We see comments like this from far too many in the crypto community lately:

“I know this alt coin has better technology and other improvements but BTC and ETH are winning…”

Bitcoin Core started losing as early as 2012 when corporate controlled ASIC mining took over the SHA-256 Proof of Work consensus protocol. The broader crypto community reacted with new coins designed to be ASIC resistant. This sentiment continues today amidst concerns that ASIC producers can mine clandestinely prior to handing down used miners to unsuspecting buyers.

https://medium.com/@salva.enkidu_89587/how-bitmain-indeed-mines-coins-in-secret-2ea179e7ab75

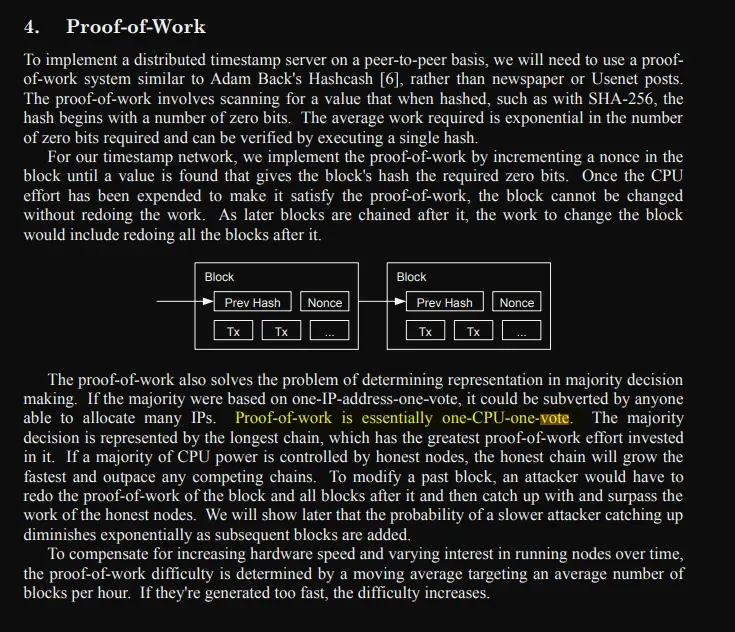

Clearly, ESG was not the immediate concern from crypto community leaders. Rather, what drove the requirement for general computing components such as those found in home PCs was the desire for ubiquitous and egalitarian access to the new cryptocurrency wealth spring. As Satoshi Nakamoto put it, “one-CPU-one-vote.”

Satoshi’s model, well intentioned as it was, was not designed defensively to assure the ideal of one-CPU-one-vote. In 2010, mining software advanced to accommodate Graphics Processing Units (GPUs) and in 2012 the flood gates opened to ASIC mining. GPU mining marked a tenfold boost over CPU mining and ASIC miners would be more than a thousand times as powerful as CPUs.

ESG (Environmental, Social, and Governance) vitriol against Bitcoin Core for power hungry ASIC mining is not surprising. However, the root causes of such problems are twofold 1) Corporate greed and 2) Lack of specific community interest to defend Bitcoin Core.

To the point of corporate greed, it is what it is. Shareholders expect value and the purpose of a business is to be profitable. Defense from corporate greed is the duty of defensively designed protocols such as what we see in newer coins like Epic Cash.

To the point of community interest, Bitcoin Core codebase remains largely unaltered because of rightly placed respect in preserving the genesis of a financial revolution. Bitcoin Core will ALWAYS have this level of respect. However, this is the technology sector and technology moves on. Moving on in the tech field means adopting new disruptive technologies such as Mimblewimble and quantum-resistant algorithms. As such, it only makes sense that value be attributed to newer and better technologies.

An example of this can be seen in diminishing returns of the sector-leading cryptocurrency. BTC cycle-to-cycle value gains have consistently diminished by a factor of 5.33.

Raoul Pal famously sold all but 1 of his BTC.

Then there’s the #2 coin, Ethereum.

Ethereum was really doomed from the start, all the way back in 30 July, 2015, with what every miner in the crypto community knows as the biggest red flag: Huge Premine. The power and control of those possessing this premine was finally put on full display this year.

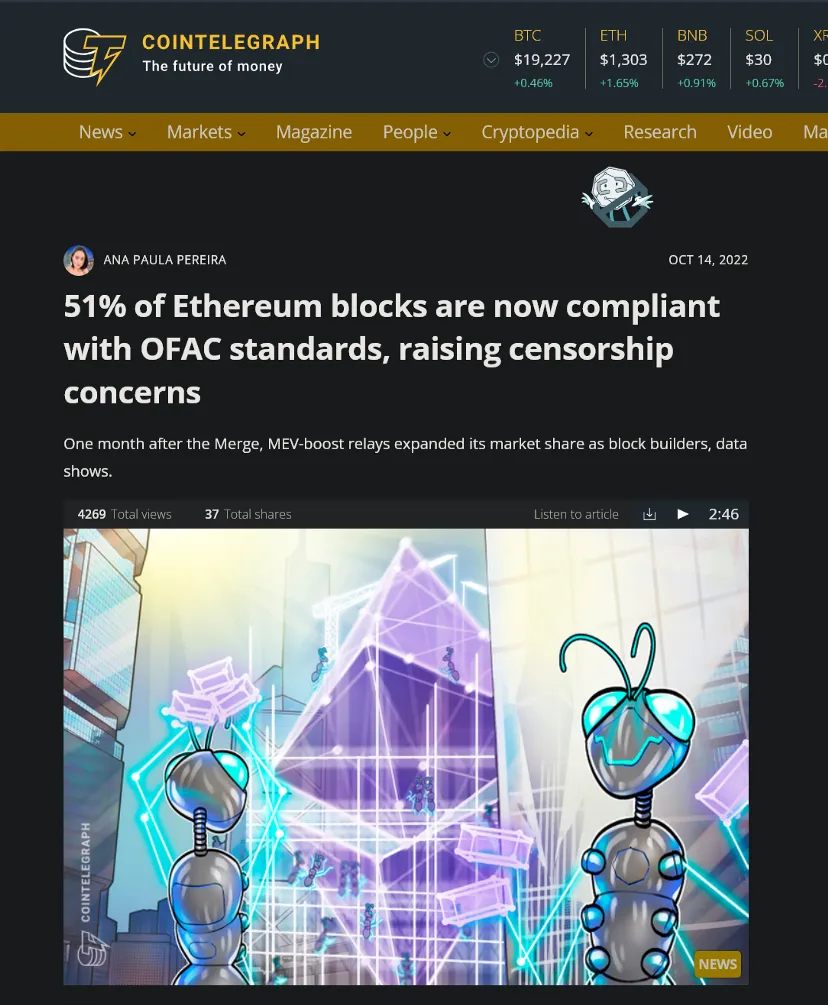

On 15 September, 2022, Ethereum chose Proof of Stake (PoS) rather than Proof of Work (PoW) consensus and distribution of coins. PoW is a feature that would have assured Ethereum decentralized censorship resistance. Instead, the Ethereum community, led largely by early holders of premined coins, chose to be a PoS protocol. With this choice, Ethereum assures centralized censorship may be exercised by nation state regulators presiding over centralized exchanges. It’s even possible for the Ethereum community itself to “slash” assets pooled in centralized exchange staking nodes if they disagree with centralized exchanges complying with regulators such as the Office of Foreign Asset control (OFAC).

Ethereum holders must now acknowledge they are more centralized and more prone to censorship than ever before. Rather it be from State actors with deep resources or their own Ethereum community, innocent coin holders on exchanges like CoinBase, Gemini, and many others are now possible victims of “slashing” if the Ethereum community takes action against State enacted censorship.

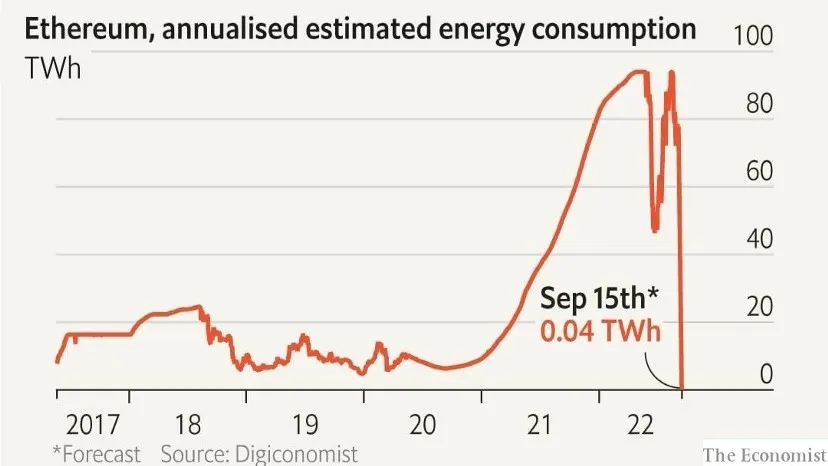

Finally, we must acknowledge and discredit the vast ESG kudos given to Ethereum for transitioning from Proof of Work to Proof of Stake. Very little was gained in the way of ESG and far too much was lost in the way of decentralization and censorship resistance.

Q: Did Ethereum really save 100 TWh annual energy costs by choosing centralized staking nodes for consensus?

A: Nope!

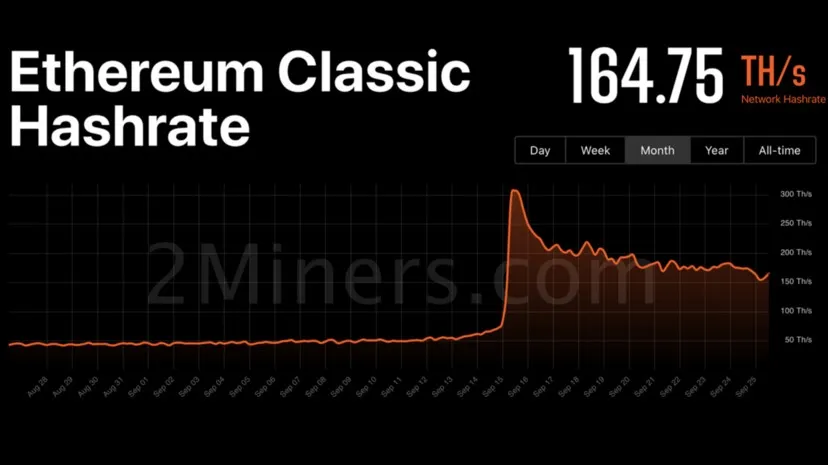

Instead, the network hash rate of other mineable cryptocurrencies more than doubled. Hash rate is the key indicator of electricity spent to mine crypto currencies. It doubled nearly instantly after Ethereum swapped to staking and over time it has increased by several orders of magnitude. Epic Cash for example has seen network hash rates multiply by factors as high as 5X.

Even Ethereum Classic had a boost:

Ethereum and Bitcoin market dominance continue to give way to the more than 20K coins and tokens entering the market. This is for good reason. Newer coins have better fundamentals and better technology.

Look at the trend and consider this age-old advice, “The trend is your friend.”

Consider the trendsetters such as Epic Cash. EPIC stands for “Epic Private Internet Cash” and EPIC’s technology assures scalability, decentralization, and freedom from illegal surveillance.

BTC and ETH have NOT been winning for years! The tide has been turning along with emerging technology.

This is your wakeup call!

Come learn more: