Disclaimer: Breckenridge Research is short $KODK - Eastman Kodak Co.

At the time of writing this $KODK - Eastman Kodak Co shares are trading around $45 and have jumped over 2,400% in just a few days this week after they received a $765 million government loan to help produce ingredients used in key generic medicines to fight the coronavirus.

The development bank loan was the first of its kind under the Defense Production Act in collaboration with the U.S. Department of Defense, and intended to speed production of drugs in short supply and those considered critical to treat Covid-19, including hydroxychloroquine, the controversial antimalarial drug touted by President Donald Trump.

(Source: Yahoo Finance)

Not so fast

So Kodak is basically given $765 million dollars to be a pharmaceutical company with no prior history in that sector. The CEO, Jim Continenza claims otherwise and said "We really didn’t make cameras, we made film. We’ve always been a chemical and chemistry company."

(Source: Yahoo Finance)

If that is true or not, what is true is Kodak will now be manufacturing and producing these chemicals/drugs for humans not cameras. Producing drugs for humans takes time, especially when the company has no background in such field. There will be many trials and phases the drugs will have to go through and pass before they even get to market. I also see the drugs they are planning to produce such as hydroxychloroquine haven't been proven to be affective for Covid-19.

To sum this part up, we are a long time away from Kodak actually producing drugs for humans. Let alone drugs to fight against Covid-19, if they can even produce drugs for human use. Is this CEO capable of running a pharmaceutical company? Looking at his LinkedIn page, Jim Continenza has no prior history of working or being educated in pharmaceuticals whatsoever. His only history appears to be technology related. In a few years from now, maybe they get some products on the market and start to see some profits on their pharmaceutical ventures. However, in the meantime the share price reaction to all of this is far beyond reality.

35% of trading volume likely coming from retail investors

Based on data provided by Robinhood it is clear retail investors have found a new place to park their money. Within the past 2 days well over 100,000 users on Robinhood added $KODK - Eastman Kodak Co to their portfolios. If we average each user to have invested $1,000 in $KODK we would have $100 million just from Robinhood users alone. I can only predict trading patterns from retail investors on other platforms such as TD Ameritrade, E Trade, Interactive Brokers, and so on all look the same as they do on Robinhood. With that we can guess between $300 and $500 million in volume the past 2 days are from retail investors alone.

Possible insider trading?

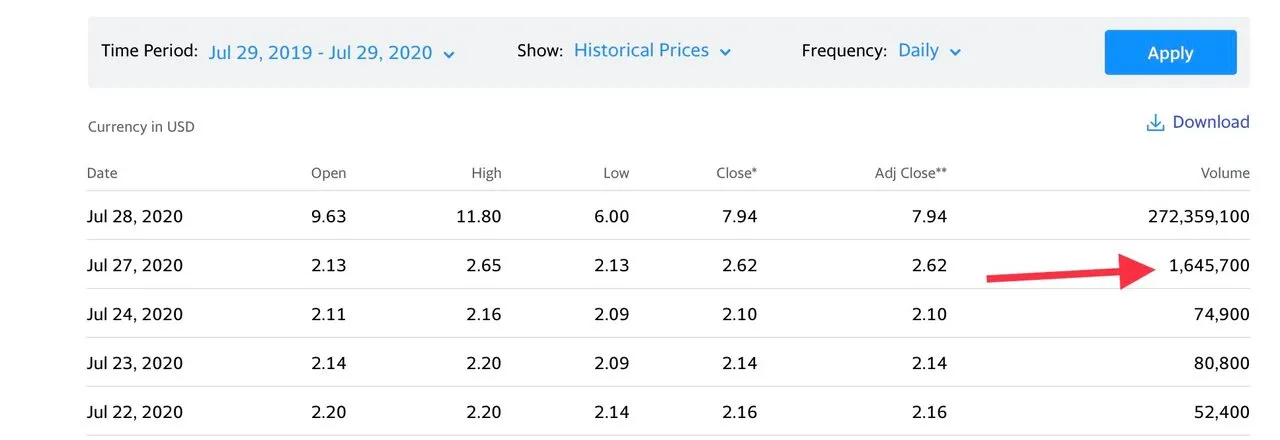

So this last part here doesn't really have anything to help my case for being short, but I did find this interesting... I was looking on Twitter and seen a user posted this image indicating possible insider trading before news broke about Kodak getting the $765 million government loan.

(Source: @TESLAcharts)

You can see in the image above volume on the 22nd, 23rd, and 24th are all very low between 52,000 and 80,000 shares traded per day. Then on Monday the 27th, volume spikes 1,645,700, near 2000% of the average volume with shares up 24% just a day before the news released. As you can see Tuesday the 28th, news released publicly and volume was close to 300 million. I'm almost certain somebody knew something and profited very nice... It's too bad we will never find out who as the SEC doesn't do their job.