1: Have Cash

You need to have enough cash to pay for your normal expenses. You need to have an emergency fund.

What you want to avoid is having your day to day finances affect your investment portfolio.

You can research and find out exactly why you think an investment will increase in the future, but experience tells me that it often goes down even further and can certainly take longer than you predicted.

So that means you have to be financially secure enough to let your investments grow unhindered by your normal finances.

To do this you have a few months to a years' worth of living expenses set aside. Exactly how much depends on your personal situation and how secure your income is. But I will say that 3 months worth is probably a good amount to aim for.

2: Pay Off Debt (Especially High-Interest Debt)

Debt is an investment return killer.

Whatever the highest interest rate debt you currently hold is the amount you need to beat to turn a profit. On the other side, if your investment loses money your debt interest rate magnifies your losses.

Let me explain.

If you have a credit card debt at 15% then you need to earn at least 15% just to break even! This is because you have to pay that 15% interest on your loan. Effectively, just by paying off that debt you are earning a guaranteed 15% return on your money!

Now if your investment LOSES money (it happens to us all), not only do you lose whatever percentage the investment went down you also lost the interest rate you are paying on your debt.

So if you lost 5% on your investment and you have credit card debt at 15%, your effective loss is NOT just that 5% but a full 20%!

So you see, paying off high-interest rate debt is something you must do before you start investing. I know it is not as sexy as investing, but it is the smart thing to do.

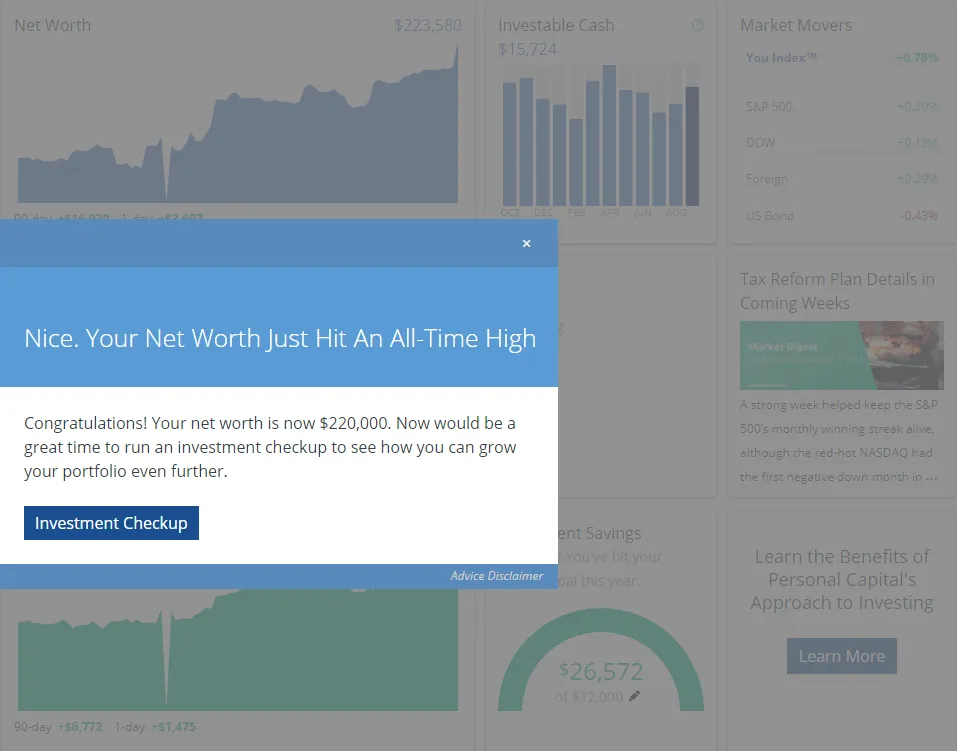

A great place to track your debt, expenses, and investments is Personal Capital. I use it almost daily to keep tabs on my net worth.

If you haven't signed up yet, use this link to get $20 when you do (I will too).

3: Know Yourself (Risk)

Before you start investing you need to understand at least two things about yourself, your risk capacity and your risk tolerance.

Your risk capacity is your financial ability to take a loss on your investments. This means that you can afford to lose every single dollar you invest. You don't want to risk not meeting your current financial obligations because you were counting on your investments to pay for it.

Your risk tolerance is your emotional capability to take a loss. You don't want to be a panic seller. Investments should be made based on logic and fundamentals, not emotions.

You can improve your risk tolerance by improving your financial situation. By having little to no debt and a healthy emergency fund you insulate yourself from these market fluctuations.

Another way you can improve your personal risk tolerance is by thoroughly researching your investments before you put in one penny. This brings me to the next point.

4: Research and Plan

It's easy to start investing, but just dropping your hard-earned money in whatever sounds good will lead to mistakes.

- First, you need to know how much of your income you are going to set aside for investing.

- Second, how are you going to split your money into your different investments. Stocks, Bonds, Real Estate, Crypto, Precious Metals, Collectibles – what percentage for each?

- Third, what type of investing strategy do you want to follow? Growth, Income, Dividend Growth, Landlord or Flipper are some strategies. You also want to decide upon your investment timeline – how long you plan to hold any particular investment or at what price you will sell.

- Then you need to know what type of investment vehicle you are going to put that money in. You have plenty to choose from, Traditional IRA, Roth IRA, 401(k) – 403(b) – TSP etc., Brokerage, and even how you are going to store some physical or crypto assets.

- Fifth, you need to know how much time you are going to put into picking your investments. Are you going to index, pick sector ETFs, mutual funds, or pick individual investments?

There is a lot to consider and it is easy to make mistakes. However, don't get overwhelmed and then just not invest. It is still better to invest than to not invest. When you are just starting out with small amounts, it is the best time to be making mistakes and learning from them.

Plus, most aren't life-shattering.

For instance, when I started investing I held some REITs (Real Estate Investment Trust)in my brokerage account when it is more beneficial tax-wise to hold them in an IRA or rIRA.

I now hold all my REITs in a Roth IRA.

See, no real biggie. It cost me some time and some transaction fees, but I had a lot more money than if I had not started investing at all.

5: Pick your Investment Platform

Interactive Brokers, TD Ameritrade, Charles Schwab, Ally Invest, TradeStation, Coinbase, Bitfinex, and plenty more.

Some things to consider are ease of use, services, the information presented about each investment, and fees.

Avoiding high fees is of particular importance. You want to invest on a platform that has little to no fees. That is why I invest mostly with Robinhood, as they have ZERO fees.

Imagine you have $200 to invest and you are charged $5 for each buy and sell. That means that your investment has to go up by 5% just for you to break even! ($5 for the buy and $5 for the sell is $10. $10 is 5% of $200)

Now with Robinhood rolling out an integrated zero-fee crypto trading platform, they are only getting better.

If you haven't signed up for Robinhood yet, you can use this link and get a free random share of stock when you do (I will too). There is even a small chance of getting a share of Apple or Warren Buffet's Berkshire Hathaway.