The majors and the smaller coins are still mostly in a corrective phase after the late-spring spectacular rally that was led by Ethereum, but also boosted by Bitcoins relentless rise to all-time highs. The several 100% moves needed to be corrected, and as we wrote two weeks ago in our previous long-term outlook on Bitcoin:

“Is this the best time to buy Bitcoin for the long run? Probably not, even if the fundamentals are there, and it will most likely rise much further than the current levels. So, why it is not a good idea to buy it? Because, a 30%-40%-50% correction, that has been normal for Bitcoin in the past, is a huge psychological burden that makes a panic sale likely, usually just before the bottom. Because of this, it is better to wait for the correction and oversold readings, even if you will buy it at a higher price later on.”

Since then we had a swift 30% correction in the majors that gave a good buying opportunity to investors, but the quick snapback rally meant that the overbought readings haven’t cleared on the charts of BTC and ETH. Ripple and LTC were in a different phase two weeks ago, and Litecoin proved its strength as we expected by a break-out. Ripple attempted a move but so far it was held back by overhead resistance.

Bitcoin

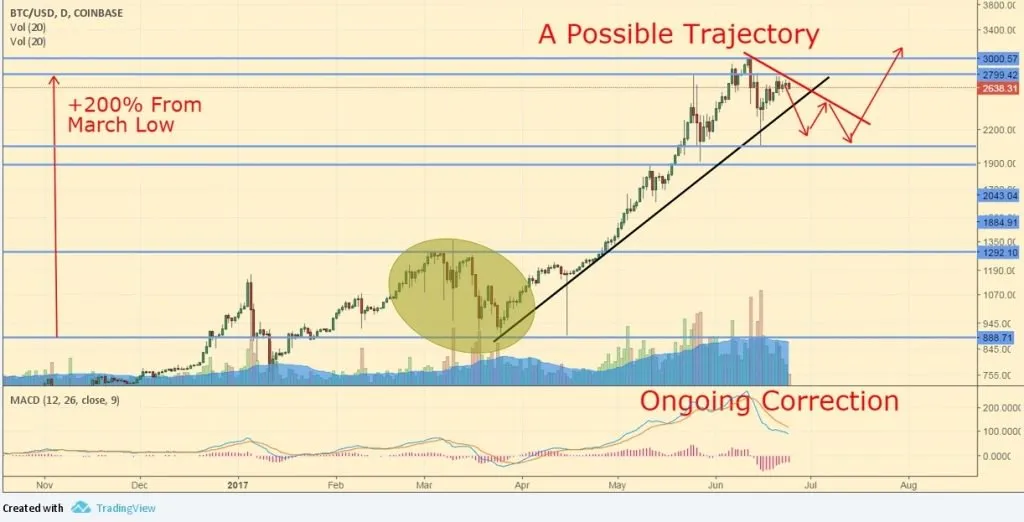

Daily Chart of BTC/USD

Bitcoin has cleared a part of its overbought state since hitting a high near $3000, but usually, BTC corrects in a more complex way after a huge rally, as you can see with the example of the March correction (we noted a possible trajectory for the correction). We expect more corrective action in the coming period that might provide more great buying opportunities for long-term investors. We still think that short-term BTC is vulnerable, and a re-test of the previous short-term low is possible. A move about $2800, on the other hand, would trigger a new buy signal.

Ethereum

Daily Chart of ETH/USD

ETH is still in a similar technical position to Bitcoin, being in a clear corrective phase after the monster rally. We expect more consolidation in the coming period, with a possible move back to the $250-$270 range that supported the coin during the previous move lower. ETH is still well inside the strongly rising trend, which converges with the support range in about a week, providing an ideal target for the correction.

Litecoin

Daily Chart of LTC/USD

We wrote two weeks ago that:

Litecoin’s chart is looking promising from a long-term perspective, as LTC is after a lengthy and deep (-55%, after 1000% of gains in 5 weeks) correction, while several signs point to a bullish turning point. (…)While it is entirely possible that LTC will consolidate more if Bitcoin enters a correction, it will likely outperform both BTC and ETH in the coming weeks.

The chart now is out of the buy-zone as the MACD is already overbought, but the break-out move is still intact, and another move higher, possibly towards the range-extension target at $60, is in the cards, new positions are riskier here than previously. The long-term rising trend is intact and we advise investors to hold on to their core positions.

Ripple

Daily Chart of XRP/USD

Ripple has lagged Litecoin and failed to produce a sustained break-out so far after its lengthy consolidation period. The MACD indicator is still in neutral territory, but it hasn’t given a clear long-term buy signal yet. Long-term investors could still add to their existing XRP positions here, while short-term traders could try to buy the break-out attempts, as they provide a good profit/risk ratio thanks to the long-term picture.

How to Use These Charts?

As we stressed in our article on Bitcoin: “…not all strategies are binary (either holding an asset or not).There are many long- and short-term investment and trading strategies that can be successful in a roaring bull market like the one that the crypto-coin segment is experiencing, but mixing the time-frames and mixing trading and investing (see our article on the topic) could lead to troubles.”

Here are some of the possible strategies once again:

- Buy and hold, without caring about day-to-day (or even month-month) fluctuations

- Buy and hold a core position and add on the major dips; a very powerful strategy

- Buy a certain amount every week or month, and even-out your entry price, without the hassle of timing the market

- Try to catch major turning points to reduce and “re-boost” your position

- Trade short-term movements with stop-losses, targets, and strict risk management (this is trading not investing)”