Week 37 - Sept 9 Investment Moves

- Current US Markets

- Sept 9 Options trades

- Week 37 dividends

- 2030 SP500 Prediction - Tom Lee

Current US Markets

The premarket at 8:00 am shows this:

Last week was one of the worst weeks of the year because it was a BIG RED week. With the S&P 500 losing 4.3% and the tech-heavy Nasdaq losing 5.8%. September is a hard month to make money because it been historically the worst month of the year.

Sept 9 Options trades

Here my option trades as of 10:15 am (EST)

I still adjusting my PUT credit spread downward because I expect September to be downtrending. If I get a chance to roll the covered call, I will adjust those also.

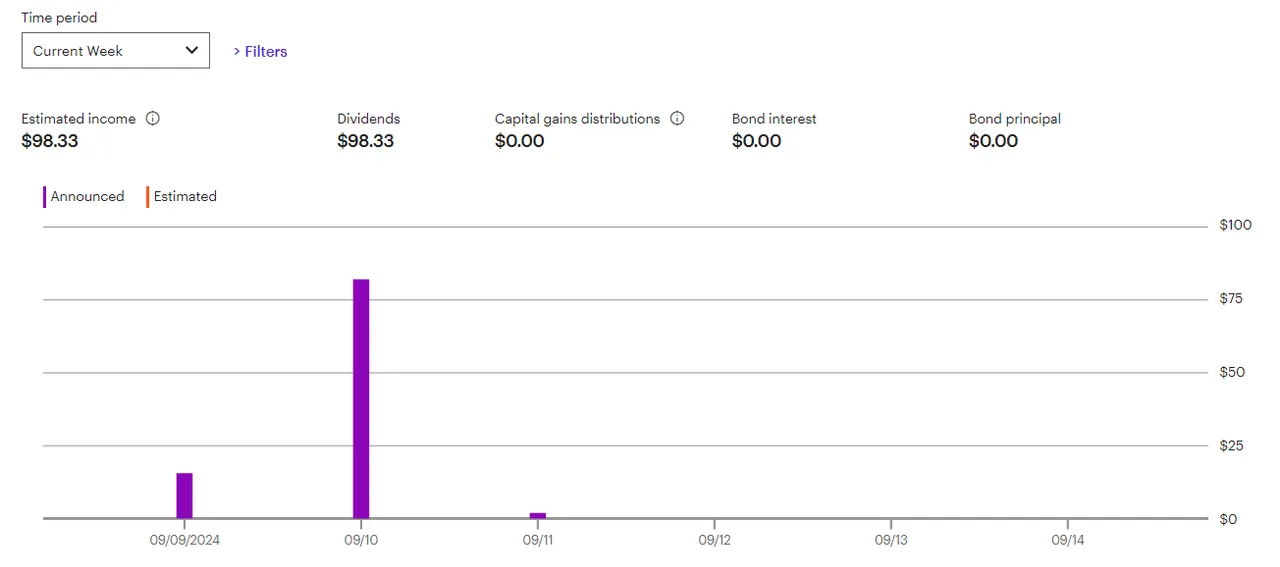

Week 37 dividends

This week's dividend is coming in at $98. This week's dividend is small compared to the prior week. However, I'm using the dividend to reduce risk and rebalance my portfolio.

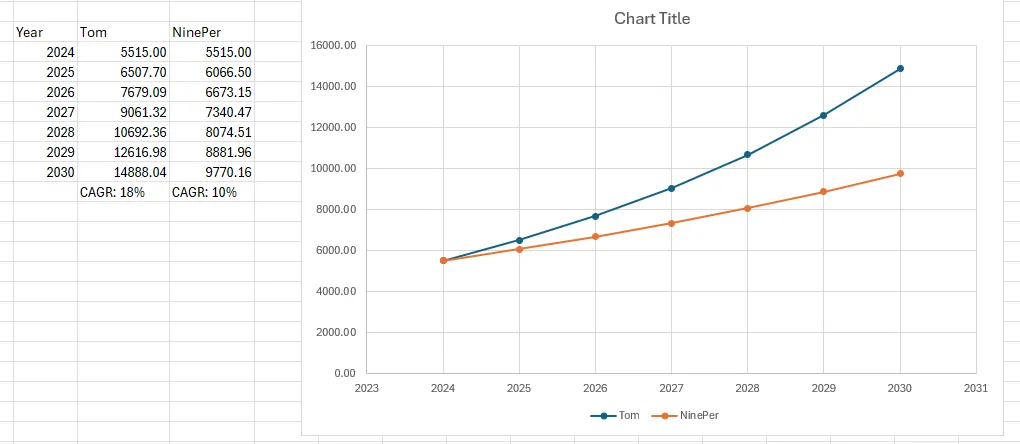

2030 SP500 Prediction - Tom Lee

Tom Lee believes the SP500 will be around 15K (or about 170% higher). Tom Lee is one of the most exciting analysts in recent years because of his bold predictions. The key here is to know the DIRECTION, not the "PT" (the price target). Analysts will often get the price target wrong and that is normal just the weatherman. The thing I look for is will the market go down or will go up?

https://finance.yahoo.com/news/1-vanguard-index-fund-buy-081200788.html

Using Excel, I can model Tom's prediction and it comes to around 18% return per year. Let's say you think he is too optimistic, I lower the expectation to 10K in 2030, which turns out to be more in line with historical averages of 10% a year (CAGR). Tom's prediction is the blue line and the historical average is the orange line.

Q: What should you do now?

If you know the markets will DOUBLE between now and 2030, what should you do?

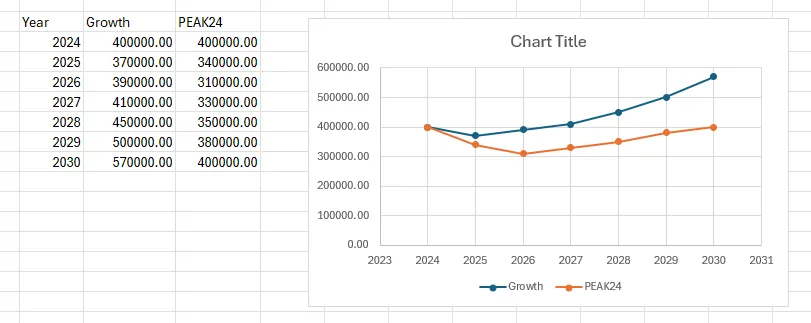

Q: What about Real ESTATE?

Real Estate is looking a lot like 2008 at PEAK value. The last time this happened, it took over 7 years (or more) to get back up to the previous peak. While it was "exciting" to see home value PEAK recently, this means it might follow a similar pattern. 2024 is the turn point and you are seeing the housing price drop in some markets.

I wanted to also model two different outcomes with real estate:

- The first is to assume real estate will continue to grow.

- The second model uses a "peak" price concept where it takes years to get back up to the previous price.

If you own an Airbnb or rental is it better to use that cash in the SP500? Real estate does look to enter a period of zero or little growth over the next 6 years or so. In some markets, housing prices are dropping back to 2008-2009 prices. If the stock market when back to 2008-2009 prices, many folks would lose so much money.

Having a profitable day!