Christmas has left us in red, January is more difficult than ever (and without any sherpa to lend us a hand) and saving seems like one of the first New Year's resolutions that we will leave in the ditch.

However, lately we only hear about the kakeibo method (which is actually pronounced kakebo), a Japanese accounting system, and thanks to it we can control our expenses and save. Yes, even after having lived a maelstrom of excessive Christmas shopping and having gone through the consumerist orgy of the sales. Is it possible?

Actually it is not about anything that we have not seen before, but we already know that everything that comes from Japan falls in love and immediately becomes fashionable. We tell you what it is and that of course, as in many other things, you can use technology and a variety of apps to manage your expenses and get to the end of the month.

The Kakeibo presumes that it is easier to put into practice than to pronounce its name. A system consisting of a small booklet of accounting and finance. Yes, exactly, like the ones our grandmothers carried during the Prediluvian Period.

But we are not talking about any notebook, but one that gives us a certain structure and makes it easier for us to write down the calculations.

In addition to being simple, Kakeibo books boast a beautiful design.

It is a very simple and Zen method to visualize how much money we spend, on what and how. And of course, it helps us in that ideal goal: to save at the end of the month. In the end it is a system to better manage money and enjoy what you save.

How kakeibo works

The purpose is to record at the beginning of each month the income and the fixed expenses, such as the mortgage or rent, the electricity, the community, etc. In this way we can know when money is available for the rest of expenses we have during the month.

Every time we make a purchase or pay something, we must write down the day and the corresponding section. If it is food, leisure, clothing, etc.

The important thing about this system is to be constant and meticulous. You can not leave anything without scoring, no matter how small the expense, or it will not help. And it is only by pointing in detail at what we invest our money is when they come to light those small superfluous expenses that we can do without and that are the ones that do not help us save.

The first Kakebo was published in 1904 by Motoko Hani, editor of one of the most important women's magazines in Japan at that time and concerned that women could better manage the expenses of their home. Her goal was very feminist, because she wanted to empower women, since their personal money depended on what they managed to save (up to 15% of the income).

Its effectiveness was such that to this day the Kakebo model of Hani is still valid and is used by all those people interested in controlling, managing and valuing the expenses of their home.

** Is it as effective as they count? **

Gonzalo García Abad, a graduate in Economics and with a broad interest in accounting and finance, explained that the key to saving and managing our money better is based on two simple ideas.

On the one hand, planning. We have to make some plans, have an idea of what we are going to spend and take it to figures.

And secondly, once the period we analyzed has passed (one month, for example), check whether it has been fulfilled or not and see for what reasons there may have been some deviation: "In short, it helps us to become aware of how our personal finances work and so that we can take charge of them ".

For this expert it is recommended that, at the beginning of the month, we have a budget allocated for each of the expected expenses, but also a margin for contingencies and, of course, a figure destined for savings: "and logically, as we are seeing As the months go by, we can learn from the experience of the previous one, "he says.

The kakeibo seems to fit perfectly with this system, but as some of the users of the system have pointed out to us, the objective of Kakebo is to help you save money, but it does not encourage you to invest or do anything with that money saved and in the end it does not You take advantage of everything you save.

** The apps that can help us **

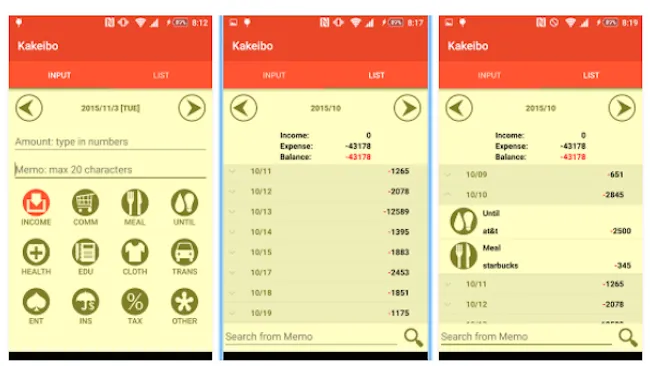

Although the Kakeibo seems a simple system and we love the beautiful ones that are some of the books that can be purchased in the market, having an app on your mobile will make pointing each and every one of those expenses much easier than going with a notebook everywhere. Or having to trust your memory. We have found these two available.

Kakeibo: available for Android, Kakeibo is an application for mobile that in a very visual way helps us to become aware of unnecessary expenses and acts as that booklet in which to record all our expenses.

Zoe's Kakemoney: this app available for iPhones and for Android allows you to keep accounts up to date and record all expenses by categories, as well as set budgets to evolve and improve each month in our personal finances.