Come swim in our Liquidity Pool

For those following Threshold Guardian Gaming Guild this year, you will know that we created our Swap.Hive Liquidity Pool (LP) 2 months after minting our Token.

This Liquidity Pool offers a place for investors to SWAP our $THGAMING Tokens for $SWAP.HIVE : Hive Engine's Layer-2 Swappable version of $HIVE which can be withdrawn (converted) to $HIVE at any time.

Many of our guild members have been asking, "What is a liquidity Pool (LP)?" - This post will explain in detail how LP's work and the advantages and risks of using them. If you're experienced with LP's, feel free to skip through the next few paragraphs.

HOW OUR LP WORKS:

$THGAMING and $SWAP.HIVE are added into the pool by 'Liquidity Providers' at a ratio of 50:50, meaning equal dollar values of both tokens, and this liquidity can be withdrawn INSTANTLY at any time.

Furthermore, our LP has also been injected with Hive Engine Layer-2 tokens rewarded to Liquidity Providers every 24 hours for simply holding their Tokens within our Pool.

The Current Reward APR (Annual Percentage Rate) is 98%, so you will earn a fair amount of 'Layer-2 Token Profits' for keeping your Liquidity in our Pool.

The 90-Day Reward Contract will continue to pay out Liquidity Providers for the duration of the Smart Contract, at which point we will create a new Distribution Contract and reinject rewards into the pool for the next 90-day cycle.

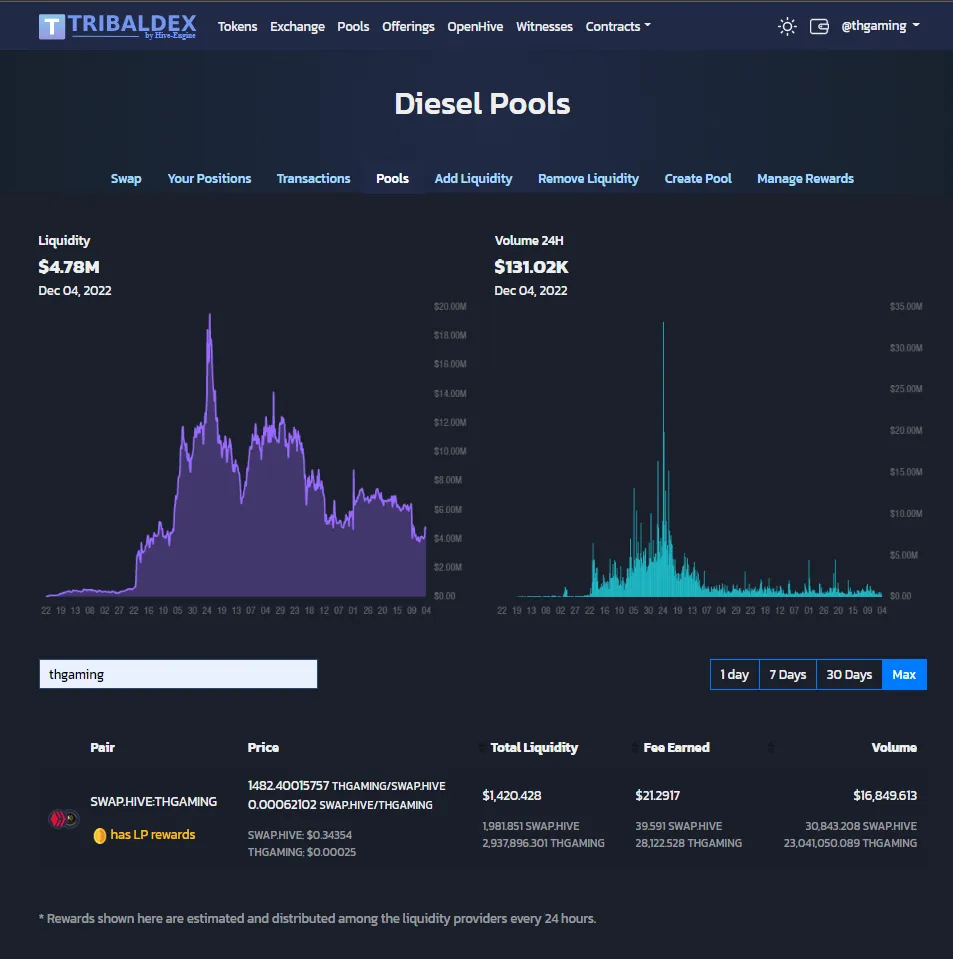

[Above] You can add liquidity to many different Pools through TribalDex by visiting https://tribaldex.com/dieselpools. In the picture above, we searched for "thgaming" to bring up our pool's details. At the top of the page, you have options to:

- SWAP (tokens)

- (show) YOUR POSITIONS (in pools)

- (show your pool) TRANSACTIONS

- (ADD or) REMOVE LIQUIDITY (instantly)

- CREATE (your own) POOL

- MANAGE (pool) REWARDS (contracts)

What is a Liquidity Pool (LP), and why should you care?

A 'Liquidity Pool' offers Liquidity to a pair of Tokens by providing a Swap Pool (smart contract) where two or more Tokens can be traded off of the open market.

The Token swap prices in the LP vary if one Token is being 'swapped for' more than the other, and this volatility enables traders to purchase Tokens at reduced prices. As with all trades, there are risks involved. It's important that you thoroughly research every Token and trading strategy before making any purchase / swap trade.

LP DEFINITION: A Liquidity Pool can be thought of as a pot of cryptocurrency assets placed within a smart contract which can be used for exchanges, loans and other applications. In traditional finance (Centralized Finance or CeFi), liquidity is provided by a central organization such as a bank or a stock exchange.

If you'd like to learn more about LP's, please read this excellent Blog Post by Alejandro Gutierrez - Operations Lead at Defactor.

Liquidity Pool Risks:

The first major risk with Liquidity Pools is the fact that Token prices may decrease. As with all cryptocurrency investments, the prices of Layer-1 or Layer-2 crypto is dependent on the market, and what goes up may also come down. As we are in a very precarious 'Bear Market' at the moment, it is risky to invest fiat (traditional money) into crypto. We are advising investors to dollar cost average into crypto or use already existing crypto holdings / positions. As the saying goes, "never invest more than you are willing to lose." If you choose to invest please research the project thoroughly, and look at crypto/tokens with long-term growth potential.

The second risk in Liquidity Pools is called 'Impermanent Loss' which refers to Token volatility caused by the ratio Tokens are invested at : in a 50 / 50 value split. If the price of one Token goes up or down drastically, your share (number) of the other Token will likely also change. This loss is called 'impermanent' as your investment should return to normal when the value of both Tokens returns to their original 'ratio price point'. Stable Coins like $USDT or $HBD usually suffer from very little impermanent loss thanks to a typically low price volatility. Still, all stable coins have some risk of becoming unpegged and losing their original 'dollar value'.

The last risk doesn't happen very often, but we still feel it should be mentioned. There is a chance that the DEX or Smart Contract is hacked or compromised allowing fraudsters to 'clean out' the LP's. Our Liquidity Pool is built using Tribaldex Dieselpool Contracts, and none of our Guild Devs have access to the underlying code.

Liquidity Pool Advantages:

Liquidity Pools provide Crypto to the DEX (Decentralized Exchange) offering stability to that exchange and the layer-1 or layer-2 Tokens placed in those Liquidity Pools.

Most Liquidity Pools will REWARD their Liquidity Providers with Tokens through a smart contract and provide a percentage of all Swap fees to LP Providers (which gets added straight into their positions).

LP's offer a place for investors to swap tokens off of the open market, so Tokens can often be purchased for cheaper than they would on the DEX. This is especially true for sought after Tokens that people are HODLing. Arbitrage traders will take advantage of price variations between Open Market and LP's to make profits.

Our Liquidity Pool Rewards, 97.8% APR

- As mentioned, the SWAP.HIVE:THGAMING Liquidity Pool offers instant Swaps of $THGAMING for $SWAP.HIVE, or vice versa. A Rewards Pool contract automatically distributes rewards to Liquidity Providers.

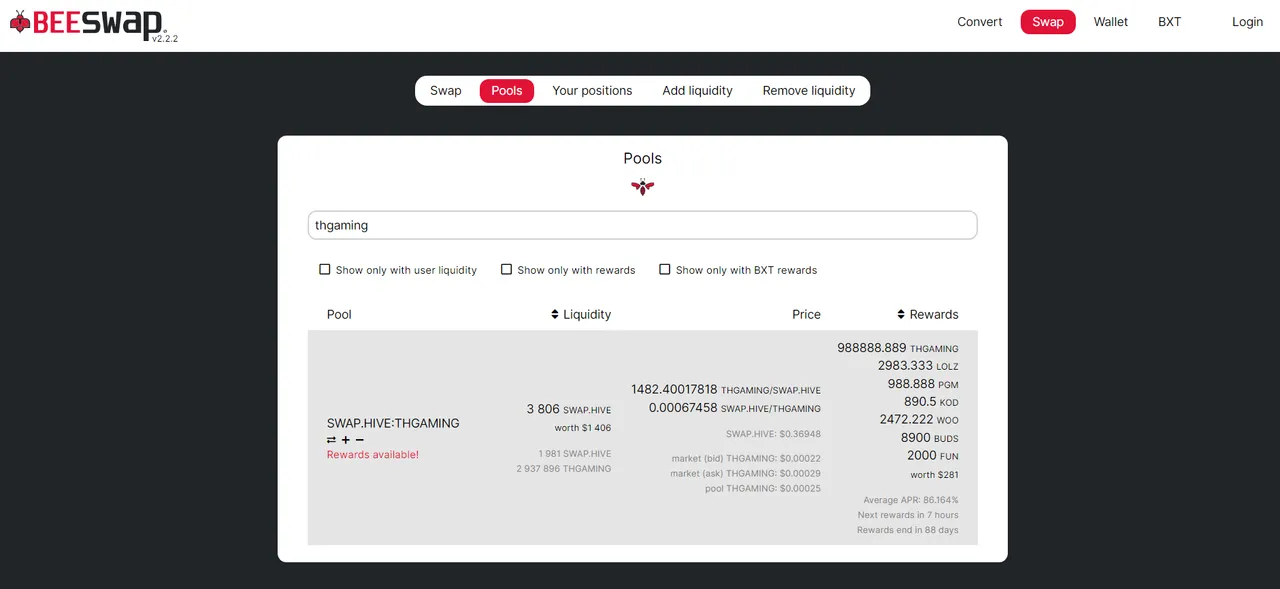

[Above] Providing Liquidity at a 50 / 50 Split of $SWAP.HIVE and $THGAMING will earn you liquidity rewards in all of the rewards tokens listed. Add Liquidity yourself on the DCity Beeswap Platform or on the Tribaldex Dieselpools Frontend.

We have been saving up our Layer-2 Tokens, and—with the help of our Partners—have injected our LP with many Rewards Tokens for this 90-day reward period. Being a gaming guild we always provide some game related Tokens into our Reward Contract! At the time of writing we have added the following Tokens into the Reward Pool :

- $THGAMING - The Curation and future Governance Token of THGaming Guild

- $LOLZ & $FUN - Tipping and Curation Tokens of the Lolz Fun House Community

- $PGM - Player Gamer Token - Tipping and Curation

- $WOO - @wrestorgonline - Gaming Token

- $KOD - @kingofduels - Gaming Token

- $BUDS - @hashkings - Gaming Token

- $PIMP - @tokenpimp - Tipping and Curation

Guild and $THGAMING Developments

At time of writing the $THGAMING token is sitting within 7199 $HIVE wallets, including 29 THG Whales : Accounts holding more than 100 000 $THGAMING Tokens.

Due to strictly controlled Distribution Mechanisms, only 2.91% of $THGAMING is currently minted (circulating) with plans to ramp up the distribution as use-cases increase and global cryptocurrency markets improve.

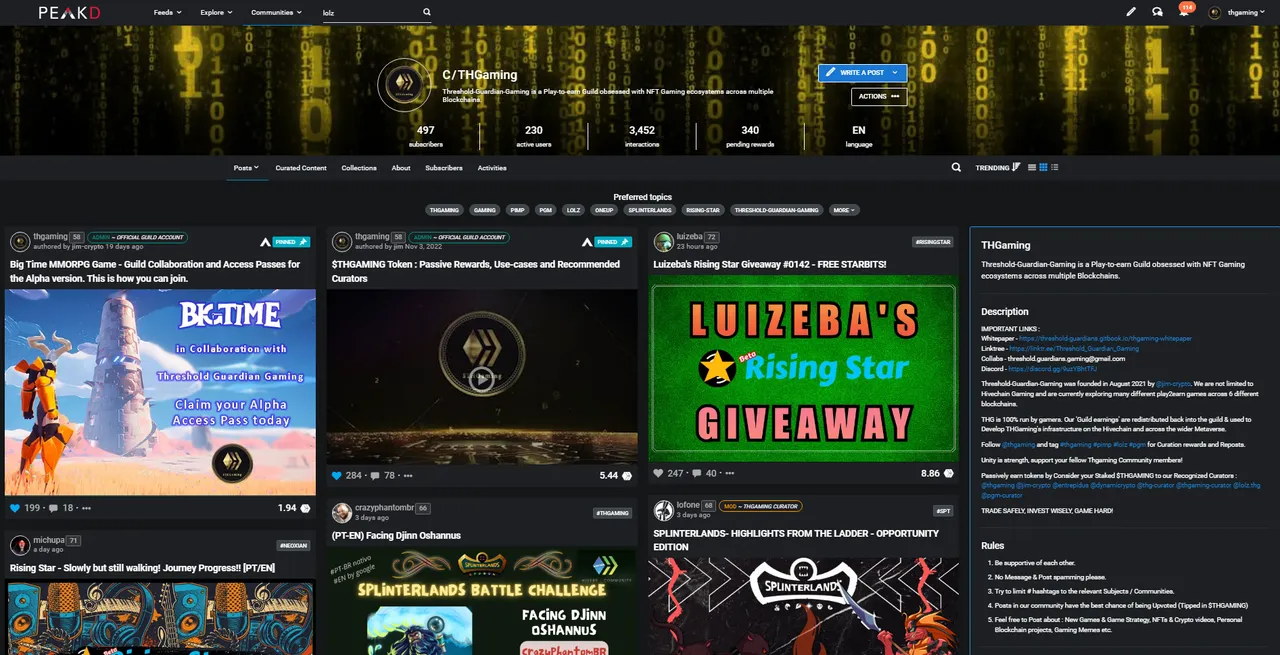

$THGAMING has been upgraded to allow Staking, Delegation and Curation rewards on Hive Blogging platform posts. Utilizing the hashtag #thgaming and/or posting in our community will allow your Blog posts to accrue $THGAMING curation rewards when upvoted (tipped) by users holding staked $THGAMING.

Growth across our main Social Media Channels :

- Hive Community - 498 Subscribers

- Twitter - 372 Followers

- Discord - 385 Guild Members

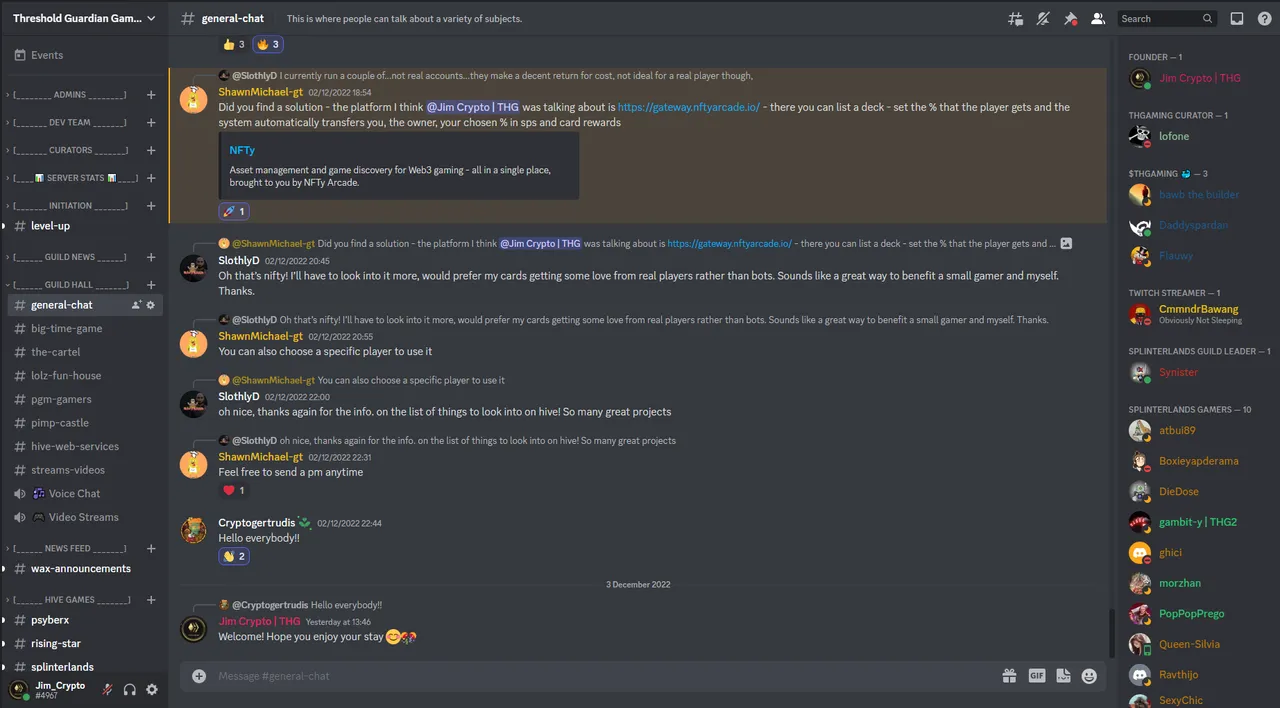

[Below] Our Discord Server is the heart of our Guild and continues to grow every week. We have channels for many popular games and places where our members can share their Hive blog-posts from our favourite Hive Communities & Partner platforms.

For more information about $THGAMING Curation and Gaming use-Cases, please read this post: 'Nov 3rd 2022 - $THGAMING Token : Passive Rewards, Use-cases and Recommended Curators'

Wrap Up

As always and MOST IMPORTANTLY, do not spend any Money / Crypto you can't afford to lose! The global crypto market is undergoing what could be a long-term 'Bear cycle' (more sellers than buyers), and everyone should be preparing for the long haul.

During the current Bear market, Threshold Guardian Gaming will continue to innovate and collaborate, rigorously developing our Token, Guild and Economy.

If you would like to join THGaming and explore the #metaverse with us, our Social Media links are below.

Trade safely, Game hard!

Linktree Official - All Social Media links