Hello everyone !

My first priority in life for the last few years has been to find a way to live independantly and not be chained to a desk at some company working a job that I am not passionate about.

I first discovered Bitcoin on some libertarian forums when it was under 1$, but as I was more in the gold-backed currency camp back then I unfortunately did not invest anything and forgot all about it for several years.

This is how I feel about that decision today :

Mid-2017 I saw in a news article that BTC had hit 2K, and finally started to invest in cryptocurrencies.

When the bear market hit us in early 2018, I switched from HODLing to more actively trading, and have been working on improving my skills ever since.

About 7 months ago, I quit my job to trade cryptocurrencies full time.

Looking through the main tags on Steemit, I quickly felt at home and have decided to share my current thoughts on the market with the community.

I trade BTC/USD on Bitmex as well as the Alt/BTC ratios on Binance.

I rely mostly on horizontal and diagonal trendlines, as well as fractals, volume, moving averages and BolingerBands.

For my introduceyourself Post I thought I'd share a post from the r/BitcoinMarkets subreddit that I made back in mid-April, as it sums up my current broader view of the cryptocurrency markets :

☼☼☼☼☼

I think it is more likely we'll be above 7-8K than below 5K by the end of the year.

A few reasons that make me lean this way :

Bakkt, a possible ETF and other news of that kind that are on the horizon provide all of the narratives people need to allow their FOMO to run rampant again

I think the market has already shown that it is hyped for the LTC halvening in August (LTC lead a couple of rallies this year and already did a 4x from the lows)

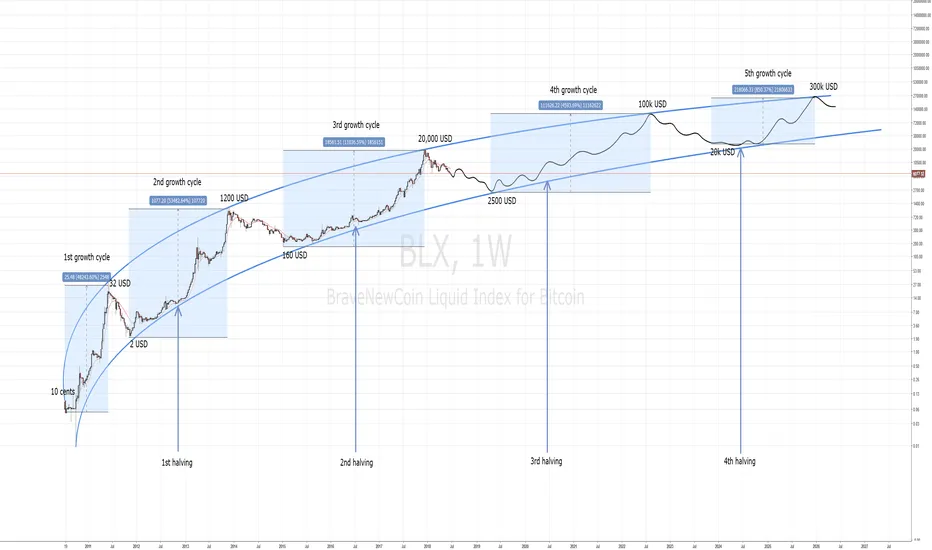

The BTC halvening coming up in June 2020

The convincing break of the 200 Daily MA on BTC

https://www.tradingview.com/x/zr4OnetB/The volume on the total crypto market cap is higher than it was in December 2017

https://www.tradingview.com/x/EWqu5MlN/

The volume on this chart is from CoinMarketCap, so it includes alot of exchange that fake their volume.

However, relevant to me is the comparison, so unless there is way more fakery going on today than there was in December 2017 I still see this as a very relevant indicator.

Since early March the smaller Alts have been breaking all kinds of trendlines on (legit) ATH Volume on Binance

The general public has for the most part completly written off crypto. Even my friends who are very much into crypto are sleeping on them after the initial pain since we broke down from 6K. Historicaly, this has been the case in post-bottoming periods.

A comparison with the last bear market, which I have been looking at since the middle of last year :

https://www.tradingview.com/x/tjdaleho/

Fractals have served me well throughout the bear market, which is why I place alot of value into this kind of comparison.

Most notably, we broke through the trendline of death (the red and pink lines) that acted as resistance throughout the whole bear market. The last bear market also ended when this trendline was broken as can be seen in the above chart.

Assuming that I am correct, the interesting question now is which one of the green circles we currently are in in comparison to the last bear market from the above chart.

=> If the first one we could still have a retrace below 4K (though not making a lower low) before the true bounce that ignites the bullrun happens.

=> If the second one we could still pump to anywhere between 6-8k before having the for some much awaited significant retrace, painting a lower low arround 5-6K.

=> If I am wrong and we did have one more leg down below 3K, BTC and Alts even more so would be at such ridiculous levels (<80$ ETH ?! <25$ LTC ?! <40$ XMR ?!) that I'd be very happy for that opportunity to fill my bags further, but for the first time since early 2018 I am more convinced that we've bottomed (~70%) than not.

A big confirmation of my thinking would be breaking through the heavy resistance in the 6-7K range, as well as seeing a big increase in volume on BTC on the ''clean'' exchanges.

I am currently 85% back into crypto (with my HODL stack) and will put in the last part when we convincingly break 6.8K or in case I am wrong and we do make a lower low.

Good luck to my fellow veterans out there, I think we've made it through the war !

☼☼☼☼☼

In my next few posts I will be giving a more short-term analysis of the market and how I am currently trading it.

I thank you very much for your attention and would be delighted to receive your feedback !

DISCLAIMER : This is not investment advice and should not be traded upon. It is merely my intent to bring to the attention of people data that they might not have looked at before, so that they can interpret it for themselves and make their own decisions.

Do not be this guy :