AMD (AMD) has been receiving a lot of attention lately as its stock price has grown from nearly $2 per share last year to $14.04 as of writing this, thanks in large part to the introduction of AMD’s new high-end processors in March, the Ryzen chips. While all the buzz seems to center on AMD’s underlying financials and their capability to expand their total available market, not much has been said on how Intel (INTC) could affect AMD’s price, since Intel is their only real competitor in the processor space.

I argue that specific decisions in Intel’s short- and long-term business model, along with realities in the future of semiconductor development, will render Intel’s stake in the PC CPU market vulnerable to competition from AMD over the next three or four years. AMD is the better buy not only because of the inroads it has made this year in the high-end CPU market, but also because the juggernaut in the field, Intel, desires to navigate away from the processor space.

Intel is focusing its resources on expanding into growth markets while downsizing and streamlining its processor business. This is not a well-guarded secret; the CEO of Intel, Brian Krzanich, has written that the company’s “...strategy itself is about transforming Intel from a PC company to a company that powers the cloud and billions of smart, connected computing devices.” At the 2017 Consumer Electronics Show, he pressed that a shift from PC computing to server computing was necessary to maintain a growth strategy for the company. Intel has resigned themselves to the fact that the PC market is not their future, and their financials reflect that.

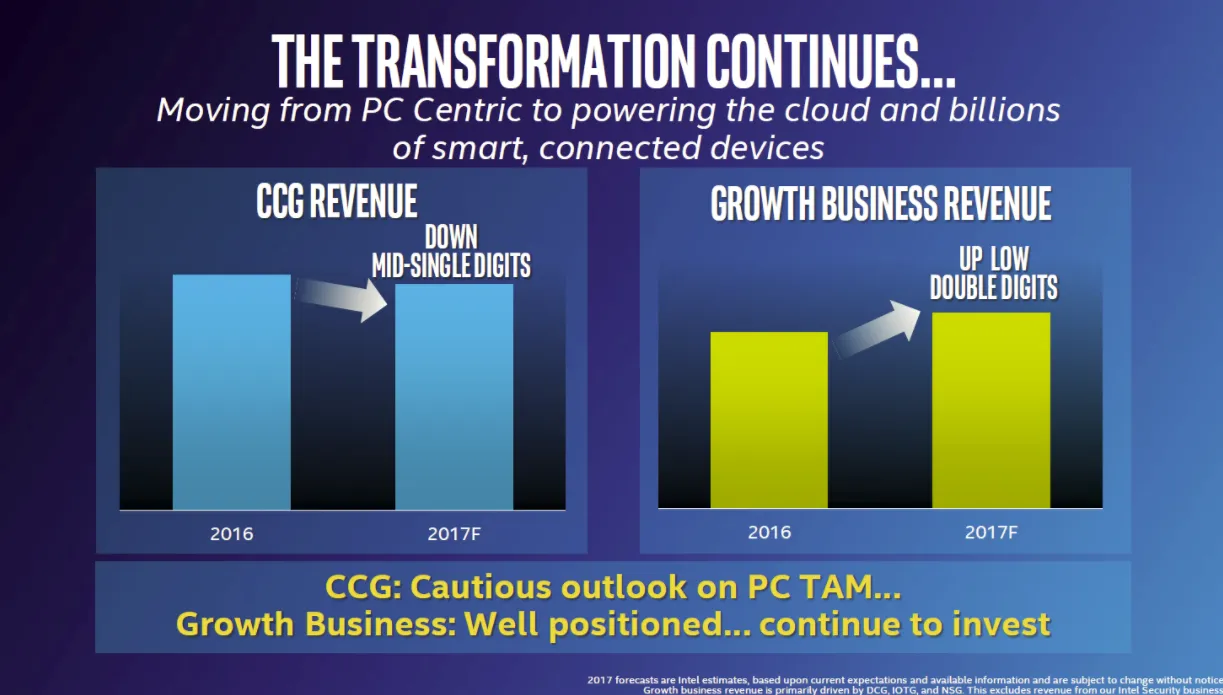

As seen in the figure below, which was taken from Intel’s 2017 Investor’s Report, Intel predicts that the Client Computing Group (CCG) will see a decline in revenue of between 5% and 7% from last year, while the batch of markets they consider “growth business” will see a jump in revenue in the low double digits.

In 2015 and 2016, Intel’s CCG revenues were increasing rapidly even while total PC sales were in decline. Over that two year period, PC sales suffered a 14% decline thanks in large part to the unpopularity of Windows 10, but Intel’s CCG revenue increased by 2% over the same period. Now, Intel is not only wary of the decline in total units sold, but it also projects that it can no longer inflate prices to offset that decline. Given these revenue and sales conditions, the CCG is a very poor growth tool for the company. That sentiment is reinforced by Intel’s projection that their PC CPU TAM is already mostly addressed and does not have the capacity to expand.

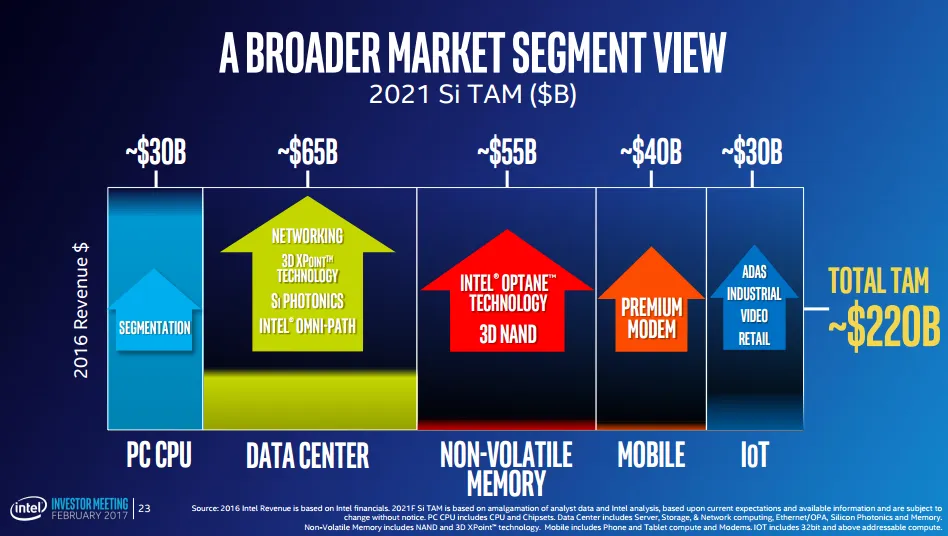

In contrast, Intel believes the TAM of their growth sectors are largely untapped and comprise a total of $190 billion. In order to address the decline in both CPU revenue and units sold, Intel plans to reduce the operating costs of their CCG. This way, Intel’s operating margin may improve, even while revenue declines. As a bonus, those extra funds could be reinvested in growth markets. The image below describes how funds from restructuring the CCG will be funneled into growth businesses.

So far, CCG restructuring has delivered some good numbers; in Q1 2017, operating profit rose from $1.86 bln to $3.03 bln, fueling a quarterly increase of 41% and a year-over-year increase of 60%. The cause for this tremendous increase is multifaceted; however, one major reason is that many of the CCG’s operating costs have been redistributed to the DCG, since they both share a lot of common technology. This is why Intel as a whole has only experienced a net income year-over-year increase of only 30%.

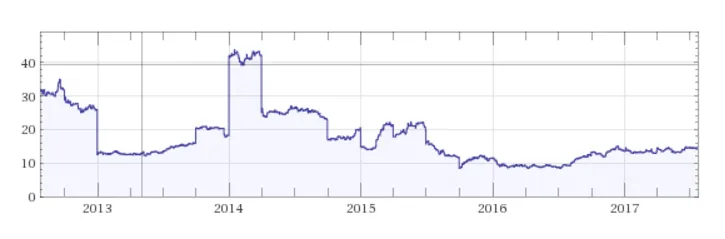

It is important to remember that Intel’s TAM projections above are for 2021, and that the majority of revenue (55.4% in 2016) still comes from Intel’s CCG. This means that for the next few years, vulnerabilities from a weak position in the processor space will translate to a measurable decline in Intel’s revenue. Indeed, in the short run, Intel could find its stock price in jeopardy as AMD begins to carve out its space in the high-end processor market. Below is a graph which plots Intel’s P/E ratio over the last five years:

Intel’s P/E ratio has remained noticeably flat since Q2 of 2015, even as Intel experienced a rise in revenue from $55 billion in 2014 to almost 60 billion in 2016. It can be implied that for Intel, stock price moves tightly with revenue. In 2016, the CCG drove $32.9 billion, or 55.4%, of Intel’s revenue. If AMD can snag just 3% of that revenue with their competing Ryzen and Threadbuster chips, that’s $970 million lost from CCG’s revenue, which could translate directly to stock price. These numbers are quite reasonable as well; as seen in the image below, AMD’s computer and graphics division has reported a $200 million jump in revenue from Q2 2016 to Q2 2017, and AMD estimates its TAM in the PC space at $28 billion, only $2 billion off from Intel’s estimated CCG TAM.

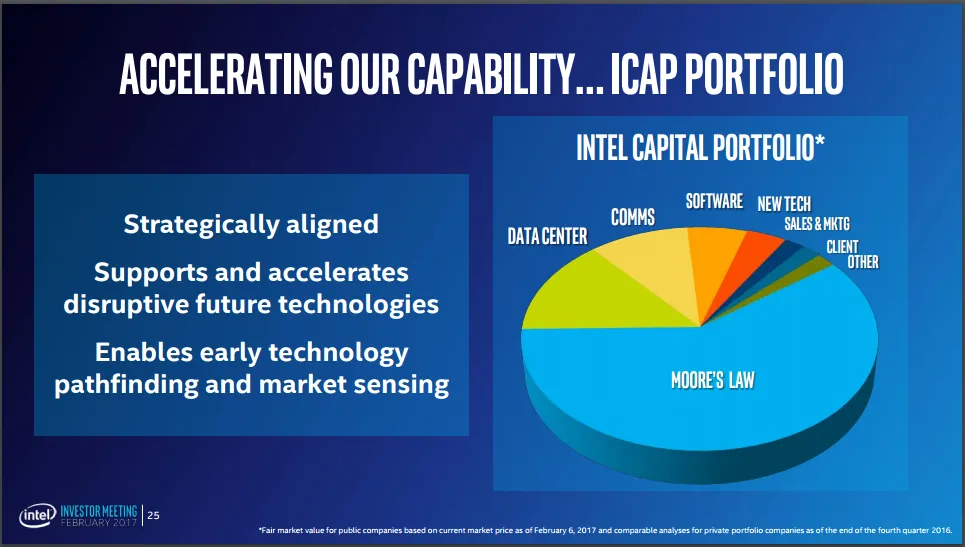

Intel also seems to believe that advancing their manufacturing process will render the same results as it has in the past. As seen in the image below, Moore’s Law takes the lion’s share of Intel’s capital portfolio. This falls in line with the Intel’s CPU strategy outlined by Krzanich, who writes that “Moore’s Law has driven the products delivering massive computing power growth and increasingly better economics and pricing… Intel’s industry leadership of Moore’s Law remains intact, and you will see continued investment in capacity and R&D to ensure so.”

Krzanich has faith that Moore’s law will allow the company to continue remaining two or three manufacturing generations ahead of their competition. Unfortunately, process size has deviated from the trajectory implied by Moore’s law since around 2014.

The reduced potential of Moore’s Law diminishes the manufacturing advantages which Intel has enjoyed over its competitors. Assuming that Intel even could follow the rigorous schedule they have set for themselves, which projects a release of their 7 nm technology by 2020 and 5 nm technology by 2022, the unfortunate reality is that smaller transistors are contributing less and less to faster processors. In brief, transistors are becoming small enough that many of the materials within them have been shrunk to a thickness of one molecular unit; that puts an upper bound on the speed benefits derived from them.

There is evidence as well that without regular updates to the manufacturing process, Intel struggles to stand on architecture updates and new features alone to win over their target consumers. Intel’s Kaby Lake processors that came out earlier this year were the third generation that used the 14 nm process, and they were panned for their marginal improvements over the previous generation Sky Lake and Broadwell processors. The lackluster improvements which Kaby Lake brought to the table demonstrate that Intel may be unprepared to improve microarchitecture in ways that stimulate new market interest.

Already, the limited development in Intel’s architecture and features has allowed AMD to enter as a viable alternative. One need look no further than the video game industry, where both Xbox and Sony have both decided to house semi-custom AMD Jaguar processors within their flagship consoles. The reason why AMD holds an edge over Intel in this market comes down to a particular feature of the AMD CPU – Free-Sync. Free-Sync technology removes a bottleneck on the performance of video games by providing developers with greater freedom in how they design process-intensive parts of their games. AMD is able to design features which cater to a specific market, a quality which holds more and more relevance in the success of processor models.

I think Intel’s business strategy, as well as its continued investment in Moore’s Law, give credence to AMD’s efforts to enter the high-end processor space. Intel also stands to lose CCG revenue to AMD as it transitions from a PC CPU company to one invested in many growth sectors. These facts make AMD the preferred company to invest in to capture growth in the processor market.