Week 43 - Oct 25 Investment Moves

- Current US Markets at 12:30 pm (EST)

- Oct 25 Investment moves - as of noon (EST)

- Visa Iron Condor Explained (3.33% in a month)

- 2024 Roth IRA.

Current US Markets at 12:30 pm (EST)

The markets are still moving up after #TESLA added some confidence since beating earnings. This could be a good sign for the "MAG 7". I'm not too worried about the markets, as I adjust my RISK based on what is happening. My goal is to make money in all market conditions.

Read what I did today and how #Visa made me money in the last month.

Oct 25 Investment moves - as of noon (EST)

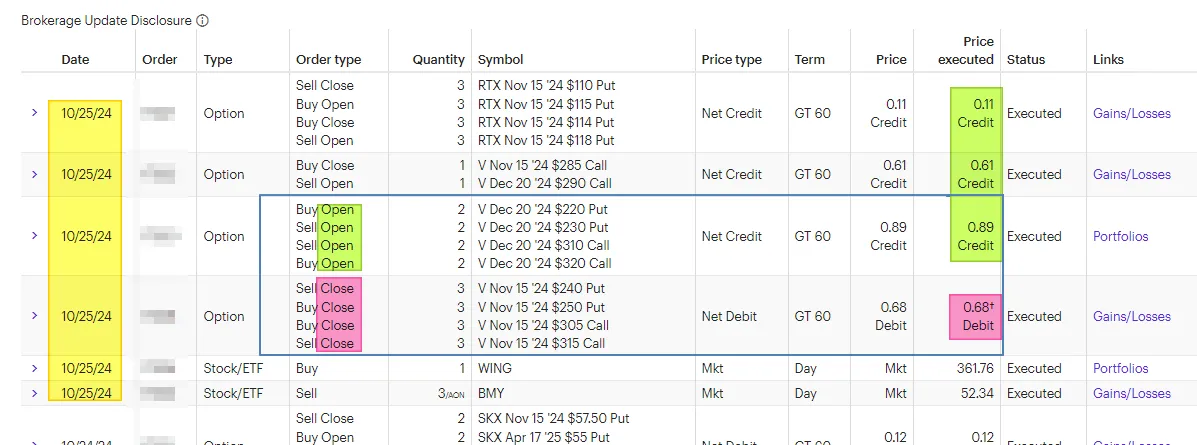

Here are my moves so far today:

Summary of #option and #stock trades

- Rolled the Put Credit Spread up for more risk and collected $11 for each contract.

- Rolled Visa Covered call up and out for $61 cash premium. Up strike price by $5 (in my favor).

- Closed Visa Iron Condor (Nov 15). Time Decay did its magic and this is a profitable trade.

- Open Visa iron Condor (Dec 20). Only using 2 contracts. Visa moves lots in Nov/Dec. $89 premium each.

- Sold 3 shares of #BMY. Reducing boring dividend position a week before dividends payout (Paired with WING).

- Buy 1 share of #WING at $361 (Paired with BMY). Adding more growth to my portfolio over time.

Visa Iron Condor Explained (3.33% in a month)

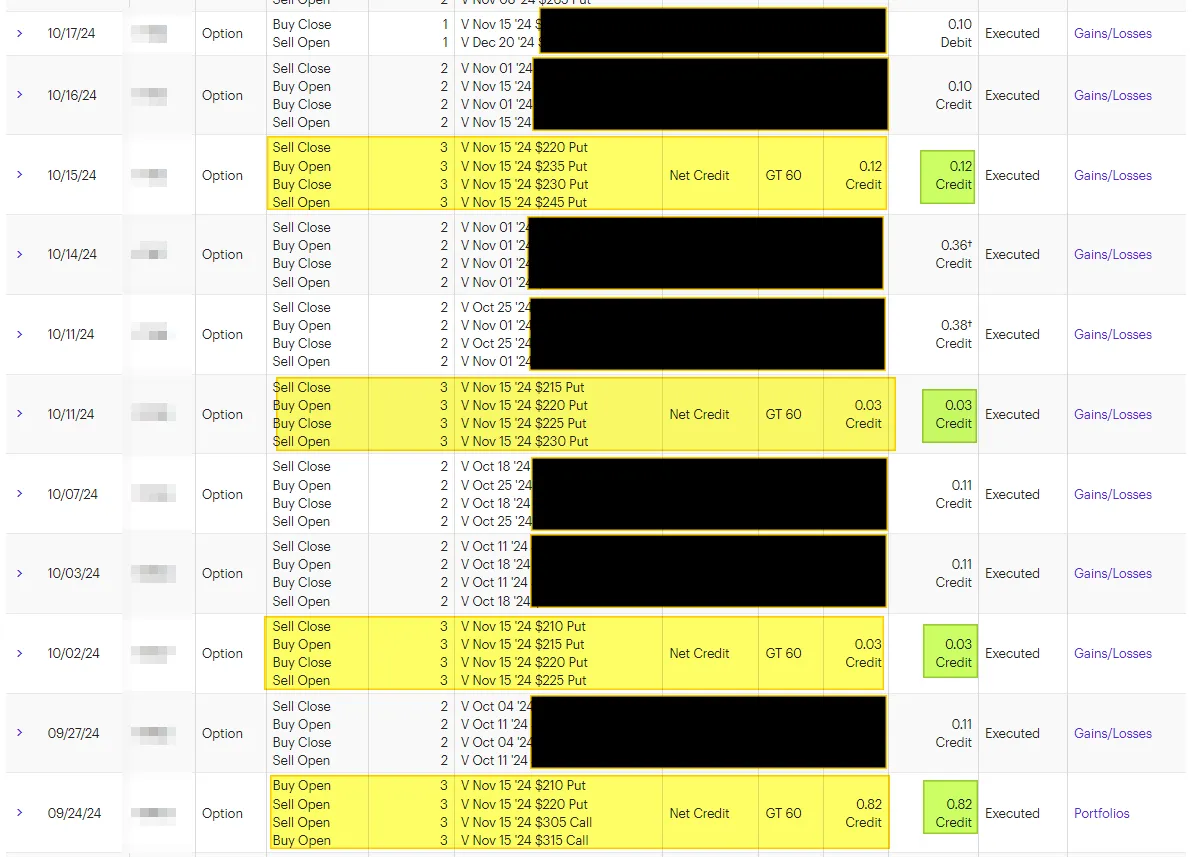

I will show you my Visa Trade history. Only follow the yellow box for the Nov 15 Iron Condor. The other visas are part of a different method/trade (not an Iron Condor).

- Open Visa IC on 9/24 for $82 each premium

- Rolled on 10/2 for $3 each

- Rolled on 10/11 for $3 each

- Rolled on 10/15 for $12 each

- Rolled on 10/17 for $4 each (not shown in screen capture).

- Closed on 10/25 for $68 each.

Net of $0.36 each (or about $108).

Minus the option trading fees, it's about $100 profit for 31 days.

That means it is $100 profit using $3000 capital for the used for the Iron Condor.

That is 3.33% in 31 days (or a month). If you can do this 8 more times a year, that would be over 25% annualized return.

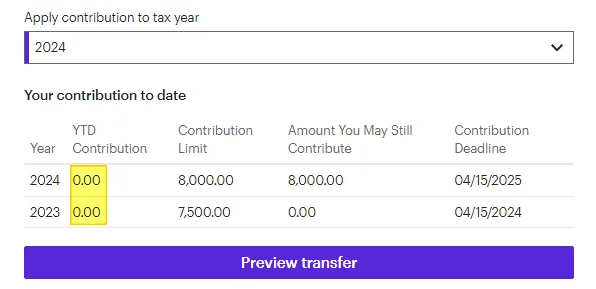

2024 Roth IRA.

I have not contributed to my ROTH IRA in over a decade. However, I believe I see plenty of market opportunities and I decided to add some new capital (CASH) to my ROTH IRA account. I will reduce some of my cash allocation from the 401K and use that cash for this ROTH IRA.

Can't wait to see if I'm right on this move.

Have a profitable day!