October 16, 2022

The @hiveph community initiate a blogging contest about financial literacy and financial education.

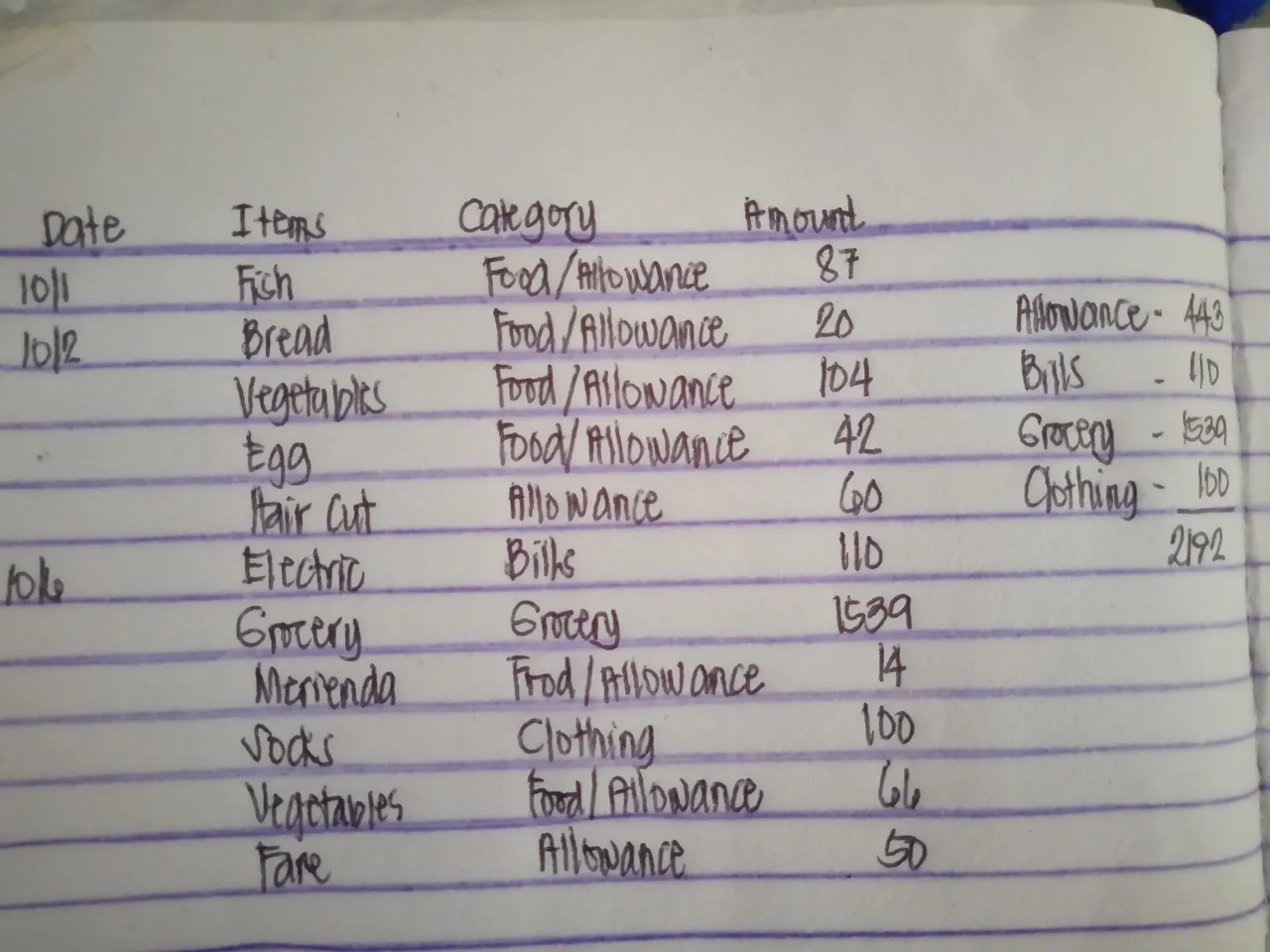

It is divided into four topics to be submitted weekly. Last week, I tried to join even I am a bit late but it's okay because by doing so I know where every peso go and I learned that I need to adjust some of allocation in my budgeting. Last week topic is about daily expenses tracking and here is my expenses tracking for a week.

Second week is all about making an important financial decision.

Open a bank account, invest in stocks, buy more crypto, or reading about financial books. Anything related to self improvement for your financial health that you have done recently. The post should also include your daily tracking up to that point.

Here is my expenses tracking last week.

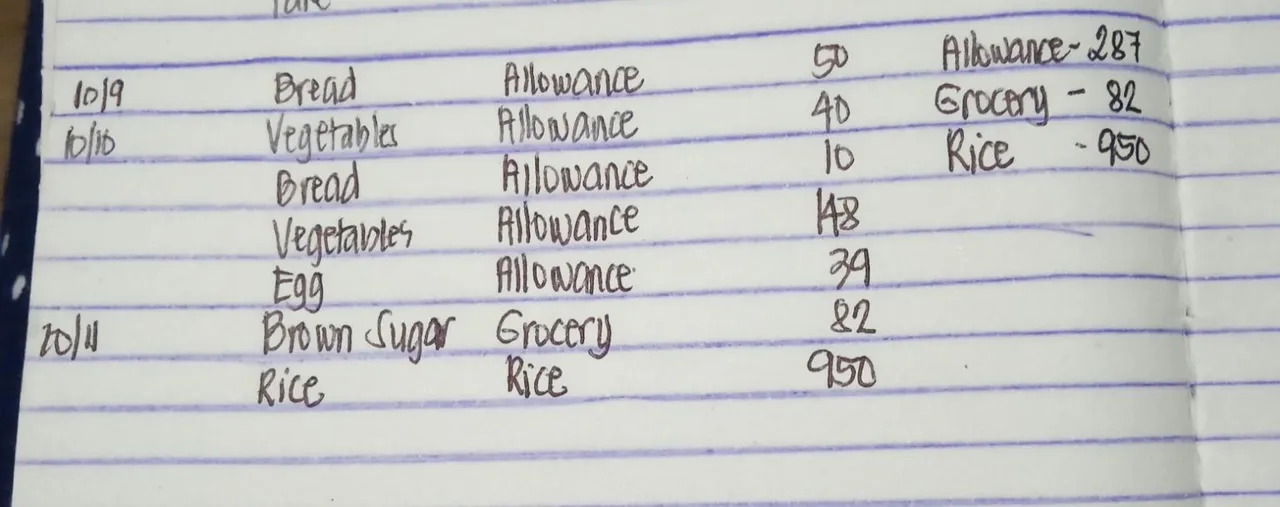

Here is my expenses tracking for this week.

You might wonder that there is only 3 days expenses. You might say I haven't completed it but I must say that it is complete based on my expenses.

I am having grocery once a month and it includes almost all necessary things we need at home like noodles, canned goods, milk, milo, biscuits for my son, shampoo, bath soap, dishwashing paste, tooth paste, detergent soap and powders, and many to mention. Having it means I don't need to buy a sachet of shampoo or anything in a small store. So, I usually don't have to spend for groceries daily.

I also went to the market once or twice a week to buy vegetables for our family. So, I don't need to buy daily. We also buy rice once a month.

The reasons I mentioned above is the answer why I only have 3 days in expenses monitoring.

So, let's talk what I did for this week that will help my financial education journey. I didn't open a bank account, I didn't invest in stocks nor buy more crypto because honestly I don't have yet a lot of idea about it. I just read a book, a pocket book entitled Counsels on Stewardship. We have a money but basically we don't own it, we are just a steward of it. God owns it and He wanted us to use it wisely.

I came in chapter or topic 48 entitled Living within your income. The author said:

Many, very many, have not so educated themselves that they can keep their expenditures within the limit of their income. They do not learn to adapt themselves to circumstances, and they borrow and borrow again and again, and become overwhelmed in debt, and consequently they become discouraged and disheartened.

It is true that many of us are living not within our income. It can be seen anywhere that many are borrowing money from others a day after the salary day. I really wonder about it, it become thier habit to borrow, pay, borrow and pay and it is a never ending practice.

Even in the middle of the year, some will said, Can you lend me some money and I will pay it on December when my 13th month pay came. Imagine, spending money even you haven't have it yet.

It sounds okay when you use it for some important things or for some emergency purposes. In this case, borrowing money is not needed if you have savings, this is also the reason why savings is very necessary.

I have also read an article Bible verses about debt. I am amazed that even the Bible talks about it. You can read it and learned a lot from it.

I learned...

Saving is necessary

I learned that saving is really necessary. In my case I didn't open a bank account but I have a small envelope intended for savings and we practice to have a coin bank or alkansya.

Saving is needed as this will also serve as our emergency fund. Saving will save you in the future.

Debt is not good

Debt is not good because it won't teach us to live within our means. It won't teach us discipline on how to spend our money wisely. It won't teach us to save because how can we save if our money is even not enough to pay for our debt.

Debt is also a form of slavery, the borrower is the slave of the lender. It is sad that some lender is taking advantage to the borrower by giving a big interest. It is also sad that other borrower will forget their obligation.

Debt also prevent rest because we tend to work hard and work over time in order to have some money to pay our debt.

A debt free life brings happiness.

Live within your means

Living within your means is living within your income. When you live within your income, you don't need to lend some money and you can have somw savings. Saving also need self discipline to do it because sometimes we save but still we are tempted to get it back again the next day and it results no saving again.

We need to live within our means is to spend money not more than our income because if we will do, for sure debt is waving.