I have to admit, it's been pretty fun watching the price of Bitcoin move on from the $58K to $62K range and at least temporarily find a home in the $66K to $68K range. There is a lot of stuff going on in the world right now and I think many of us are just waiting for the other shoe to fall no matter how badly we want BTC to break that $72K mark again.

It is time again for another Finance Friday/Friday Finance. This is a series I started where I talk about random bits of financial stuff that I have seen, gathered, or experienced during the week. I hope as a reader you find it informational, entertaining, or both. I also hope it can generate some good discussion and edify the community.

I've been trying to watch the news lately for any juicy bits of crypto goodness I can share with you. Unfortunately, everything is geared towards the impending election right now. Anything along that line related to crypto is more of a footnote or just a sliver of the bigger story. I think the main thing we need to remember is that the crypto lobby is strong and growing stronger. I think before long it isn't going to matter what the SEC thinks or does.

Just look at the firearms lobby and the tobacco lobby before that. People are/were literally dying and they were still able to push their agenda through. Crypto should be easy mode for these guys.

SMR

I've posted in the past about my fascination with this company called Nuscale Power Corp. Their wheelhouse is nuclear power and more specifically small modular nuclear reactors. I was following them even before their company went public. When they finally did start releasing stock, I was sure to pick a little bit up.

The opening price of the stock was something like $10. I think I bought around 50 shares back then. Things went a little south at the end of 2023 and early 2024 with the stock touching $1.81, but it has since bounced back and is fetching $18.02 per share now. The all time high was recently achieved at $19.74 per share.

This isn't financial advice and of course you should do your own research, but I have a feeling some of these nuclear power companies are going to be decent investments at least in the short term. I was reading an article last night about micro nuclear reactors that businesses are looking at to power data centers and computing clusters for things like AI.

Like it or not, I think we can all agree that AI probably isn't going away. If anything it is going to grow even bigger and the power for it is going to need to come from somewhere.

As nuclear power becomes safer and some of the stigma starts to fade away, I think some of these companies are really going to pop off. Hopefully Nuscale is one of them. Their small modular nuclear reactor is supposedly "meltdown proof".

More Investments

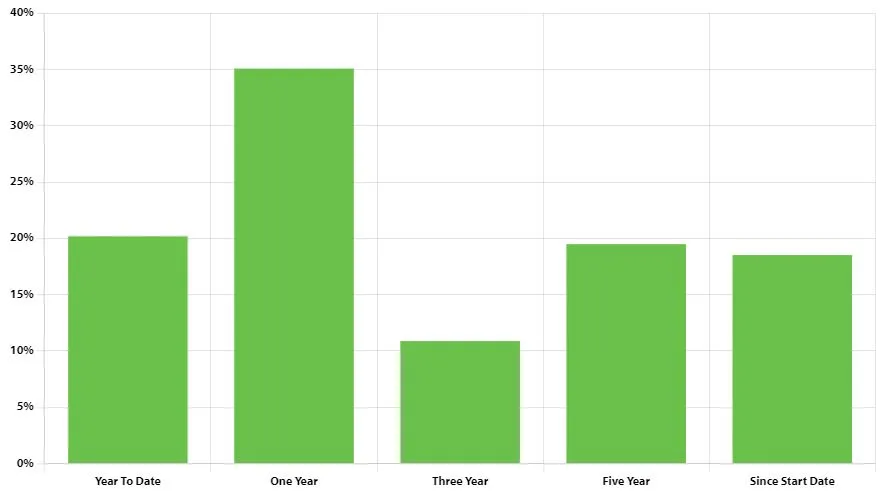

The stock market has been quite interesting lately. I have talked to several people who have turned their attention that way as they wait for the impending bull cycle to really kick into gear with crypto. I pulled this chart from one of my accounts the other day and I think it is pretty impressive.

This chart is actually a bit misleading. Back in 2019, my broker decided to start his own firm. He split away from Wells Fargo and moved over to Baird Financial. Although my investments have been working for close to 20 years, the "since start date" in this chart is actually 2019.

As you can see, this has been a good year for my investments with the return being something like 35%. The past three years have been a bit meh, but the overall return is closer to 20% across what is essentially 5 years. I'm not an expert, but I think that is pretty good.

The funny thing is, that chart just covers my Roth IRA, my 403b (where the bulk of my investments go) isn't even included in that.

Looking at my 403b, it looks like my annualized returns since my initial investment in 2006 are 8.04% and my year to date gain is something like 18.79%. Again, I am no expert, but I think that is pretty dang good. Sure, there are probably ways I could do better, but this seems to be quite stable and has already went through at least two major market events (the housing crash, and Covid).

I'm looking forward to seeing how much this grows when my dividends and capital gains get added at the end of the year.

Hive

Last but not least, I wanted to talk a bit about HIVE. I've had some buys out on the market for while now waiting for them to trigger. I was hoping for $.16 or even $.12 HIVE to make my buy, but it appears we are heading the other direction. I think when my buys expire I am just going to swap from HBD to HIVE at the current price. Really the difference is only going to be a couple hundred HIVE at most. While that may be a lot to some, it's really only about $20 in the grand scheme of things.

That barely buys you a decent dinner out in the US, so at least from my perspective, it might be smarter to make the move in case the price miraculously keeps moving up. Believe it or not we are running out of time before 2025 gets here and if the experts are to be trusted, all bets will be off then.

Meanwhile, I am going to just keep doing what I have been doing all these years. Five posts a week or so from my main account and at least during this exciting time in university sports, five times a week from my @bozz.sports account that I am trying to grow as well.

Sports Talk Social - @bozz.sports