Markets keep making new highs. Applied the screens to add more Japan exposure. Using pullbacks to add a few more slots in US markets. 56 Percent Club update has some new entrants in options but not in stocks.

Portfolio News

Market Rally

Markets keep pushing higher with Nasdaq making 13th consecutive high

Nerves about the China trade deal are still around but mostly affecting Asia and not US

Treasury yields are looking a little more normal with the curve no longer inverted

US shale oil sector is looking a little rocky with high debt levels and lowish oil prices and low natural gas prices beginning to weigh.

My holding in Chesapeake Energy (CHK) is looking sick and the oil drillers are following down too

Bought

Did something of a rotation in Japan taking some profits and applying stock screens to find 3 new stocks.

Komatsu Ltd (6301.T): Japan Industrials. Price has broken and retested the weekly downtrend. Komatsu has not recovered in the same way Caterpillar (orange line - CAT) has. Be aware there is a currency effect in the chart - CAT in USD and Komatsu in Yen but the shape tells the story.

Sumitomo Chemical Company (4005.T): Japan Chemicals. Return to the portfolio after something of a selloff. Same style of chart

JK Holdings Co Ltd (9896.T): Japan Building Products. New entrant looking for a stock tied a bit more to domestic Japan than the other two.

Cameco Corporation (CCJ): Uranium. Price edged ahead from the purchase made last week - added another small holding. See TIB487 for the discussion on uranium.

Qualcomm Inc (QCOM): US Semiconductors. Qualcomm has shaken off the blues from its Apple patent dispute and the China trade story. There was a downgrade from Morgan Stanley. I added a small parcel to run the 5G theme as my holdings in Marvell Techhnology (MRVL) are going to be assigned on covered calls.

Starbucks Corporation (SBUX): US Fast Food. Jim Cramer idea based on his latest interview with CEO.

Twilio Inc (TWLO): Cloud Computing. Added a small holding in one portfolio - Jim Cramer idea to add to holdings and buy on weakness.

WestRock Company (WRK): US Paper Manufacturer. CNBC talking heads idea of a cyclical stock that is likely to benefit from the US-China trade deal - price has broken above a key resistance level ($40) - hold there and it could add another 10 or 15%

Pilbara Minerals Limited (PLS.AX): Australian Lithium Explorer. Added to a small holding to average down my entry price. I had chosen not to invest in the recent Share Purchase Plan as they ran a minimum top up amount which is more than I wanted to buy. Police action yesterday following a fatality pulled price closer to SPP price. This is a long haul investment on lithium and lithium post processing.

Sold

Russell/Nomura Small Cap Core Index Linked ETF (1312.T): Japan Small Cap Index. 25% profit since March 2016.

CVS Health Corporation (CVS): US Healthcare. Price has been moving ahead strongly as market revalues the Athena acquisition and has closed above $70 for some days now. Closed out the January 2021 57.5/70 call spread bought as part of a call spread risk reversal. This locks in 125% profit since May 2019. I have left the sold put (45) in place to run to expiry. If I was to buy that back now the profit figure would be 205% - more if price stays above $45 to expiry (38% away from $73.25 closing price). With this sold call closed I was able to write a covered call for this week's expiry.

Updated chart shows price moving ahead harder than the price scenarios I modelled. The sold put (45) looks very safe.

Expiring Options

iShares U.S. Real Estate ETF (IYR): US Real Estate. With price closing at $91.37 exited November 2019 91/88 bear put spread for 90% loss = saved some capital. Of course I will kick myself if price drops below $91 by Friday (it went to $90.73 on Tuesday). I will leave the sold put (88) to run to expiry.

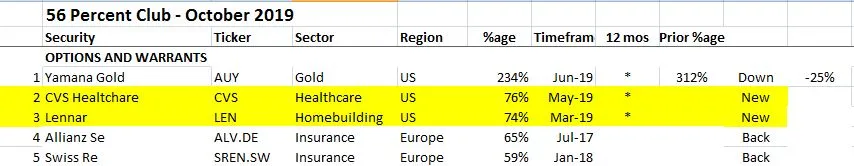

56 Percent Club

Update for month of October - sorry did not do September.

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

First is the table of stocks. I have also marked up whether they have gone up or down since last time.

What stands out

- No change at the top with Australian payments technology company, EML Payments (EML.AX) holding its place and going up another 7%

- Dropping off the list is Bank of America (BAC) and Zurich Insurance (ZURN.SW) sold and Yamana Gold (AUY) (5 vs 8)

- European Mid Caps and Japan still feature

- None of the stocks were bought in the last 12 months.

On the options side same deal - two new entrants marked in yellow

- Quite some change here with only 1 stock left from last list (5 vs 4)

- All 3 off the list were sold or rolled up - iShares Silver (SLV), Van Eck Semiconductors (XLK) and Veolia Environment (VIE.PA)

- Europe Insurers Allianz SE (ALV.DE) and Zurich Insurance (ZURN.SW) come back onto the list.

- New on the list are US Healthcare provider, CVS Healthcare (CVS) and US Homebuilder, Lennar (LEN)

- 3 of the contracts were bought in the last 12 months (starred)

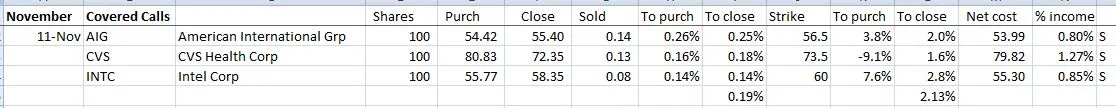

Income Trades

3 covered calls written at average premium of 0.19% and coverage of 2.13%. With only 3 or 4 days to go to expiry, I have written at below the normal average premium I look for (0.19% equates to 0.76%)

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $526 (5.8% of the high). Price dropped through support at $8891 making a lower low.

Ethereum (ETHUSD): Price range for the two days was $7 (3.7% of the high). Another quiet session with price drifting lower but holding above the cycle low (180)

One new trade opened looking for a reversal on 4 hour chart. Trade taken in by the spread

Ripple (XRPUSD): Price range for the day was $0.00846 (3% of the high). Also a quiet session with price drifting lower and making a lower low on the cycle.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 1 trade on XAUUSD for 0.23% profits for the day. 9 Trades open (0.1% negative). Trader does not have any GBP trades but they have opened a short on UK FTSE100 - I hate it when forex traders start trading stock indices. That is not what the outsourcing is about.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

November 11-12, 2019