There are very few analysts I pay attention to with regards to commentary on cryptocurrency, however Thomas Lee is one of them. Recently he presented "The Economics of Cryptocurrencies" at the Upfront summit. Lee is one of the few analysts with a positive outlook on cryptocurrency. His talk consisted of the following four points:

- Digital trust ( why it is important and valuable)

- Millennials driving change (how millenials will drive forward the crypto market)

- Crypto is an asset class (Cryptocurrency is already a significant asset class)

- Why Wall street will care (Why wall street will invest)

While all of these topics are important, something jumped out of me immediately when Lee talked about it;

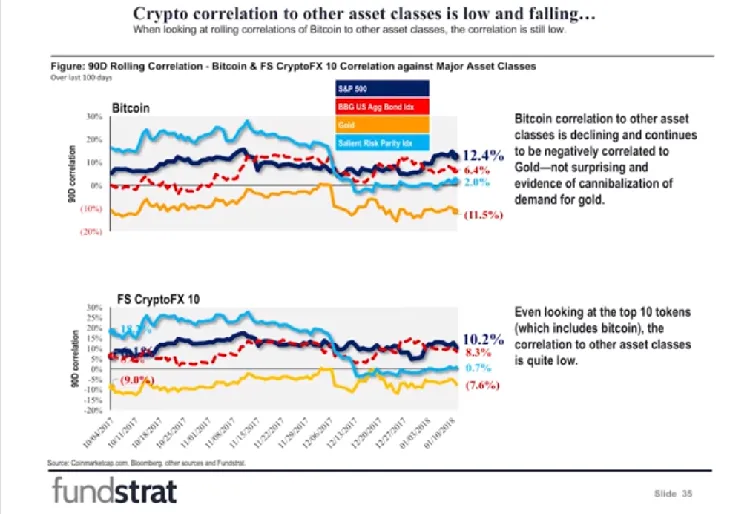

"As a portfolio, crypto has uncorrelated Alpha. What does that mean? [References chart on screen]. Bitcoin and Crypto are uncorrelated to other markets right now. That is almost a holy grail for portfolio allocation".

Holy grail indeed, for those of that you are experienced investors you will know that almost all asset classes have either a positive or negative correlation. The fact that crypto has currently no correlation to either stocks, bonds, gold and hedge funds is a serious buy signal for investors that have not yet entered the market. Many investors and portfolio managers are agnostic to the actual assets that allocate in their portfolio, that is to say they aren't so focused on the micro/industry specific factors pertaining to the asset class they are investing in, rather they are primarily focused on returns and how they integrate with the rest of their portfolio. As a consequence of this, as long as crypto continues to be uncorrelated we should see further investment by portfolio managers and investors.

This point can not be slept on, for the first time there is a major selling point for crypto that isn't concerned about the underlying utility of crypto assets. While early-satge investors in crypto have a good understanding of the utility in crypto and continue to do research, portfolio managers do not, however that will not be an issue as their job is to allocate money predicated on assembling diversified portfolios that are positioned to minimise risk while maximising potential. Given the lack of correlation between crypto and traditonal asset classes, crypto just became a must have for any intelligent portfolio manager and investor.

Check out the full presentation below:

This is not financial advice, please do your own research.

Image sources: Fundstrat & Banking.com