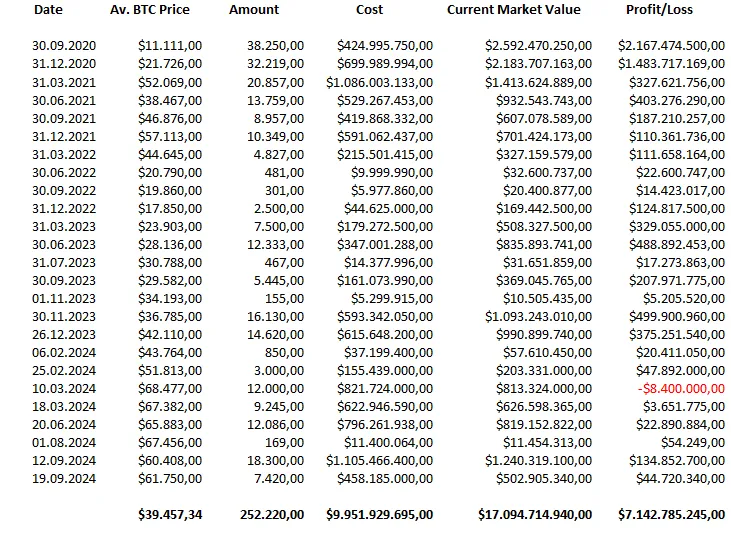

Since August 2020, MicroStrategy has accumulated a total of 252,200 Bitcoin (BTC), spending approximately $10 billion at an average price of $39,500 per Bitcoin.

As of today, with BTC valued at $67,777, the market value of MicroStrategy’s holdings has surged to $17 billion, reflecting an unrealized gain of $7.1 billion. This means that the company’s total Bitcoin position is now 71.8% in profit.

Acquisition Breakdown

MicroStrategy’s CEO, Michael Saylor, has been most active in acquiring Bitcoin since 2021:

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Funds deployed | 70% | 6,9% | 19,3% | 40,3% |

| Nr. BTC acquired | 43,4% | 6,1% | 22,5% | 25% |

The company now controls approximately 1.2% of Bitcoin’s maximum supply of 21 million, marking a significant stake in the cryptocurrency market.

Strategic Financial Restructuring

In addition to accumulating Bitcoin, MicroStrategy has engaged in strategic financial maneuvers. Saylor has successfully shuffled finances by selling attractively structured Senior Notes while redeeming older notes. Below is a summary of recent bond activities:

| Date | Size [$Billion] | Coupon [%] | Conversion Premium [%] | Due Date |

|---|---|---|---|---|

| 11.03.24 | 0.8 | 0.625 | 42.5 | 2030 |

| 19.03.24 | 0.6 | 0.875 | 40 | 2031 |

| 20.06.24 | 0.8 | 2.25 | 35 | 2032 |

| 20.09.24 | 1.01 | 0.625 | 40 | 2028 |

These moves have helped MicroStrategy optimize its financial position while continuing its aggressive Bitcoin acquisition strategy.

Sources:

Source Microstrategy financials:

Microstrategy investor relations page for 8-K, 10-K and 10-Q reports.Source Microstrategy stock market data: finance.yahoo.com

Source shares outstanding:

ycharts.comSource BTC price:

coingecko.com

Notes:

- Funds deployed: funds allocated during a certain period in comparison with overall investments in a particular asset

- Nr. BTC acquired: amount Bitcoin acquired during a certain period in comparison with total amount on the books

Vote for my witness: @blue-witness