October 23, 2022

Budget plan is to plan your budget by writing it down to decide how you will spend your money, your income in every month, every week or bi-weekly. This will help you to have enough money for the week or month depending in the range of your budgeting. Without it, you might spend all your money before the next salary day.

We are in the third week of Hive PH Community challenge for financial literacy and financial education.

For third week's topic:

Formulate A Budget Plan. Google how to do it and then apply the principles using the data you've gathered for the past 2 weeks.

I am familiar with budgeting as I am doing and having it based on my own understanding and based on my own experience but I am not familiar with budget plan until I google it as this community told us to do so for the third week challenge.

I tried to search it and found different forms of a budget plan but I love one because I can understand it.

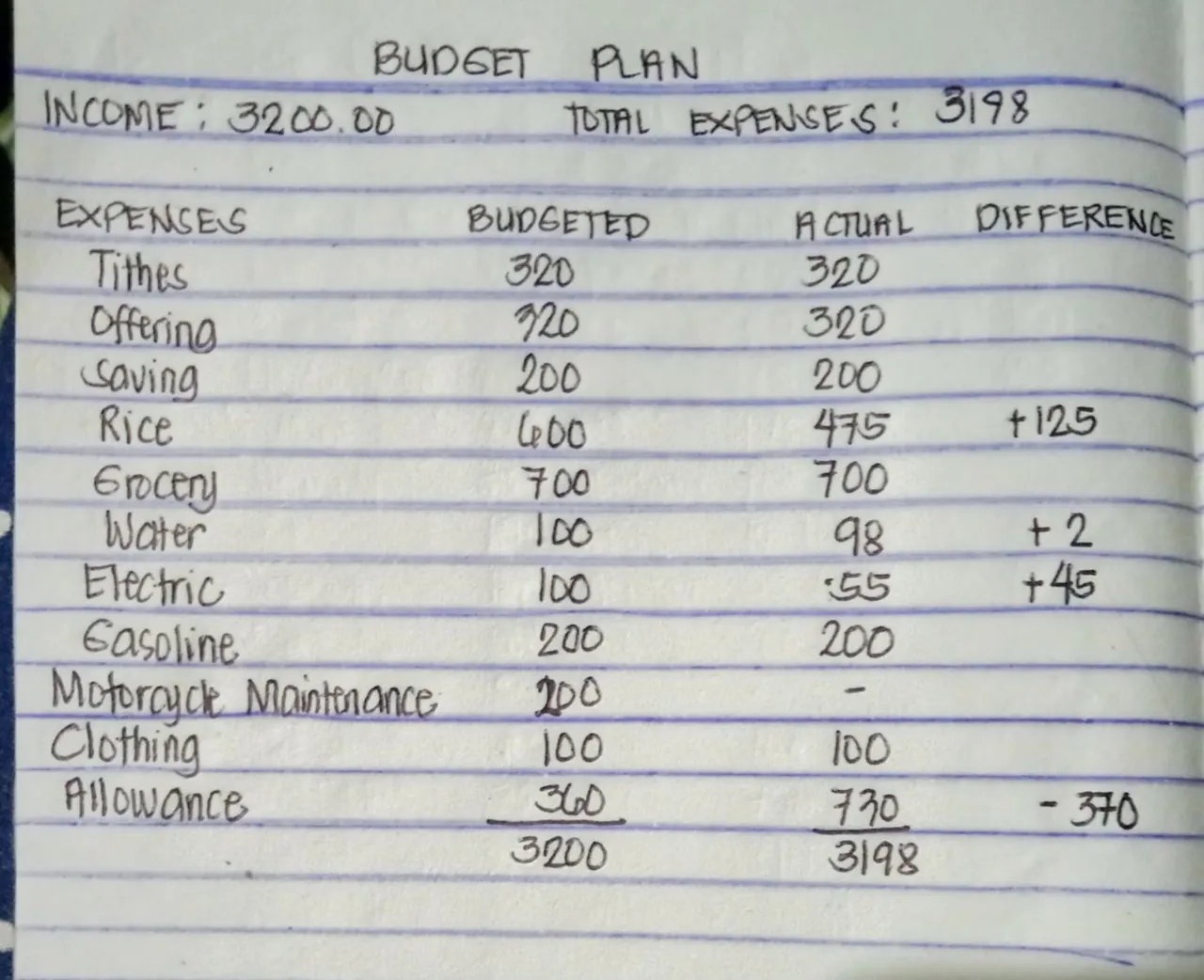

It has income, expenses, budgeted, actual spending, the difference as well as the total expenses.

I tried to fill in the table using the expenses I track for two weeks as I am budgeting bi-weekly and here it is.

In some case, the actual budget is equal to the actual spending while other is not. Some have a lesser or greater difference but I am amazed because my total spending doesn't exceed with the income. It means, I haven't lend some money from others just to buy or provide our needs.

I always tried to live within our means because I am not fond of having some debts except those very important loans but there were times that we are short from our budget. We really need to adjust our spending or we really need to have savings so we could get some from it to provide our specific and emergency needs.

Steps on creating a budget plan

1. Identify your income.

Jot down or calculate your net income and the budget will base from it. In my case I record my husband's net salary.

2. Track your expenses.

I haven't done this before until Hive PH Community initiated this challenge. Here's how I track my expenses for a week. Tracking your expenses means you will list all your expenses it is either daily, weekly or monthly expenses. By doing this you will know where your money goes, you will know where the last coin goes.

3. Set realistic goals.

After tracking your expenses, you can then start to set realistic goals on how you alocate and where you will spend your money. You can set some goals for savings, you can also set goals on how much to spend for specific thing or needs.

4. Make a budget plan.

In creating a budget plan, you need to identify your income, your expenses, the budgeted amount, the actual spending, their differences and the total expenses. In doing this, you will know if you spend lesser than your income or you spend within your income or you spend more than your income.

Creating this will also help you realized how you spend your money, if you spend it wisely or you spend it without even thinking to save any penny.

You can create a budget out of the details you listed about your expenses. You can now sight or estimate the needed budget for a specific need.

5. Put your plan into action.

Creating a budget plan is still a plan without an action. So, we really need to put an action in our plans. If we plan to spend a specific amount for a particular need, we should follow it or else that plan will be useless. Always remember to set realistic goals so you can act accordingly to what was planned.

6. Adjust your spending to stay on budget.

When tracking the expenses is done and the budget plan has been created, you will really see where you spend most and where you spend less. You can then see where you need to adjust your spending so you won't be out of budget again.

7. Review your budget regularly.

We really need to review our budget regularly because we can find some more improvement or adjustment about our budget. As time goes by we will realize where we became wrong in spending.

I really learn something new about finances because of this challenge. I just learn about this budget plan and I hope I can track our expenses again next month to monitor it very well because I would like to know our spending in a monthly basis.

It is sad that very few joined this challenge. This is not just about the challenge but it is also about what we could learn throughout the challenge.

I am not sure if I did the right thing because as what I have said, I just knew about it. To those who is expert about this topic, I would love to hear your suggestion, correction or some additional guidelines and idea about this topic.

Thank you so much @hiveph community admin for this initiative.