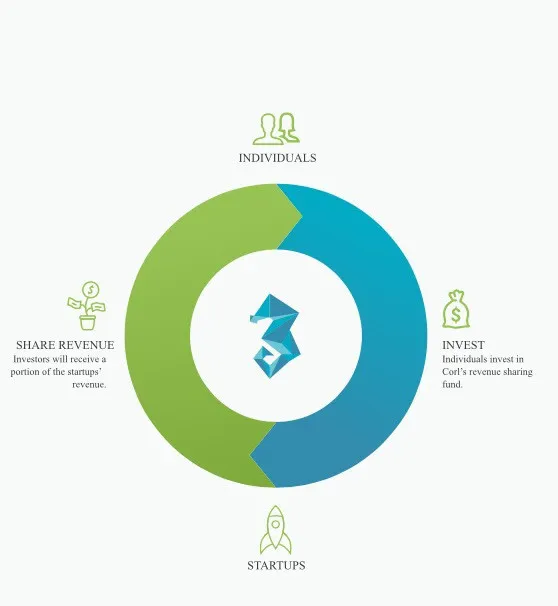

In today’s fast-changing world where startups especially in the United States, With fewer than 50 employees are constantly faced with the herculean task of raising capital to push through with their innovations. Corl steps in to reinvent the wheel by bridging the divide between investors and startups.The location(s) of startups is no longer an issue; Meaning startups can be anywhere, Silicon Valley (USA) or Bangalore (India), or even in Seoul (South Korea) and prospective investors can be resident anywhere on the globe. Corl seeks to “sidestep” traditional methods of fundraising which is fraught with restrictive regulations, fragmented, easily manipulated and mostly inaccessible to most investors by utilizing the power of the blockchain to issue tokens representing equity ownership in a company, providing funding to firms or companies with high potentials based on a profit sharing model.

Corl: “ Under The Microscope”

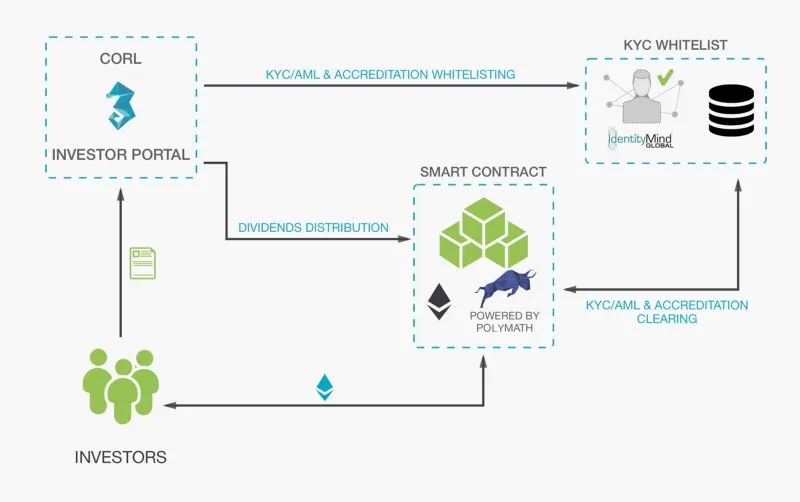

Corl seeks to provide funding and capital to high potential revenue startups and companies. A platform where firms can access capital in a secure and streamlined way. Corl plans to launch the first regulated securities token on the blockchain, by harnessing the power of the blockchain to power the growth of emerging companies via a revenue-sharing model with 100% equity ownership in a company, tokenized dividends “Ethereum (ETH)” and a KYC compliant system.

To simply put, imagine enjoying the success of a company in Silicon Valley but you live in Kuala Lumpur or Sub Saharan Africa. Basically, think Amazon, Brandbucket or maybe Envato as startups springing out of Silicon Valley, all with one problem “funding” and Corl steps in as the middleman to bridge the gap. Corl utilizes the funds supplied by you to help these startups that meet its financial standards(high potentials). Meanwhile you the investor would be made to go through KYC and AML. Thus harnessing the power of the blockchain to bring investors and startups closer. Corl sets the precedence by introducing crowdfunding and revenue sharing on the blockchain.

Corl Token Update

Please be aware that at the time of dropping this article, the sales of the Corl token has been postponed until the summer. This is to allow Corl set modalities on the ground more to serve you more effectively. please kindly disregard message(s) of Corl sales right now. if in doubt please send a mail to Hello@corl.io

Team :

Chief executive officer

Sam Kawtharani

10 years in product development, strategy, and lending. Previous Head of Product at IOU financial (Startup to IPO- TSX: IOU). Contributed to 500 million in small business originations. Current advisor at Lend mart and Fundica. Holds a Master's degree in Quality Systems Engineering from Concordia University

Chief revenue officer

William R. Tharp

35 years in investment banking, corporate finance, asset management, and venture capital. Previous CEO at Grenville Strategic Royalty Corp (TSXV: GRC), with senior roles at HSBC (LON: HSBA) and CIBC (TSX: CM), Closed 100+ deals valued at $1+ Billion. Current Board member at 6 Asset Management firms and investee companies.

Chief investment officer

Derek Manuge

And a host of other capable hands on the advisory board.

Corl's partnership with polymath would enable it standout not just based on revenue sharing on the blockchain but with another added layer of security.

Website- https://corl.io

Twitter- https://Www.twitter.com/getcorl

Telegram- https://t.me/corltoken

Reddit- https://www.reddit.com/r/Corl/

Facebook- https://www.facebook.com/getcorl

Bitcointalk- https://bitcointalk.org/index.php?topic=2876801.0