Week 38 - Sept 16 Investment Moves

- Current US markets (11:00 am EST)

- Today option trade

- This week (38) passive dividend

- Fed Rate Cut

Current US markets

The markets are split as of right now (11:00 am EST). The big news is the FED rate decision that is coming on Wednesday. However, what the markets do between now and then can be much harder to predict.

I'm adjusting my put credit spread down and my covered call up. I am playing both sides of the moves and I need to ensure I'm not caught with too much risk with the FED moves.

Today's option trade

Here are today's (Sept 16) trades:

Summary:

- Rolled PUT side of the Iron Condor Up.

- Rolled RIOT Cash Secured Put down and out.

- Rolled RIOT covered call out for $10.

- Adjusted MRVL put credit spread for $2 premium each.

- Rolled ALLY put credit spread for $5 premium each.

- Rolled F covered call down and out for $8.

- Rolled F cash-secured put for $7.

This week (38) passive dividend

This week's dividend is a nice payment. I'm currently using about ~50% of the dividend to purchase my assets. The goal is to reduce the dividend and shift some of the assets into QQQM, and other ETFs I own.

Fed Rate Cut

This rate cut is an important signal to the market.

https://www.cnn.com/2024/09/16/economy/interest-rate-cut/index.html

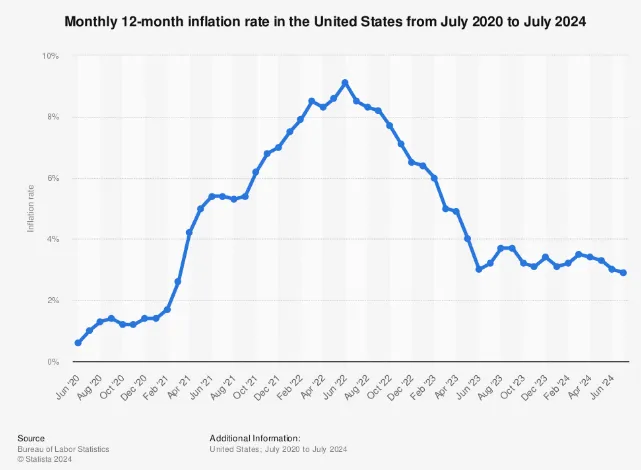

When the economy is "hot" and inflation is running over 8% with a peak of over 9% inflation, the first cut is important. Having a high interest rate will reduce the likelihood of borrowing because the cost of interest is very expensive. The US experienced high inflation which impacted food prices at the supermarket. Nearly everything has gotten more expensive as businesses have to raise prices to maintain their margins.

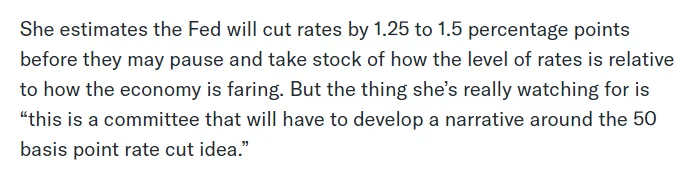

At some point in the cycle, high interest rates will slow down the economy where laid off and consumer spending slows. That process can take a while to show up in government data and earnings guidance from publicly traded companies. The first cut is often made after enough time has passed for the "high interest" rate to slow down the economy. The normal path is a series of cuts that will lower the interest rate to the point where the FED can go back to stimulate economic growth. The goal is often to make money cheap to borrow again so we can start the cycle over again.

What do you do during rate cut cycles?

The most important thing is to realize that the down cycles are often shorter than the uptrend cycle. That means the best opportunity to build wealth at the beginning of the downtrend.

Whether we are at the beginning or the middle of a "recession" is not important but you need to make moves before the "last" interest rate cut. Often when the first-rate hike happens, the economy is already strong and hence that is a sign that the peak of the economy is near. This is why making moves right now is the right time to position yourself for the next BULL cycle.