2.5 billion adults worldwide don’t have a bank account, they are the unbanked. They are unbanked because financial services providers themselves have a huge cost of operating. But, with blockchain technology there’s really no need of that, it reduces the overhead of running the platform to zero.

Kora is a project that aims to monetize the capital of the unbanked, a capital of 10 trillion dollars.

Kora is a project of hope for those who lack the opportunities to use current financial services and systems available to accomplish their day to day essential financial transactions.

Cost in accessing the current financial services, lack of valid identification which is essential in accessing financial services, lack of trust in certain financial services, lack of understanding of the technologies used by financial systems and financial illiteracy are a few main reasons as to why Kora is a project that is now deemed necessary for the world.

Kora is led by someone who understands what it means to be unbanked, Dickson Nsofor, CEO & Co-Founder, was born and bred in a small city in Nigeria. He is a man with a great vision and a mission to solve the problem.

Although Banks, Local ad-hoc networks, mobile money operators and blockchain projects have tried to bridge the gap for people with the above-mentioned challenges, there still are certain shortfalls that are prominent. Such as high costs for certain services provided, lack of being accessible universally and conveniently, interoperability issues with surrounding existing systems, lack of knowledge etc.

Therefore, while also working in co-operation with these existing solutions the Kora network will aim to provide low cost, universally accessible services while enabling the existing financial service providers and networks to avoid such shortfalls of the current solutions and systems and thereby provide a better solution overall.

“We like this market because there’s no competition here” says Maomao Hu, COO & Co-founder of Kora. If there was competition, these people, the unbanked, would have financial services.

“Kora sees COLLABORATION not COMPETITION”

https://www.kora.network/downloads/Kora_Vision_Paper_International.pdf

https://www.kora.network/downloads/Kora_Vision_Paper_International.pdf

So what is this miracle system? Let’s have a look..

The Kora network in short is a public blockchain system containing tools for which people can use to accumulate and increase their capital.

Since it is defined as both a “self-sustaining” and a “community-owned” system, it provides people within a community to manage and perform their day to day financial transactions with ease and without the previously mentioned challenges.

The four building blocks of the Kora network are as follows;

- Identity: Verification of the user

- Secure Storage: Protection from easily being stolen or devalued.

- Money Transfer: To be done quickly and securely.

- Marketplaces: Creating venues for users to exchange their money

But as many of us may already be aware of, there is a concern of the level of trust held by people in rural areas regarding digital currencies and technology.

Therefore, as a solution to this, the Kora network will not only be using its native crypto currency Kora Network Token (KNT), but will also include the ability to support national currencies as an electronic, cryptographically secure token (eFiat). By doing so this will increase more opportunities of financial services and transactions to take place while also increasing the level of trust of the people.

KNT is a utility token that is used within the Kora network and has usages beyond its monetary value. These will be used to pay for the costs within the network and act as a bridge between eFiat currency pairs and other decentralized currencies. It will also act as a hub for the eFiat currencies to connect with the crypto currencies since it will contain and maintain the exchange rates with other cryptocurrencies.

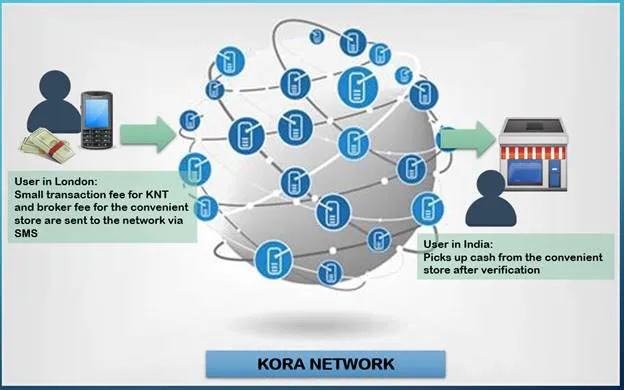

Heard of the “cash-in/cash-out” problem, also known as CICO?

It is up to date one of the biggest issues with money transfer. Thanks to the usage of eFiat this can be resolved! How is that done you ask? Well the kora network introduces entities called ‘Agents’ and ‘Merchants’.

The ‘Agent’ is a role played by a user who will chose to convert between eFiat and physical cash. These agents will act as cash out points and accumulate the physical cash.

So, in order to make this process much more worthwhile for these agents the network has introduced ‘Merchants’.

This increases the interoperability of eFiat. In short Merchants are other businesses that will accept their payments in the form of eFiat. This forms a loop as you will now see which will be continuous in its transactions within the community. The physical cash will be continuously re-used while providing the general benefits when using digital currency and thereby resolve the CICO problem.

How does Kora hope to resolve the previously mentioned challenges?

- Universal Access and Cost for Access

Usage of feature phones and SMS which are not very costly and accessible to everyone in the world today.

Kora will provide its financial services even on the most cheapest of feature phones. Smartphone apps and web applications are also provided

- Identification

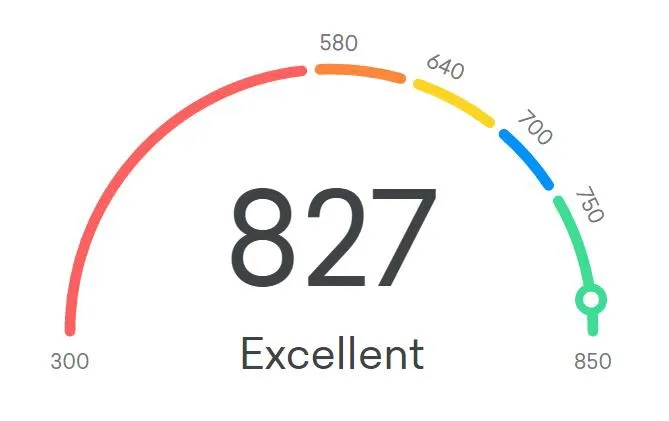

The Kora network provides a “hybrid on-boarding process on a tiered KYC ramp”.

This will allow users to join the network with whatever information they have E.g. Government ID, Referrals, Biometrics etc. The transaction limits and levels of access will increase as the users prove their credibility.

- Cost of the services provided

This is achieved by Kora through the usage of the blockchain instead of establishing and running a front-to-back financial institution, which can be very costly.

Hiring of staff, and the cost that is required to ensuring the cash is secured and protected is no longer necessary due to the use of the blockchain and digital currency. Therefore, people will be able to perform their financial transactions in a far less costly manner than usual.

The Kora Network is a 4-layered model;

- Protocol: defines basic rules for the users on the network.

- Data: This layer contains the blockchain database. Information related to the users and anything that they wish to store are contained in this layer.

- Applications: In this layer the data that is included in the data layer are processed, monitored etc.

- Access: this layer is used by the users to access the network e.g. via a phone

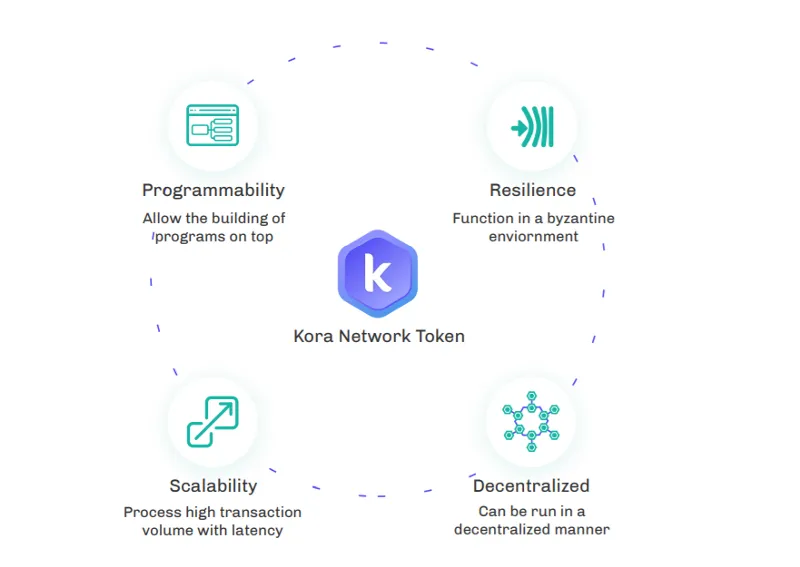

“The Kora Network is built on Ethermint, which implements the Ethereum Virtual Machine with Tendermint consensus.”

Why Ethermint?Well apart from it supporting the Ethereum development community it also provides the following advantages;

- Scalability: Able to process bulk volumes of data

- Programmability: The ability to build programs and integrate with ease

- Resilience: Flexible to function in various environments

- Decentralized: Running of the network can be done in a decentralized manner.

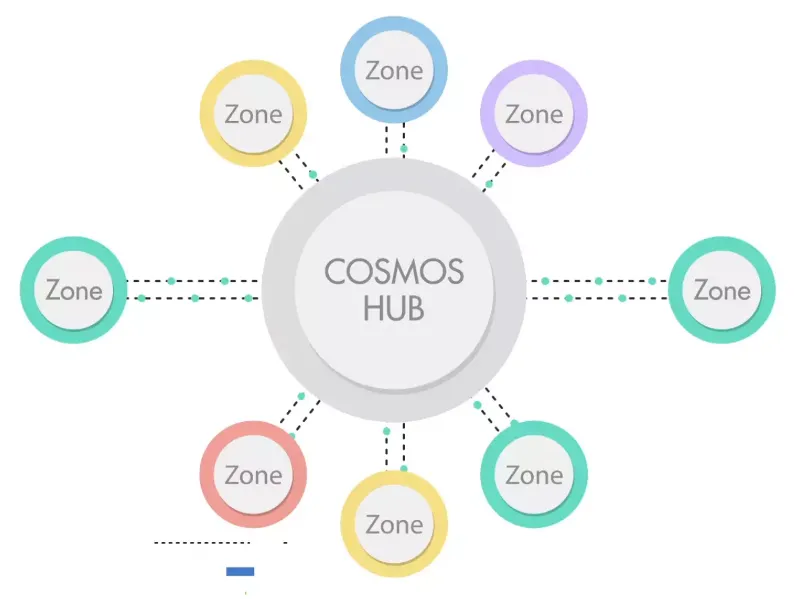

Kora platform will be able to connect with Ethereum, bitcoin, cosmos decentralized exchange and various other cosmos zones ensuring interoperability.

“Ethermint integrates natively with the Cosmos Network”. And because of this the Kora platform will be able to connect with Ethereum, bitcoin, cosmos decentralized exchange and various other cosmos zones. This is how the network will be interoperable with other blockchains.

The Kora network’s objectives are to provide financial services with universal access in a cheaper, faster and profitable manner.

Although the Kora network is not a licensed financial institution or does not provide the financial services directly it still requires that the users who are willing to provide such services and exchange tokens via the network to be licensed financial service providers or mobile money operators.

“The Kora Network will be secured with a modified version of DPoS”

Providers of the financial services will first read the blockchain and then write to the transaction pool whereas the users can either directly access the block chain and read/write or else they can also access the blockchain via a Provider. But this will be a bit costly.

The Kora Foundation;

The foundation in the early stages will be in a centralized state and will make decisions for the network along with its stakeholders. However, there is potential for decentralized governance since the network does run in a decentralized manner. But because this is still under research and discussions, the foundation will initially be referred to as a “centralized counterparty”.

The most important stakeholders of the network are the participants, also there are other stakeholders including national governments, financial institutions, NGOs and other parties affected by the Kora Network.

Hernando De Soto, who revolutionized thinking on poverty once said;

The poor don’t lack capital, they just can’t monetize it…Fixing that would be the greatest thing you can do to foster economic growth.

When Kora solves that, anyone can make payments directly from mobile phone through USSD. One day, Kora will be able to provide the necessary opportunity for people to: get a loan, lend, provide financial history, financial scores and do cross border payments via Kora platform