Nexo to Accept Binance Coin (BNB) as Collateral for Instant Crypto-backed Loans

Starting July 1, 2018, Binance’s own BNB coin will be accepted on the Nexo platform as collateral for instant crypto-backed loans, a move highly appreciated by Binance CEO CZ.

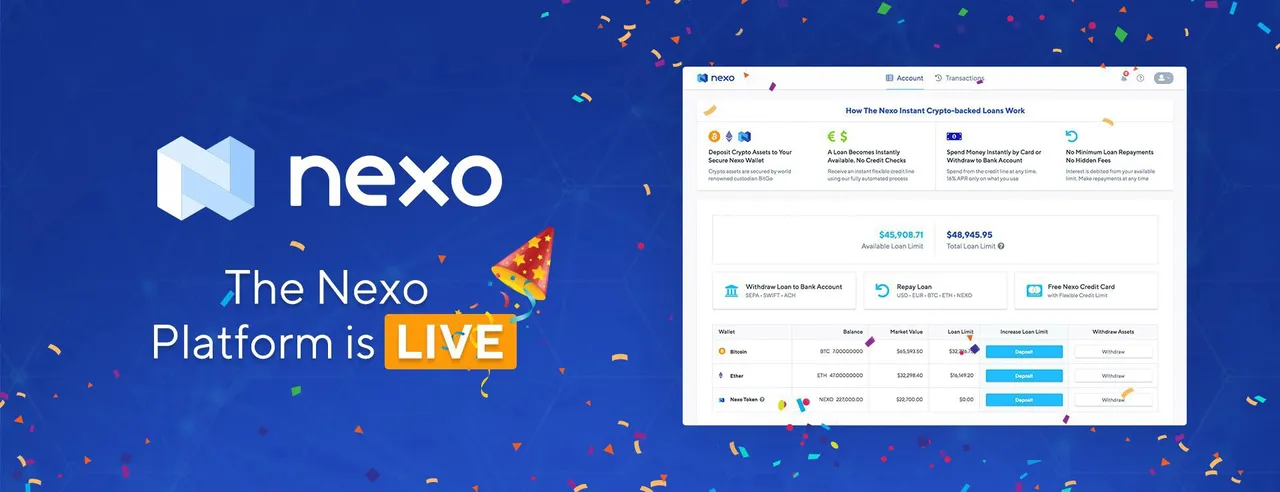

Instant Crypto-backed Loans up to $200,000 in USD, EUR, Tether (USDT)

Аlmost all Nexo accounts are already eligible to receive loans in EUR to an European bank account. If you are a…

medium.com

A poll during the Nexo token sale indicated that the world’s largest crypto exchange Binance is the preferred destination for crypto investing. In addition, there is a considerable overlap between Binance and Nexo’s customer base. Listening to our community is of great importance to us and going forward we will continue to shape Nexo to that accord. The Nexo Team has therefore decided to add value to both platforms by giving BNB coin holders the ability to access instant cash against their asset while retaining the upside potential of their BNB coins. We are thus giving further utility to Binance’s native cryptocurrency and expanding the variety of collateral options on the Nexo platform ahead of schedule.

The BNB Coin and the NEXO Dividend Token bear similarities in certain perspectives. A look at the historic performance of Binance’s coin shows that it significantly outperforms risk-on assets like Bitcoin and Ether when markets are in correction modes. This quality solidifies its status as a safe haven due to the stability and profitability of the Binance business model, all the while performing exceptionally well in bull runs as well. NEXO Tokens are asset-backed and pay out 30% from the company’s profit as passive income in the form of dividends, and are also regarded as a safe haven by the crypto community. Both Binance and Nexo have strong business cases, teams with over 10 years of experience and expertise in their respective domains. Those have resulted in platforms delivering ultimate user experiences in terms of functionality and efficiency.

Applications to be Accepted on Nexo

Nexo will continue to expand the range of crypto assets that are accepted as collateral for the world’s first instant crypto-backed loans. More than 26 companies have already submitted applications for their tokens to be added on the Nexo platform. And they have significant incentives to do so. Allowing their respective token holders to borrow against their coins rather then disposing of them, lifts the selling pressure off exchanges, provides additional utility to tokens and further ensures real-life application of digital assets, which is something of huge importance to the crypto community as a whole.

Do check out our earlier blog posts, share them with your friends and let them too be part of the Nexo success story!

Instant Crypto-backed Loans up to $200,000 in USD, EUR, Tether (USDT)

All Nexo accounts are already eligible to receive instant loans in EUR to a European bank account. If you are a non-European client, you might consider services like Revolut or TransferWise Borderless that offer a free EUR account from where you can conveniently send your Nexo loan to your local bank account in almost any country and currency.

Due to high demand for USD fiat loans by SWIFT and ACH, we are processing the requests of the earliest Nexo supporters with priority. If the option is not active on your account, you are currently on the waiting list for USD fiat loans. In the meantime, all Nexo clients can withdraw instant USD loans using Tether (USDT), which is a convenient intermediary step for those on the waiting list. It allows them to exchange Tether (USDT) for a cryptocurrency of their choosing, to be exchanged into USD or another fiat local currency that is most convenient for them on exchanges that offer fiat withdrawals like Coinbase/GDAX, Kraken, Bitstamp, itBit, Gemini, etc.

Nexo is constantly working on improving the product and meeting the tremendous demand for our crypto-backed loans by securing additional financing.

We are happy to announce that we are increasing the maximum credit limits to $200,000 from $100,000 per client. In individual cases, Nexo can extend custom limits of up to $2,000,000.

The minimum loan amount is $1,000.

Please contact Nexo Support for additional information.

Accounts on the USD Waiting List

We value your business and work vigorously to meet the overwhelming demand for Nexo’s USD crypto-backed loans. You certainly will appreciate the fact that early Nexo supporters have priority. These are the Nexo investors, our advisors and the influencers that helped us with product development, getting the message across and reaching our funding goal.

If you would like to expedite the process and receive your USD fiat loan sooner, please make sure you complete all of these:

- Complete basic and advanced verification on the Nexo platform;

- Enable two-step authentication to secure your account;

- Use your unique invitation link located at the bottom of the Account page and motivate your friends, colleagues and family to register on the Nexo platform;

Note: Clients with 5000 or more NEXO Tokens in their Nexo Wallets will be given priority.

In the weeks to come we are rolling out all currencies to all Nexo clients.