The last of the portfolio updates for the personal portfolio from my trip away. Biggest wins come in agricultural commodities (Wheat and Soybeans) and China benefiting from the improvement in the US-China trade talks. Agriculture trades paid for my entire trip away - flights, accommodation, rail, etc.

Bought

Lyft, Inc (LYFT): Assigned early on strike 50 sold put (part of call spread risk reversal). See notes below. This is going to be a long haul investment to recover.

Sold

FireEye, Inc (FEYE): Cybersecurity. Assigned on covered call for 4.7% profit in 3 weeks (including sold put premiums)

Chicago Wheat (WEAT): Wheat Futures. 4 contracts closed for average $7.80 per contract profit (1.55%)

Soybean Futures (SOYB): Soybean Futures. 4 contracts closed for average $8.75 per contract profit (0.96%)

Expiring Options

Yamana Gold Inc. (AUY): Gold Mining. Sold leg of strike 4 bull calendar spread expired in my favour on October expiry - i.e., price stayed below $4. Now looking for price to rise above $4 for November expiry. With closing price at $3.60, this has some way to go. Might well be selling another strike 4 call option in a few days.

iShares U.S. Real Estate ETF (IYR): US Real Estate. With closing price of $94.67, 92/89 bear put spread expires out-the-money. This trade never went in the money as yields kept sliding.

Lyft, Inc (LYFT): Ride Sharing. With closing price of $40.79, 75/85/50 call spread risk reversal expired out-the-money. The sold put leg (50) was exercised ten days early when price was $39.24 = one happy seller who could sell at $50 and buy back under $40. Net premium received on the call risk reversal was $0.315 which brings entry price down to $49.685 and average cost for all holdings to $46.73 (versus latest closing price of $42.98)

Walmart Inc (WMT): US Retail. With closing price of $119.14, 105/95 bear put spread expired out-the-money.

Vanguard FTSE Europe Index Fund ETF (VGK): Europe Index. With closing price of $54.86, 51/49 ratio put spread expired out-the-money. At $54 net premium, the price of dinner for one covers Europe hedging risk.

Income Trades

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. October expiry strike 24 naked put options expire in my favour with price closing at $27.12. Got to love writing naked puts on hedging trades and getting paid for the pleasure of protecting a portfolio.

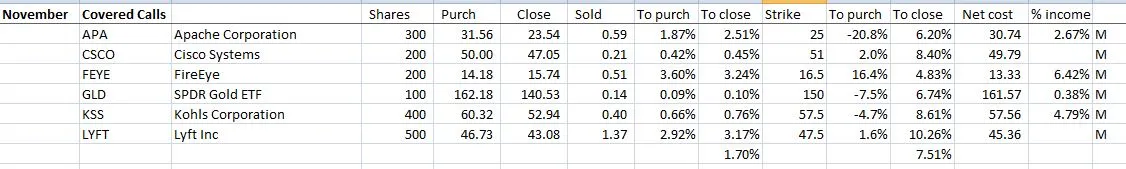

7 covered calls closed with only one assigned (FEYE). Replaced with 6 new covered calls at average premium of 1.70% and 7.51% coverage ratio. I do note that I have written one more call contract on Apache Corproation (APA) than I am holding stock (a naked call for one contract which looks safe enough). Coverage is over 6% at latest close of $23.84.

Cryptocurency

Bitcoin (BTCUSD): Price range for the 23 days to Oct 25 was $1527 (18% of the open). There was a largish drop in that time but the big rise comes after. One trade closed for $162.19 per contract profit (2.03%)

Ethereum (ETHUSD): Price range for the 23 days to Oct 25 was $44 (25% of the open). Two trades closed for $12.56 (7.08%) and $4.30 (2.50%) per contract profit

Ripple (XRPUSD): Price range for the 23 days to Oct 25 was $0.06898 (27% of the open). The low was reached well before the other pairs on Oct 3. One trade closed for $0.011 per contract loss(3.90%)

Currency Trades

Chinese Renmimbi (USDCNH): With US-China trade talks improving closed out 6.7015 strike call options for 145% profit since February 2019. This trade was set up as a hedging trade on stock purchases made on Chinese stocks - they are now unhedged beyond the profit achieved on this trade.

The updated chart shows the exit point just past where the Chinese currency starts strengthening - removing the hedge has worked just fine thus far. Instinct tells me to sell the stocks and bank the profits there too.

Outsourced MAM account Actions to Wealth closed out trades for 3.85% profits for the period = their best trading spell for some time.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

October 2-25, 2019