In this second presentation, I will be talking about another finance math that many people already know about - simple interest. We will learn the following:

- Understanding simple interest

- How to calculate simple interest

- How to calculate other components of simple interest

Right away, we will start with the first item on the list.

Understanding simple interest

You probably have an idea of how lending and borrowing works. Lenders do not give out money without asking for a charge based on the time the borrower would return the money. Of course, they also consider the amount of money involved. So the fee that lenders collect for borrowing money to another person is called interest. Beyond the interest, there are other concepts you need to understand, that are all connected with simple interest. One of them is the Principal.

When you borrow money, the initial money you received from the lender is called the Principal. The principal plays a big role in determining the interest to be added. Usually, the bigger the principal, the higher the interest. The next thing to know is called the amount. When you return the principal and the interest at the end of any agreed time, that money returned is known as the amount.

When money is borrowed it accumulates interest over some period. How long the borrower holds the money before returning the entire amount to the lender is called Time. Normally the longer the time, the smaller the interest, as more time will make the interest accumulate and become something reasonable. Interest is usually calculated as a percentage of the principal. This is called rate. So quite often, you do hear things like 5% or 10% interest rate.

So far in the above explanations, we have been able to establish some fundamental components of simple interest and they are as follows:

- Interest: Money charged for borrowing money.

- Principal: The total money borrowed.

- Amount: The principal and the interest at any point in time

- Time: How long money was borrowed

- Rate: interest calculated as a percentage of the principal

Having understood the above terms, its easier now to understand simple interest. So we can explain simple interest to be the interest paid periodically to the lender by the borrower, which is calculated with respect to the Principal. The most prominent features of simple interest is that money is borrowed and repaid at agreed intervals, together with extra money charged for borrowing. The intervals could be weekly, monthly or daily.

How to calculate simple interest

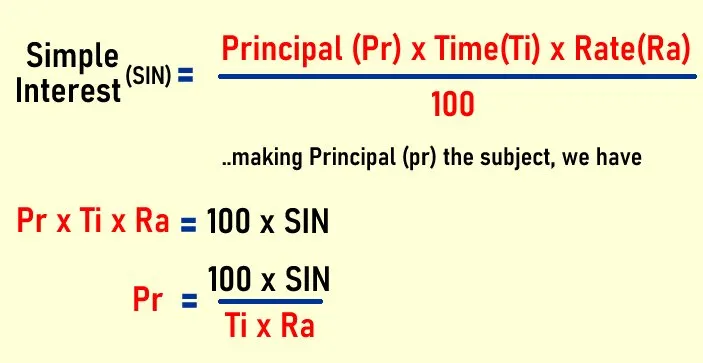

Usually, Simple interest is calculated based on the amount borrowed, the time period of returning the money, and the interest rate agreed. The bigger the principal and longer time, the higher the interest. Here is the formula for calculating simple interest:

Now we will use the above formula to do one sample calculation of simple interest.

Example 1: Calculate the simple interest on $10,000 borrowed for 5 years, at a rate of 9% per annum.

Solution:Using the formula for Simple Interest above,

Simple Interest = ?

Principal = 10,000

Time = 5 years

Rate = 9%

Therefore, Simple Interest = 10,000 x 5 x 9/100

= 50,000x9/100

=450,000/100

=4,500

How to calculate other components of simple interest

From the formula of simple interest, we can easily deduce the other components such as amount, rate or time by making that item the subject of the formula. Lets work with one example now:

Example 2: Find the capital whose interest is $900 in 4 years at an interest rate of 3% per annum.

Solution: The questions above requires us to find the Principal. From the formula of Simple interest, we have to make Principal the subject of formula and use it to calculate this example above. Here is how to do it:

Having derived the formula above, we can calculate the Principal for the above example:

Simple Interest = 900

Principal = ?

Time = 4 years

Rate = 3%

Principal = (100 x 900)/(4 x 3)

= 90,000/12

=7,500

Example 3: At what rate per annum will $525 will yield a simple interest of $63 in 3 years?

Solution: We will derive the formula for Rate from that of Simple interest as follows:

Simple Interest = 63

Principal = 525

Time = 3 years

Rate = 100x63/(525x3)

=6,300/1,575

=4%

Conclusion

Calculating Simple Interest is pretty straight forward if you apply the right formulas and get all your figures right. If you need to find the other components such as rate or Principal, simple make that item the subject of formula in the Simple Interest formula to derive it.

If there is something not clear on my calculations, or you found any error here, do let me know and I will clarify them.

Note: All images are mine including the thumbnail.