As anyone who has ever spoken to me about crypto will tell you, I LOVE DIVIDEND COINS. I think these are the best coins in the blockchain sphere. The benefit of holding these coins are a double win; not only do you get revenue generating rewards for holding, investors don't want to sell which make the coin a better speculative hold.

I recently invested in TaaS fund (Token as a Service) just before their quarterly dividend payout and was over the moon to find my 530 tokens has earnt me 0.75 ETH, just for holding (https://etherscan.io/address/0x1c1398329e6b788a85eb36a3c66836ea45654df8#internaltx). I then did what any dividend obsessed investor would do and invested that 0.75 ETH in another revenue sharing crypto called Coss.io (ICO currently running).

While rummaging through ICOs in the last couple of days I found another dividend coin which sparked my interest, called Magos (http://magos.io/)

What is Magos?

Magos in its most simple explanation, is a fund which uses AI software in combination with the investment pool, to place strategic forecasts into prediction markets and sportsbooks. The data models produced so far have been very successful, outperforming the crowd with a 27.09% ROI.

Digging Deeper Into Magos:

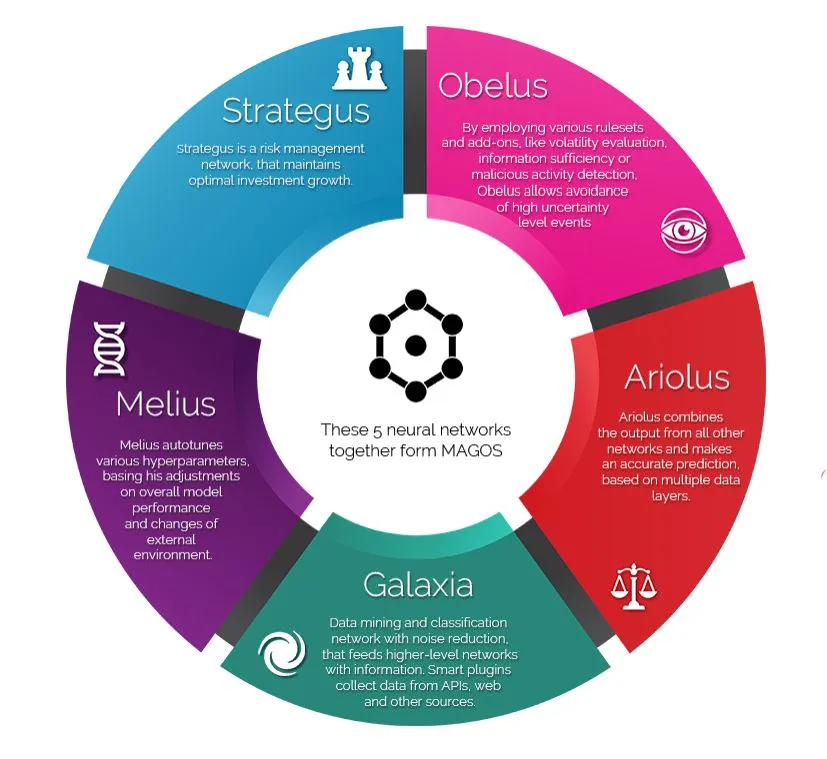

Behind the scenes of the Magos AI are a collective of five neural networks which collaborate on big data pulls and AI learning to gauge the best possible forecasts:

Melius – network that auto-tunes various hyperparameters, basing adjustments on overall MAGOS performance and changes of external environment

Ariolus – network that combines the output from all other networks and makes an accurate prediction, based on multiple data layers

Galaxia – data mining and classification network with noise reduction. It feeds information to higher-level networks. Smart plugins collect data from APIs, web and other sources

Obelus – network that employs various rulesets and add-ons, such as volatility evaluation, information sufficiency or malicious activity detection, allowing avoidance of high uncertainty level events

Strategus – risk-management network that maintains optimal investment growth.

My Favourite Part - The Dividend Yielding Model:

Magos has a great dividend yielding model, not only does the fund payout monthly (instead of quarterly), It gives back 85% of earning to the holders, while keeping 10% to reinvest into the fund. The dev team have also been graceful with the fees, only docking 5%

About The Token:

The token behind Magos has the ticker MAG which is a ERC20 Token (Ethereum) that enables the distribution of monthly profits via ETH smart contracts. The token count is of a more slender number (which I can appreciate) hitting to a total supply of 50million with no more to be minted.

Roadmap:

The Magos project has been in the pipeline for some time with the initial idea born in late 2014. Since then the Magos software has gone through prototyping, alpha testing and has been put into trials runs in e-sport forcasting. The team will be ready to hit the road running in October with the fund beginning operations with the first monthly dividend round coming as quickly as November.

Magos Bluepaper Location:

http://magos.io/bluepaper.pdf

Magos Team:

The Magos team have a diverse background in financial advisory roles, data science, data engineering, sports statistics and Solidity development.

Conclusion:

Like most of the coins I post, I’m keen of this offering and hope to participate in the ICO on August 16th, 20:00 UTC, I just require a game plan to get some money together :P

[Disclaimer: please do you own due diligence when investing and don’t solely take my point of view as the only angle. I highly recommend everybody dig through the projects bitcointalk, reddit and team linkedin profiles to help formulate your own opinion – I thank you so much for reading and wish you successful dividend returns]

Ryan

Twitter: @CryptoDividends

Crypto Dividends focuses on the niche blockchain business models that generate passive income without the need to sell or speculate.