ICO Credito Network : THE FUTURE OF CREDIT

ICO Credito Network — https://credito.io/

Credito is building a Credit Intelligence Network for the credit industry to prevent Credit Risk by identifying fraudulent transactions as they happen, allowing the industry to take well informed decisions. Although financial institutions are normally known as one of the most strictly regulated sectors, they are still a target for fraudsters. The consequences of fraud are not insignificant, resulting in financial distress for both banks and customers. While the financial institutions are active in the quest to identify fraud and reduce costs of fraud, they still lack a true global intelligence of all known frauds and compromises.

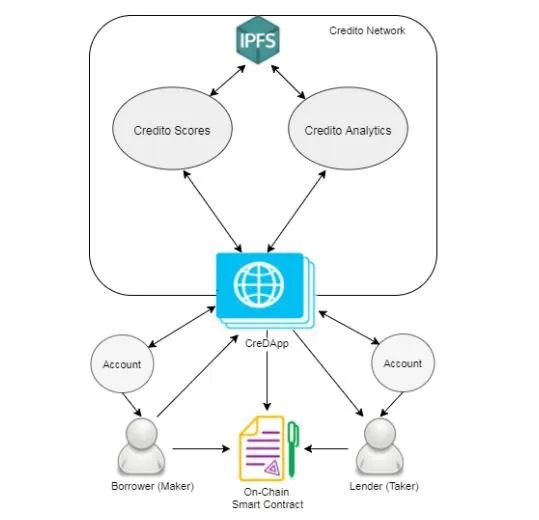

Credito is introducing a decentralized collateralized lending marketplace and enables connections between lenders and borrowers located anywhere in the world. This removes physical constraints and reduces the traditional lending costs and management fees, thus creating a better credit marketplace than anything available today.

Decentralization provides more security and trust. It is a method to organise anything in a way that does not require trust on third parties. The trust is eliminated by executing code that does not require centralized governance, management, or servers. By decentralizing lending, we do not require banks or any other intermediaries for conducting a loan transaction.

Decentralization through the use of Smart Contracts also removes any trust requirement between borrowers and lenders, providing a trustless and transparent lending environment unavailable in today’s market.

Smart Contracts achieve this through their pre-defined parameters removing the need for trust between participating parties. They are also entirely transparent and viewable by anyone using an Ethereum blockexplorer

Website: https://credito.io/

Credito Design Principles and Values.

Decentralization.

Decentralization is not only the foundation of the tamperproof properties of blockchains, but the basis of their permissionless nature. By continuing to build decentralized systems, we aim to further enable permissionless development within Credito. We believe that decentralization is a crucial component for a globally thriving ecosystem with long-term sustainability.

Modularity for simple and flexible system design.

We appreciate the philosophy of building small tools which do one thing well. Simple components can be easily reasoned about and thus securely combined into larger systems. We believe that modularity not only enables upgradable systems, but facilitates decentralization.

Secure, transparent and extensible systems.

Credito is built for the community. We value the community and will engage continually with data scientists, domain experts, academics, and security experts for peer review. We encourage testing, audits, and formal proofs of security, all with the aim of creating a platform whose robustness and security can support future innovations.

Credito is a decentralized credit intelligence network providing credit scores, transaction scores and lending marketplace powered by Ethereum blockchain, Smart Contracts and IPFS, bringing enhanced transparency and reliability. Credito brings Financial Inclusion to the “Credit Invisibles” by providing accurate and reliable credit scores. A relatively high proportion of young people were credit invisible or unscored. That’s not surprising, since they haven’t had much time to build a credit history. For some, however, not building credit as a young adult could be setting the stage for a lifetime of credit invisibility. People who don’t have a credit score or credit history may find it more difficult to rent an apartment, buy a car, purchase a home, and, of course, get a credit card. In short, it shuts them out of many common financial transactions. Credito is building a Credit Intelligence Network for the credit industry to prevent Credit Risk by identifying fraudulent transactions as they happen, allowing the industry to take well informed decisions.

What is the need of decentralized and transparent Credit Intelligence platform ?

Despite the efforts made by banks, card issuers, and merchants, credit card fraud continues to grow faster than credit card spending. Data breaches have resulted in more card details being compromised, and the growth in online shopping has led to more opportunities for ecommerce fraud. According to a 2016 report by Nilson1 , losses from credit card fraud amounted to $21.8 billion in 2015 that’s an increase of 162% from the 2010 figure which was $8 billion. The losses for 2016 are already estimated at over $24 billion, and these losses are expected to reach $31 billion by 2020.

On the other hand, peer to peer (p2p) platforms are among the fastest growing segment in the financial services space. The market for alternate finance gained popularity in recent years. A finding by Transparency Market Research suggests that “the opportunity in the global peer-to-peer market will be worth $898 billion by the year 2024, from $26 billion in 2015. The market is anticipated to rise at a CAGR of 48% between 2016 and 2024.

A finding by Transparency Market Research suggests that “the opportunity in the global peer-to-peer market will be worth $898 billion by the year 2024, from $26 billion in 2015. The market is anticipated to rise at a CAGR of 48% between 2016 and 2024.2 ” While the p2p platforms continue to face the risk of default, and fraudulent practices, the growth prospects of this segment remain strong, especially in times when the banking sector continues to struggle with lingering damages. Thus, a decentralized and transparent Credit Intelligence platform offers great opportunity for Lenders, Borrowers, and Financial Institutions to reduce their risk.

How Credito is the Solution ?

Credito is Transparent

Credito leverages the transparency that the blockchain ledger provides by monitoring the activities of borrowers and lenders to prevent either party from overextending themselves. For example, it would be used to prevent a borrower from obtaining multiple loans from different lenders which he would then be likely to default on.

Credito Loan Agreements are Smart Contracts

Credito Loan Agreements are self-executing contracts with the terms of the agreement between Lender and Borrower, directly written into lines of code which brings enhanced transparency and reliability. The code and the agreements contained therein exist across a distributed, decentralized blockchain network. Credito Loan Agreements permit trusted transactions and agreements to be carried out among disparate, anonymous parties without the need for a central authority, legal system, or external enforcement mechanism. They render transactions traceable, transparent, and irreversible

Credito is “Trustless”

Credito will avoid risks that are associated with third parties, and also removes the need to trust the counterparty. When the borrower places the loan request on Credito Network, the counterparty cannot manipulate or halt the loan request once the loan is deployed. Removing the counterparty or third party risk is vital to avoid any unfair and unwanted behaviour.

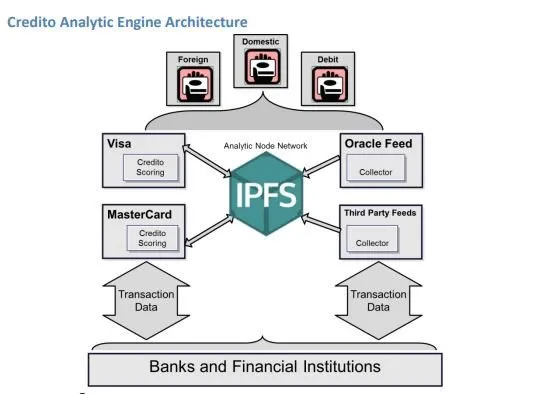

Credito Analytic Engine

Credito scores aim to derisk the investor’s investment and the borrowers’ credit score. Credito scores are generated by Credito Analytic Engine, a self-learning algorithm using a continual feedback loop with the help of Big Data analytics , Machine learning, and Artificial Intelligence, offering a score which acts as a dynamic marker of a person’s probability to repay a loan amount, which evolves with the client’s record of loan repayment.

For More Details And ICO

Website :https://credito.io/

Whitepaper :https://credito.io/pdf/whitepaper.pdf

Telegarm :https://t.me/CreditoCommunity

Official Facebook Page: https://www.facebook.com/CreditoNetwork

cryptobits3

0xb101dC14C6012D4faC2025a8f1Cdd4Daf1D9F154

https://bitcointalk.org/index.php?action=profile;u=1043526