The yield curve is bothering markets and driving flip flop moves. Gold and silver are the main beneficiaries. A price dump in Bitcoin may be linked to a US court ruling on Craig Wright, so called Faketoshi.

Portfolio News

Market FlipFlop

US market open was lower on recession worries.

The mood during the day changed after I stopped watching - with markets closing marginally higher. The key move is in the way the 10 year US Treasury yield is pushing lower as investors look for duration.

The headlines tell the flip-flop story. Side by side we see the words disaster and less panic. Is some panic a disaster? Maybe it is. Following the Bill Dudley statement yesterday, the Federal Reserve was quick to remind the world that it takes an apolitical view of markets

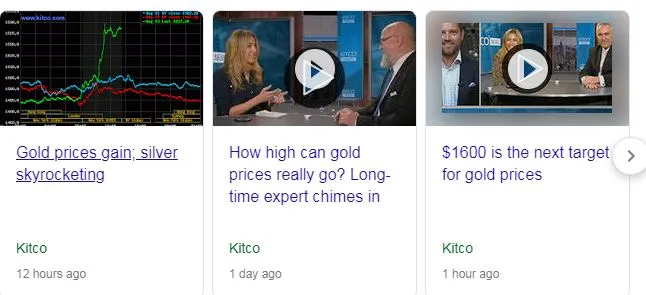

Biggest moves in my portfolios are coming from Gold and especially Silver. In TIB437, I set out the case for Silver closing the gap on Gold. At the time the gap was 18 percentage points. It is now only 13 points - still some way to go. Quick update on the chart shows iShares Silver Trust (SLV - black bars) versus iShares Gold Trust (GLD - yellow line)

Silver has especially rocketed in the first 3 days of this week. The chart also shows one of my bull call spread trades which is now fully in-the-money. Trade management says it is time to redeploy - I might go looking for some silver mines.

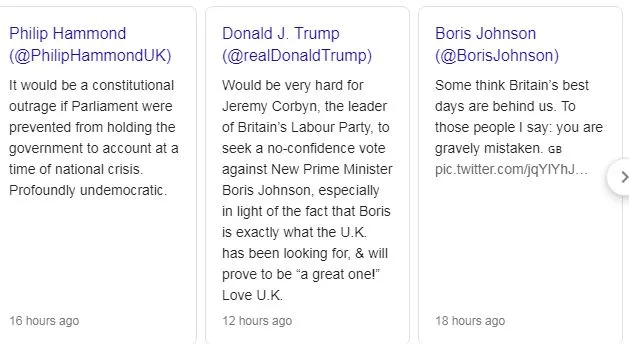

Britain Bumbles

Boris Johnson, UK Prime Minister prorogues UK Parliament and knocks British Pound back toward the lows.

This move is an attempt to avoid a Parliamentary vote on blocking a No Deal exit and/or asking Europe to postpone exit again past October 31. It is not good for markets and certainly could blow up in his face - he is happy to exit with No Deal. The tweets say a lot:

Bitcoin and Faketoshi

The Craig Wright saga continues with a US court ordering him to pay half of his holdings to estate of programmer David Kleiman

It is a saga and almost certainly contributed to a price move even though the amount of Bitcoin (say $5 billion worth) is a small slice of overall market value. The fear is it all arrives on the market in one go - a long way to go before this is resolved.

Note: The Guardian headline above says 18 hours ago. Price move was 8 hours ago. This sort of news normally hits instantly.

Sold

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. Price opened at $30.46 which is well above strike on sold leg of the short term bull call spread I have been holding. Closed out October 2019 23/28 bull call spread for 89% profit since February 2019.

I discussed the trade setup in TIB357. This is what I wrote

My earlier trade still looks possible if price can make it to the top of the range in the next 11 months. The new trade is going to need something a bit more like the blue arrow price scenario to be a winner. But the price target is below the 2016 highs.

The updated chart shows that price did get onto something like the blue arrow price scenario. The earlier trade also hit its maximum (and is off the updated chart as it is closed).

Now there is a trade management question. The original maximum profit target was 164% yet this closed trade only made 89%. There are two drivers. 1. The trade still has 17 months to go to expiry which means that there is time value still left to run. 2. Implied volatility has risen and this especially affects the leg that is closest to in-the-money (i.e., the sold leg). Options pricing suggests holding to expiry. Trade (and risk) management says take the profits and redeploy to another idea.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $725 (7% of the high). Well I did write yesterday that price looked like it was forming a pennant. It did what normally happens = a strong break in the direction of the short term trend - down pushing below the support level at $9554.

I could not help myself and I added a new trade on a one hour reversal (after topping up margin in the account)

Ethereum (ETHUSD): Price range for the day was $22 (12% of the high). I talked about price compressing into a triangle. Well the break came with price following Bitcoin with a strong push down through resistance at $177. This is a short term level - we shall see if price wants to consolidate around it

Ripple (XRPUSD): Price range for the day was $0.023219 (8.6% of the high). Price continued with the push below the triangle to test support right down at 0.24754 with close just below half way down the bar.

CryptoBots

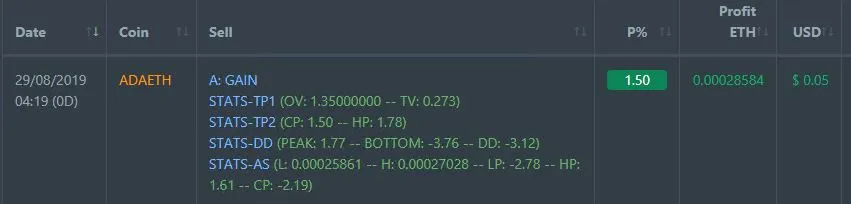

Profit Trailer Bot One closed trade (1.50% profit) bringing the position on the account to 9.68% profit (was 9.67%) (not accounting for open trades).

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 4 trades on GBPUSD for 0.43% losses for the day. Trades open on USDJPY (0.22% negative). I have again written to the outsourcer asking them to stop trading GBP until Brexit is resolved.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Tweets come from Twitter.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

August 28, 2019