included Sept 30 because I did not create a blog post yesterday. Since markets are moving down today, I want to adjust my PUT credit spread down and out.

Sept returns - up; more to come?

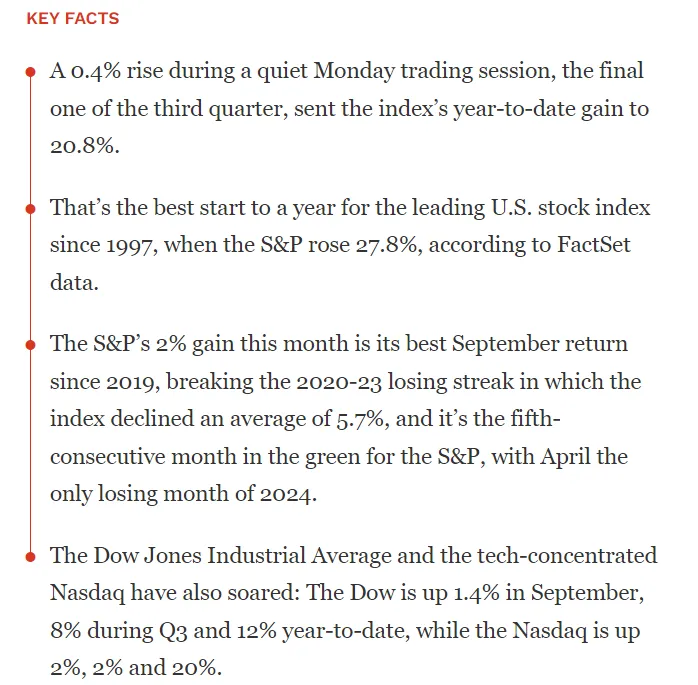

September is usually the worst month for the stock market. However, for 2024, September was a GREEN month which brought the SP500 returns to 20% YTD so far. When the market is up for the first three quarters, likely, Q4 will also be positive. That means the next 3 months will be exhilarating and very PROFITABLE for those with their assets in the STOCK MARKET.

Having the best "start" (YTD) at the start of the Q4 since 1997 tells us that September often brings the market back to a "reasonable" level. But this year might mean two things:

- The market will be corrected in Oct or Nov (later than normal).

- The market will continue to rally and finish the year near the new ATH.

US PORT Strike (can we learn from the UAW 2023 strike)

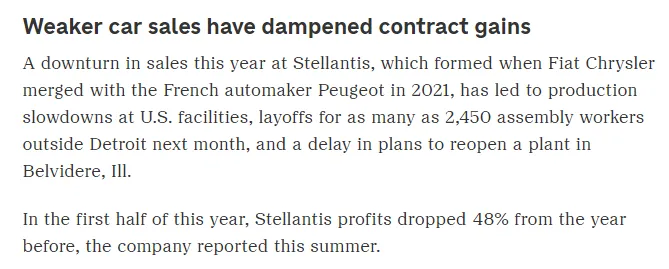

A new "strike" is on the way. Last time in 2023, the UAW pushed automakers like Ford, GM, and Stellantis into new contracts. In the end, workers got bigger wage increases. However, "cost" is passed down to the consumer of the product. Businesses need to maintain a certain margin or the shareholder will DUMP their shares.

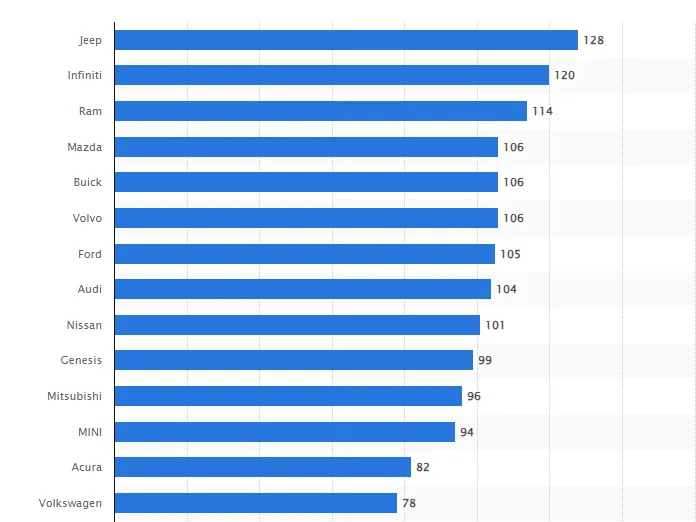

A year later, if you have FEWER workers (UAW assembly workers), then who wins? A smaller pool of workers means those who are lucky might win, but if the plant never hired more people than its previous peak, then the workers end up losing. Ford and GM have too many CARS sitting on the dealer lots and only Toyota is doing well right now.

Toyota is a non-union worker, but the pay is fairly close to what UAW workers make. They still have a competitive advantage.

Toyota / Honda / Lexus cars have the fewest days of supply compared to other car brands. Is labor cost the reason or do Americans only want to own a Toyota/Honda today?

https://finance.yahoo.com/news/the-politics-of-the-port-strike-150038425.html

Now back to the PORT strike. The timing is near the US election cycle (NOV). A strike of workers will cause some pain in the economy as well as a supply constraint that can impact all supply chains. We know what can happen since we witnessed that in 2022:

If you went shopping for a new car in 2022/2023, you might notice cars selling above the STICKER price. Others might have noticed missing features like the Blind Spot Warning Detection system were being "excluded" from your 2022/2023 model car. In the end, you might get a higher wage increase, but often there are hidden costs often at the expense of fewer workers. Let see what happens here.

Have a profitable day!